The euro was extremely weak today, falling against most of its major peers. One of the possible reasons for the slump was largely poor macroeconomic data released in the eurozone on Monday. Another one were comments from European Central Bank officials, which signaled that the ECB is ready to introduce more stimulus. The IHS Markit Eurozone Manufacturing PMI for June was finalized at 47.6 in June, slightly below the preliminary figure … “Euro Soft on Poor Manufacturing PMIs, Prospects for Stimulus”

Month: July 2019

Pound Falls on Weak UK Manufacturing Data and Strong US Dollar

The British pound today fell against the US dollar following the release of weak UK manufacturing data by Markit Economics failing to capitalize on Friday’s bullish attempt. The GBP/USD currency pair was under pressure from the revitalized greenback following the pause in trade hostilities announced by the US and China over the weekend. The GBO/USD … “Pound Falls on Weak UK Manufacturing Data and Strong US Dollar”

Canadian Dollar Mixed As Crude Surges, GDP Dips in April

The Canadian dollar is trading mixed against several major currency rivals on the Canada Day holiday. The loonie is benefiting from the rally in crude oil prices, but its advancements might be capped as the market forecasts a slip in manufacturing numbers ahead of crucial jobs and trade data later this week. Crude oil futures are nearing the $60 mark again, which … “Canadian Dollar Mixed As Crude Surges, GDP Dips in April”

Cryptocurrencies: Key levels to break for the next bullish move

Cryptocurrencies have corrected lower after a sharp rally. Each digital coin faces critical resistance lines it must recapture to resume the rally. Here are the next levels to watch according to the Confluence Detector. Cryptocurrencies have finally corrected some of their massive gains – a natural phenomenon in all financial markets. The rally has been … “Cryptocurrencies: Key levels to break for the next bullish move”

Japanese Yen Drops on Risk Appetite, Tries to Rebound. Domestic Data Mixed

The Japanese yen weakened today due to risk appetite caused by news about a trade truce between the United States and China. The currency has trimmed its losses later, though, erasing them against some rivals outright. Macroeconomic data released in Japan over the trading session was mixed. Markets reacted strongly to the news that the United States and China managed to reach a truce in a trade war. The Japanese yen, being a safer … “Japanese Yen Drops on Risk Appetite, Tries to Rebound. Domestic Data Mixed”

USD/JPY looks for a new direction amid trade and the Fed

USD/JPY has risen from the lows amid optimism about trade and moderate comments from the Fed. The Trump-Xi summit and the Non-Farm Payrolls promise an intriguing start to the second half of 2019. Early July’s daily chart indicates further falls for the currency pair. Experts see sideways movement in the short-term and rises afterward. What … “USD/JPY looks for a new direction amid trade and the Fed”

Aussie Weak Despite Market Sentiment, Economic Data to Blame

The Australian dollar declined against most major currencies today despite the positive market sentiment, which should have been supportive to the currency. The possible reason for the decline was domestic macroeconomic data, which was somewhat mixed, with some bad releases. The Australian Industry Group Australian Performance of Manufacturing Index dropped to 49.4 in June from 52.7 in May. Being below the 50.0 level of no change, the index signaled about … “Aussie Weak Despite Market Sentiment, Economic Data to Blame”

Chinese Yuan Gains vs. US Dollar on US-China Truce

The Chinese yuan rallied against the US dollar today. While the greenback firmed on the reports about a truce in the US-China trade war, the Chinese currency benefited from the news even more. The good news allowed the yuan to ignore negative domestic data. As was expected, the news about the truce in the trade war between the United States and China had a big impact on markets. The USA promised to not raise tariffs on Chinese goods further and to ease … “Chinese Yuan Gains vs. US Dollar on US-China Truce”

GBP/USD at the mercy of Boris Johnson and Trump’s trade

GBP/USD has retreated from new highs amid mixed message from Boris Johnson. UK PMI, the Conservative contest, US NFP, and trade talks are eyed in the upcoming week. The daily chart for the first week of July is mixed. Experts see little change in the short term, then bullish in the medium term, but bearish … “GBP/USD at the mercy of Boris Johnson and Trump’s trade”

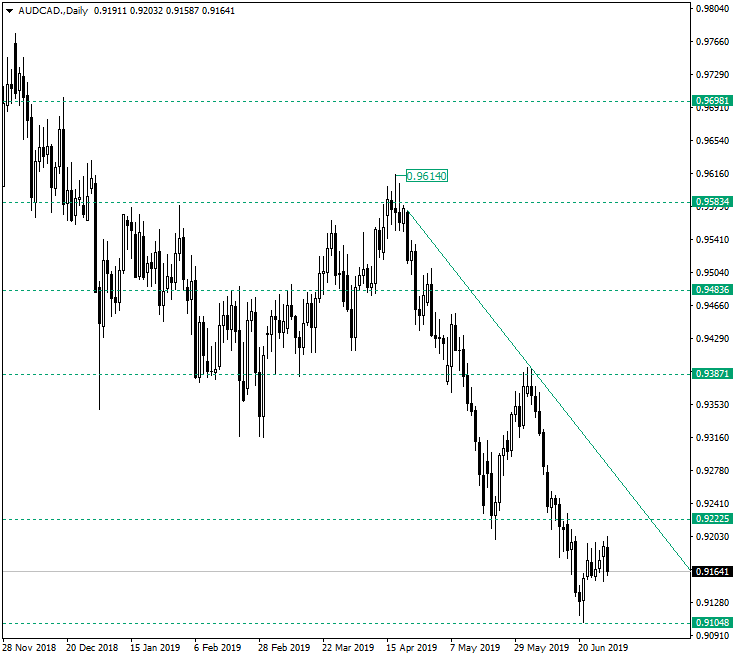

Failed Confirmation of 0.9104 on AUD/CAD

The Australian dollar versus the Canadian dollar currency pair delays its appreciation after confirming a very important weekly level. Long-term perspective The current descending trend that started from 0.9614 is still under way, but the fact that the price touched and retraced from 0.9100, an important weekly and also psychological level, should have given the first signs of trend change. The bullish engulfing pattern, on June 21, 2019, … “Failed Confirmation of 0.9104 on AUD/CAD”