The Sterling pound today fell against the US dollar as UK and European Union leaders exchanged words regarding the reopening of Brexit talks. The GBP/USD currency pair was on a losing trend from most of today’s session as markets reacted to the heightened possibility of a no-deal Brexit. The GBP/USD currency pair today fell from an opening high of … “Pound Hits Multi-Year Lows on Brexit Clash Between the UK and EU”

Month: July 2019

USD/JPY set to rock on the explosive mix of the Fed and the NFP

USD/JPY has been rising as upbeat data supported the greenback. The Fed’s first rate cut since the crisis and the US jobs report stand out. Late July’s technical chart paints a mixed picture. The FX Poll shows short-term rises followed by declines later on. What just happened: Mixed data, fresh trade talks The US and … “USD/JPY set to rock on the explosive mix of the Fed and the NFP”

GBP/USD bracing for the BOE after Boris

GBP/USD has been suffering from the Brexit impasse and USD strength. The Bank of England’s “Super Thursday” stands out. Late July’s daily chart points to further falls. Experts are neutral in the short term and bullish afterward. What just happened: PM Boris Johnson meets reality Boris Johnson, PM – a headline that many had waited … “GBP/USD bracing for the BOE after Boris”

US Dollar Rallies on Better-Than-Expected Q2 GDP

The US dollar is rallying against a basket of currencies to close out the trading week, driven by a better-than-expected but slower than usual second-quarter economic report. The gross domestic product cooled down in the April-to-June period, but there were some bright spots in the overall report, including a surge in consumer spending. According to the Bureau of Economic Analysis (BEA), the gross domestic product advanced a 2.1% annual clip in the second quarter, down from … “US Dollar Rallies on Better-Than-Expected Q2 GDP”

US GDP should encourage the Fed – and the dollar

US GDP has come out at 2.1%, above expectations. The Federal Reserve is watching the data very closely. The USD has room to rise ahead of the central bank’s decision. The US economy is alive and kicking – hardly justifying the planned Fed rate cut next week – and certainly not a pre-announcement about a … “US GDP should encourage the Fed – and the dollar”

Draghi masters the long term downfall of the euro

The ECB left its policy unchanged but opened the door to act in September. The euro has fallen on prospects of action. Draghi has prepared EUR/USD to extend its falls on the Fed decision. Mario Draghi is Super Mario once again. The European Central Bank has left its interest rate unchanged but still sent the … “Draghi masters the long term downfall of the euro”

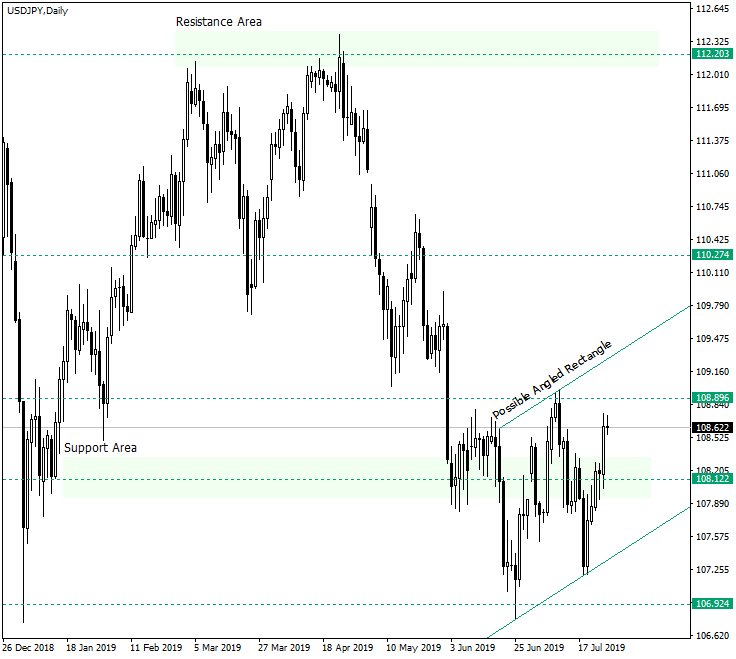

USD/JPY Might Change Course to 110.27

The US dollar versus the Japanese yen currency pair seems to be left out of the bearish interest, as the price went above the important 108.00 support. Long-term perspective After reconfirming the important 112.20 resistance, the price entered in a bearish driven movement that brought the price under 108.12, a major support. As it retraced to confirm 108.12 as resistance, the bulls took action and dragged the price above the support area. The bears saw this as a new … “USD/JPY Might Change Course to 110.27”

Pound See-Saws on Boris Johnsonâs Cabinet, Later Crashes

The British pound today see-sawed between gains and losses as investors remained cautious after Boris Johnson assumed office as the new British Prime Minister. The GBP/USD currency pair was weighed down by the cabinet reshuffle announced by the new PM with many of those appointed being hard Brexiteers, which increases the chances of a no-deal … “Pound See-Saws on Boris Johnsonâs Cabinet, Later Crashes”

Euro Weakens As ECB Signals September Rate Cut, More QE

The euro fell to a two-year low against some of its major currency rivals on Thursday after the European Central Bank (ECB) left interest rates unchanged but prepared investors for additional easing in the fall. President Mario Draghi essentially maintained a sour outlook on the eurozone economy, suggesting that the ECB needs to maintain and deliver a âhighly accommodativeâ policy even when Christine Lagarde becomes the new head. At its July policy meeting, … “Euro Weakens As ECB Signals September Rate Cut, More QE”

South African Rand Gains After Inflation Beats Expectations

The South African rand gained today after nation’s inflation beat expectations. South Africa’s annual inflation was at 4.5% in June, the same as in May and above the market consensus of 4.4%. Core inflation was at 4.3%, up from 4.1% in May, which was the lowest rate in more than a year. Monthly inflation was at 0.4%, up from 0.3% in the previous month and matching forecasts. USD/ZAR edged down from 13.9115 to 13.8908 … “South African Rand Gains After Inflation Beats Expectations”