The Great Britain pound ended the week as the weakest currency on the Forex market. While the sterling got some help from domestic macroeconomic data, Brexit fears continued to hurt the currency. The US dollar and the euro were also soft. Commodity currencies were clear winners during the past trading week. The week started poorly for Britain’s currency due to expectations that pro-Brexit Boris Johnson will become a new prime minister. The sterling … “Pound Ends Week Weakest amid Brexit Fears, Domestic Data Fails to Boost Currency”

Month: July 2019

Canadian Dollar Mixed amid Opposing Fundamentals

The Canadian dollar was mixed today, unsure where to go amid opposing fundamentals. While domestic macroeconomic data was very detrimental to Canada’s currency, rising prices for crude oil was a supportive factor for the loonie. Statistics Canada reported that retail sales fell 0.1% in May, declining for the first time in four months. Core retail sales (those that exclude motor vehicle and parts dealers) dropped 0.3%. Analysts … “Canadian Dollar Mixed amid Opposing Fundamentals”

USD/TRY Rises as Tensions Between USA & Turkey Flare

The Turkish lira fell against the US dollar today after geopolitical tensions between the United States and Turkey flared. Relations between the two NATO members worsened after Turkey decided to buy Russia’s S-400 missile defense system. Washington was threatening Ankara with sanctions if the deal comes through. It looks like the threats were not idle as the US government announced that it is suspending Turkey … “USD/TRY Rises as Tensions Between USA & Turkey Flare”

US Dollar Rallies As Market Dismisses IMFâs âOvervaluedâ Concerns

The US dollar is finishing the trading week higher against a handful of currencies as the market appears to be moving on from recent comments pertaining to the greenbackâs valuation. With a Federal Reserve bank president discussing the need for action ahead of a crisis and some data to throw in the mix, it has been a fun ride for the dollar this week. For weeks, President Donald Trump has contended that the dollar is too high and that the central … “US Dollar Rallies As Market Dismisses IMFâs âOvervaluedâ Concerns”

Japanese Yen Soft After Data Suggests Economy Weakens

The Japanese yen was generally soft today, though the currency has trimmed losses against some of its rivals by now and even managed to gain on the euro, which itself was very vulnerable. Domestic macroeconomic data, which demonstrated weakening economic activity in Japan, was unfavorable to the yen. The Statistics Bureau of Japan reported that the core Consumer Price Index rose 0.6% in June, year-on-year. While the increase matched analysts’ forecasts, … “Japanese Yen Soft After Data Suggests Economy Weakens”

Euro Falls As Fed Reassures Markets of Its Less-Dovish Stance

The euro today fell aggressively against the US dollar reversing most of yesterday’s gains after the New York Federal Reserve rushed to clarify dovish comments made by its President John Williams. The EUR/USD currency pair was also pressured by the weak German producer data released earlier today as well as the resurgent greenback. The EUR/USD currency pair today fell from an opening high of 1.1268 … “Euro Falls As Fed Reassures Markets of Its Less-Dovish Stance”

Canadian Dollar Soft After Crude Oil Drops 2%

The Canadian dollar was performing extremely poor today. While the loonie has managed to erase intraday losses versus the US dollar by now, the Canadian currency remained below the opening level against other most-traded rivals. The most likely reason for the drop was the decline of crude oil prices. Positive Canadian employment data did little to help the currency. Futures for crude oil fell about 2% on Thursday due to a range of negative … “Canadian Dollar Soft After Crude Oil Drops 2%”

Sterling Gets Boost from Brexit News, Strong Retail Sales

The Great Britain pound was one of the strongest currencies today, gaining on most of its major rivals, though failing to gain on the extremely strong Australian dollar and almost erasing gains versus the New Zealand dollar. The factors supporting the currency were a reduced chance of a no-deal Brexit and a surprisingly good retail sales report. Investors were concerned that Boris Johnson, the most likely candidate for the seat of the prime minister, may push for a no-deal … “Sterling Gets Boost from Brexit News, Strong Retail Sales”

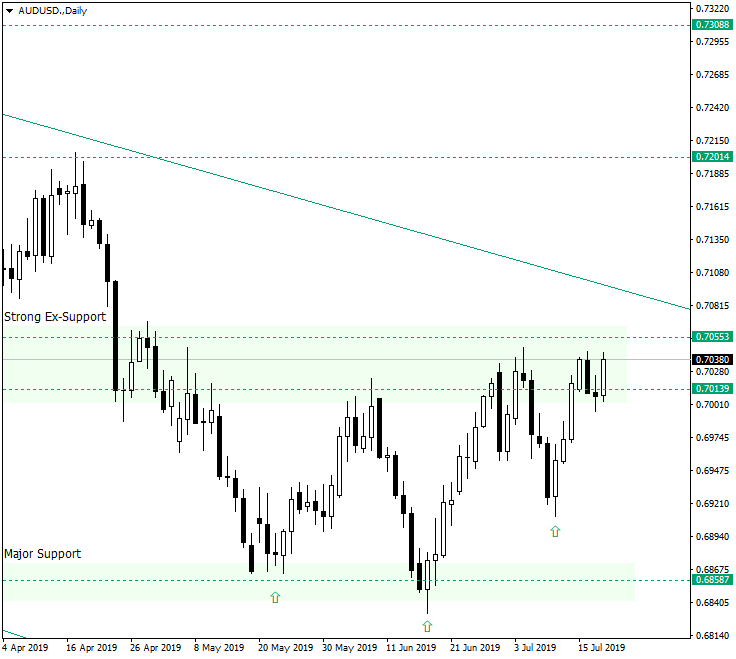

AUD/USD Facing an Important Test Before Continuing Towards 0.7200

The Australian dollar versus the US dollar currency pair is at an important resistance area, but the bulls are very determined. The clues for which path the price will take lie in a few details. Long-term perspective The price is in a downwards movement since the mid of 2018, but is also limited by the support of 0.6858 and the resistance area of 0.7055 and 0.7013. Between this support and resistance zones the waves typical for a consolidative phase took shape. … “AUD/USD Facing an Important Test Before Continuing Towards 0.7200”

Euro Drops on Fears of Further Monetary Easing From the ECB

The euro today fell from its daily highs against the US dollar as markets reacted to news that the European Central Bank was considering a different approach to meet its inflation target. The EUR/USD currency pair later recovered given that the greenback was also under significant selling pressure as markets continue to price in a Fed rate cut on July 31. The EUR/USD currency pair today fell from a … “Euro Drops on Fears of Further Monetary Easing From the ECB”