The New Zealand dollar gained against most of its major peers today. While the kiwi has lost gains versus its US counterpart by now, it was still trading higher against other peers. Market analysts attributed the rally to the positive consumer inflation print, though some of them argued that the data is not as good as might seem at first glance. Statistics New Zealand reported that the Consumer … “NZ Dollar Rises on In-Line CPI, Loses Gains vs. US Dollar”

Month: July 2019

Swiss Franc Opens Higher, Mixed Afterwards

The Swiss franc opened sharply higher against its major rivals today. While it fell from the opening level against some peers, the Swissie gained on others. Domestic macroeconomic data was negative to the currency. Switzerland’s Federal Statistical Office reported that the Producer Price Index fell 0.5% in June from the previous month. Analysts had predicted an increase of 0.1%. The index was unchanged in May. USD/CHF opened at 0.9829 … “Swiss Franc Opens Higher, Mixed Afterwards”

Chinese Yuan Tries to Find Direction on Slowing GDP, Strong Data

The Chinese yuan is struggling to find direction to kick off the trading week after economic growth slowed to its lowest level in nearly three decades. But it was not all bad news for the worldâs second-largest economy as an influx of data came in better than expected, giving the yuan some support. The big news on Monday was the gross domestic product growth rate coming in at 6.2% in the second quarter, down from … “Chinese Yuan Tries to Find Direction on Slowing GDP, Strong Data”

Australian Dollar Gains on China’s Data

The Australian dollar gained against its most-traded rivals today after the release of macroeconomic indicators in China, Australia’s biggest trading partner. While not all indicators were especially good, most of them were decent enough to support the Aussie. The National Bureau of Statistics of China reported that gross domestic product rose 6.2% in the second quarter of this year from a year ago, down from 6.4% in the first quarter and matching … “Australian Dollar Gains on China’s Data”

Pound Reverses 3-Day Rally Amid Upbeat US Manufacturing Report

The British pound today fell against the US dollar reversing all of Friday’s gains amid a lack of any major releases from the UK docket. The GBP/USD currency pair fell due to the absence of catalysts to prop up the Sterling with the pair’s performance being driven largely by investor sentiment. The GBP/USD currency pair … “Pound Reverses 3-Day Rally Amid Upbeat US Manufacturing Report”

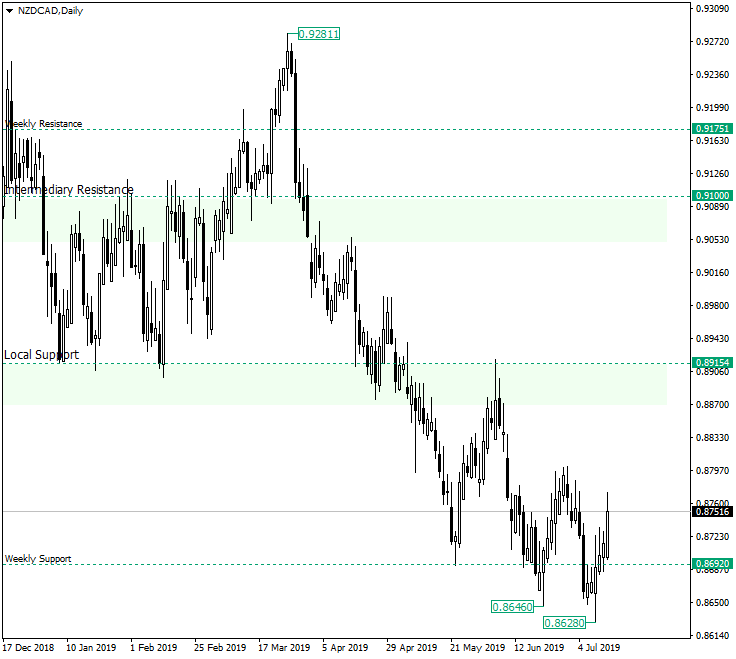

NZD/CAD Confirms the 0.8692 Support

The New Zealand dollar versus the Canadian Dollar currency pair looks as if it confirmed the weekly support of 0.8692. Long-term perspective The fall from 0.9281 was driven by the bears with extreme confidence, but now, as the price approached this important weekly level, the bears preferred to book their profits and let the bulls do their thing. This fact is represented by the low of July 1, 2019, which is a lower … “NZD/CAD Confirms the 0.8692 Support”

Australian Dollar Firm Despite China’s Trade Data

The Australian dollar was firm across the board today despite trade data from China, Australia’s biggest trading partner. While China’s trade surplus increased, the report was not necessarily good. China’s trade balance posted a surplus of $50.98 billion in June, up from $41.73 billion in the previous month and $40.91 billion a year ago, reaching the highest level since December of the last year. It was also above … “Australian Dollar Firm Despite China’s Trade Data”

US Dollar Mixed on PPI, Index Slips Below 97

The US dollar is mixed against most currencies at the end of the trading week, driven by the latest inflation numbers. The greenback is also finding direction on expectations that the central bank will cut interest rates at the end of the month, according to signals during this weekâs semi-annual testimony in front of Congress … “US Dollar Mixed on PPI, Index Slips Below 97”

Euro Rallies on Investor Sentiment, Falls on Weak German Data

The euro today rallied against the US dollar in the Asian session before falling during the European session after the release of weak German data. The EUR/USD currency pair later rallied in the American session following the release of mixed US factory data. The EUR/USD currency pair today rallied to a high of 1.1274 in … “Euro Rallies on Investor Sentiment, Falls on Weak German Data”

Mexican Peso Resilient Despite Central Bank’s Minutes, Declining Industrial Production

The Mexican peso was relatively stable today despite dovish monetary policy meeting minutes of the nation’s central bank and unfavorable domestic macroeconomic data. Political turmoil was also putting pressure on the currency, which was surprisingly resilient during the current trading session. The Banco de Mexico released minutes of its monetary policy meeting in June when policymakers decided to keep the main interest rate unchanged at 8.25%. Four out … “Mexican Peso Resilient Despite Central Bank’s Minutes, Declining Industrial Production”