The Chinese yuan is rallying midweek against some of its most traded currency rivals. Despite vehicle sales tumbling in June and inflation coming in lower than expected, the yuan is strengthening, which could be attributed to renewed trade negotiations between the worldâs two largest economies. According to the China Association of Automobile Manufacturers (CAAM), car sales fell 9.6% in June from the same time a year ago to 2.06 million … “Chinese Yuan Rallies Despite Bad Inflation, Auto Sales Data”

Month: July 2019

Pound Mixed After Slew of Economic Reports

The Great Britain pound was mixed today, falling against some rivals while rising versus others. Such behavior is not surprising, considering that Britain’s macroeconomic data released over the trading session was mixed as well. The sterling was trying to erase losses but currently is not successful. The Office for National Statistics reported that gross domestic product rose 0.3% in May from the previous month, … “Pound Mixed After Slew of Economic Reports”

Aussie Firm Despite Domestic & China’s Data

The Australian dollar was firm today despite poor macroeconomic data, both domestic and in China, Australia’s biggest trading partner. The possible reason for the rally was profit-taking after yesterday’s huge slump. The currency fell against some rivals intraday but has erased losses by all of them by now. The Westpac-Melbourne Institute Index of Consumer Sentiment dropped 4.1% in July after declining 0.6% in June. The report said it was troubling … “Aussie Firm Despite Domestic & China’s Data”

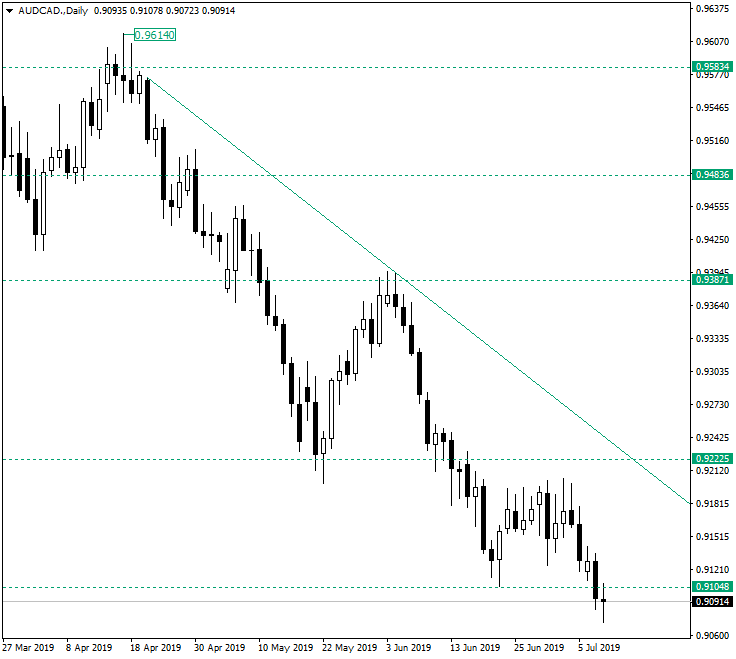

AUD/CAD After It Went Beneath 0.9100

The Australian dollar vs. the Canadian dollar considered the direction of the main trend, continuing the downwards move. What could happen next is very interesting. Long-term perspective From the high of 0.9614, the pair finds itself in a descending trend which respected the important levels, confirming each of them as resistance before the next leg down. Now, as the price went under the next important level, represented by the psychological level of 0.9100 (0.91048 on the chart), further … “AUD/CAD After It Went Beneath 0.9100”

Japanese Yen Soft After PPI Falls Unexpectedly

The Japanese yen was soft against all of its major peers today. While investors were still nervous ahead of the testimony of Federal Reserve Chairman Jerome Powell, giving them incentive to stick to safer currencies, domestic macroeconomic data was unfavorable to the yen. The Bank of Japan reported that the Producer Price Index fell 0.1% in June from a year ago after rising 0.6% in May. That was a total surprise … “Japanese Yen Soft After PPI Falls Unexpectedly”

Great Britain Pound Falls with Retail Sales

The Great Britain pound was weak on Tuesday amid risk aversion on the Forex market. Domestic macroeconomic data was not doing the sterling any favors either. Like-for-like retail sales reported by British Retail Consortium fell 1.6% in June, year-on-year. That is compared to the drop by 1.5% predicted by economists and the decline by 3.0% registered in May. Helen Dickinson, Chief Executive at BRC, blamed the Brexit for the underwhelming data: Overall, the picture … “Great Britain Pound Falls with Retail Sales”

Swiss Franc Strong amid Risk Aversion, Falling Unemployment

The Swiss franc, as well as other safe currencies like the US dollar and the Japanese yen, were extremely strong on Tuesday amid speculations whether the Federal Reserve will cut interest rates this year and how much. Domestic macroeconomic data was also supportive of the Swissie. Friday’s better-than-expected nonfarm payrolls made traders question whether the Fed will cut rates anytime soon. Market participants wait for Fed Chair Jerome … “Swiss Franc Strong amid Risk Aversion, Falling Unemployment”

USD/MXN Surges After Mexican Finance Minister Resigns

The Mexican peso sank versus the US dollar today amid political turmoil caused by the surprise resignation of Mexico’s finance minister. Nation’s consumer inflation slowed a bit last month but was not bad overall. In a surprise move, Carlos Urzúa resigned from his office, writing a highly critical resignation letter. He cited disagreements with the government over economic issues as one of the reasons for his decision, saying: Some … “USD/MXN Surges After Mexican Finance Minister Resigns”

Australian Dollar Drops with Business Confidence

The Australian dollar declined today amid the worsening business confidence in Australia and the general negative market sentiment. National Australia Bank reported that the business conditions improved from +1 to +3 in June. The report said that the increase was a result of “a lift in the employment and trading sub-indexes”. At the same time, the business confidence dropped from +7 to +2 following the sharp increase in May. The report noted that “the decline in confidence was broad-based across … “Australian Dollar Drops with Business Confidence”

US Dollar Rallies to 3-Week Highs as Fed Rate Cut Appears Unlikely

The US dollar today rallied to almost 3-week highs as market hopes for future rate cuts from the US Federal Reserve dissipated in the face of positive US jobs data. The greenback also benefitted from the uncertainty surrounding the US-China trade war that caused a significant sell-off in US equity markets and high demand for … “US Dollar Rallies to 3-Week Highs as Fed Rate Cut Appears Unlikely”