The Canadian dollar is mixed against a basket of currencies on Tuesday, driven primarily by housing data that pleased and displeased investors. The loonie is also waiting for the Bank of Canada (BOC)âs decision on interest rates this week that will either mirror its American counterpart or adopt a wait-and-see approach. According to the Canada Mortgage and Housing Corporation (CMHC), housing starts surged 26% to 245,657 in June, beating median estimates of 210,000. This … “Canadian Dollar Mixed on Housing Data, Upcoming BOC Decision”

Month: July 2019

What we can learn from trading the recent NFP

Trading the Non-Farm Payrolls is a complicated – yet potentially lucrative – task. The “whisper” number had a significant impact on the trade. Having a stop-loss is critical for the event. The first trading week of July 2019 can be divided into everything that happened before the Non-Farm Payrolls and after it. The USD dollar … “What we can learn from trading the recent NFP”

US CPI may send USD down – Preview

Investors and the Federal Reserve will be tuned to June’s all-important inflation figures. Fed Chair Powell will speak before and after the release, allowing a thorough response. FXStreet’s Surprise Index is indicating a downside surprise. Recent inflation trends are also pointing to a negative outcome. All eyes are on Federal Reserve Chair Jerome Powell and his highly-anticipated … “US CPI may send USD down – Preview”

Three reasons for GBP/USD’s downfall and levels to watch

GBP/USD has dropped to fresh six-month amid recession fears. Weak BRC retail sales exacerbate the pound’s pounding. Comments by Ireland’s finance minister also weigh. Tuesday’s daily chart points to near oversold conditions on GBP/USD. Sterling has been unable to enjoy any solace – Bears are breaking the pound as Brexit weighs on several fronts. Here are … “Three reasons for GBP/USD’s downfall and levels to watch”

Chinese Yuan Rises As New Loans Seen at Five-Month High, Forex Reserves Jump

The Chinese yuan is strengthening to start the trading week as new economic data lifted the currency against several major rivals on Monday. As Beijing begins a trade truce with Washington, foreign exchange reserves were better than expected, which also coincides with new loans expected to surge to their best levels in five months. According to the Peopleâs Bank of China (PBOC), forex reserves climbed $18.23 billion last month … “Chinese Yuan Rises As New Loans Seen at Five-Month High, Forex Reserves Jump”

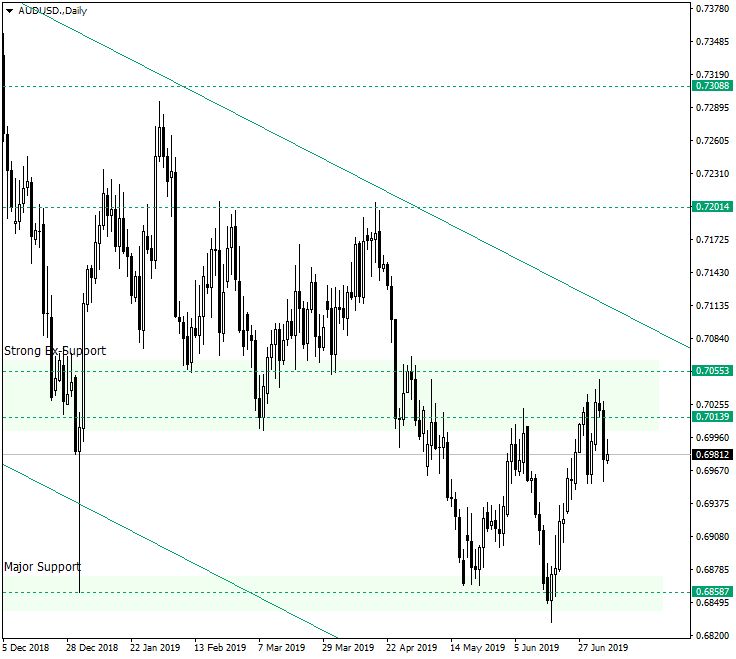

AUD/USD Looking Towards 0.7200

The Australian dollar vs. the US dollar is quietly preparing an ascent while evolving casually in the descending channel that began a year ago. Long-term perspective The pair is in a descending trend, the resistance line of which can be drawn by uniting the highs of July 8, 2018, and December 3, 2018, respectively. Besides the resistance line, two major areas that keep the price in check are the strong ex-support area of 0.7053 and 0.7013 … “AUD/USD Looking Towards 0.7200”

Turkish Lira Opens Sharply Lower After Sacking of Central Bank’s Chief

The Turkish lira opened sharply lower today compared to the Friday’s close after the news that Turkish President Recep Tayyip Erdogan sacked central bank’s governor Murat Cetinkaya, giving the office to his deputy instead. While no official explanation for the decision was given, the general consensus is that the reason for the sacking was a refusal of the previous governor to lower interest rates despite the insistence from the president. That raised concerns … “Turkish Lira Opens Sharply Lower After Sacking of Central Bank’s Chief”

Japanese Yen Loses Gains Despite Positive Domestic Fundamentals

For a while today, the Japanese yen was one of the strongest currencies on the Forex market, opening sharply higher against its rivals. But by now it has lost gains against all of its major peers despite the positive outlook for Japan’s economy. Domestic macroeconomic data was not especially good, though. The Bank of Japan reported that lending by Japanese banks increased by 2.3% in June from the previous year, while market … “Japanese Yen Loses Gains Despite Positive Domestic Fundamentals”

Canadian Dollar Forecast for 8-12 July 2019

The Canadian dollar ended the last trading week as the strongest among most-traded currencies despite surprisingly poor employment data. What expects the loonie during the current week? The week will be less eventful than the previous one, with the Bank of Canada monetary policy meeting being the only major event important for the Canadian currency specifically. The BoC will hold a meeting on July 10 at 14:00 GMT. The latest GDP and consumer inflation … “Canadian Dollar Forecast for 8-12 July 2019”

US Dollar Ends Week Firm on US-China Ceasefire, Nonfarm Payrolls

The US dollar ended the week with gains against the majority of most-traded currencies, though not against the Canadian dollar. The US-China trade ceasefire and positive US employment data were the main contributors to the greenback’s rally. The week started with positive news that the United States and China agreed not to escalate their trade conflict further and to resume negotiations. The employment report from Automatic Data Processing released on Wednesday missed expectations, … “US Dollar Ends Week Firm on US-China Ceasefire, Nonfarm Payrolls”