- The US ISM Non-Manufacturing PMI is a critical leading indicator.

- FXStreet’s Surprise Index points to a downside surprise.

- The US dollar may lose ground on the news.

Will the Federal Reserve cut interest rates in September? That is the main question currency traders are asking and the answer – as the Fed puts it – depends on the data. As the central bank tries to gauge future developments, ISM’s forward-looking Purchasing Managers’ Index for the services sector – America’s largest – is a critical figure.

FXStreet Surprise Index quantifies, in terms of standard deviations of data surprises (actual releases vs. survey median), the extent to which economic indicators exceed or fall short of consensus estimates.

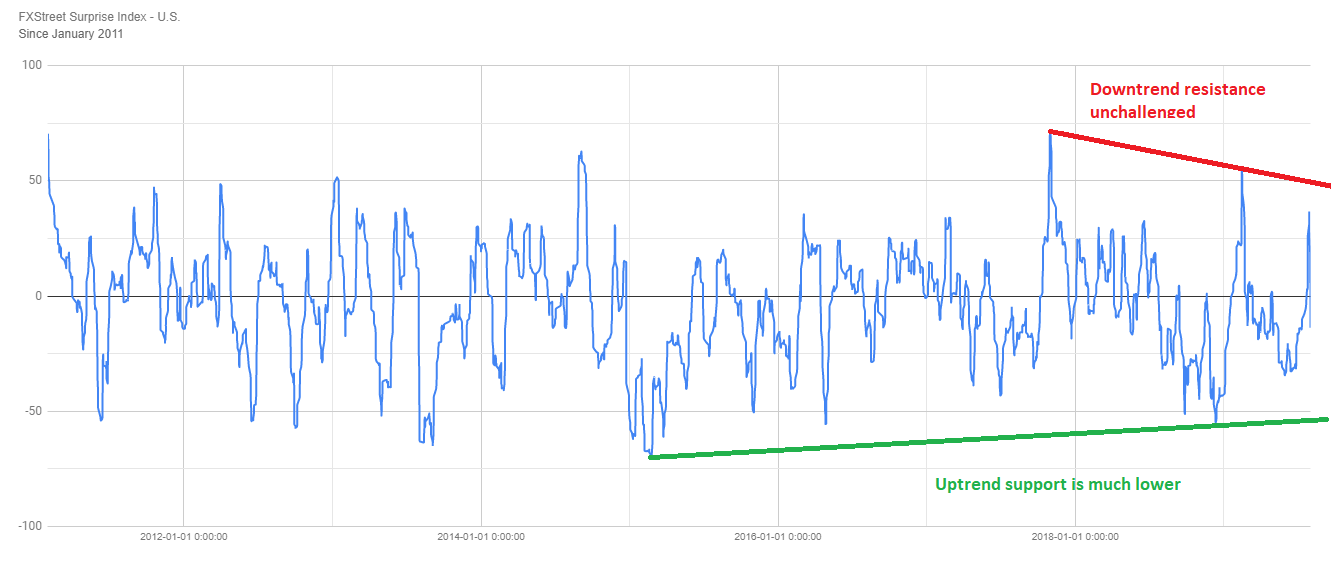

Examining US data since 2011, we can see how upside surprises became more frequent in early 2019, but that was short-lived. Since then, figures came returned to hovering around the middle-ground of surprises.

Moreover, we can draw a downtrend resistance line from the peak early in the year and see that the recent upside swing has failed to challenge the line – a bearish signal that implies further downfalls.

Also, downside surprises have been becoming less worse – higher lows on the chart. Also here, we can draw a trendline. The index has significant room to fall in order to challenge this uptrend support line – another bearish sign.

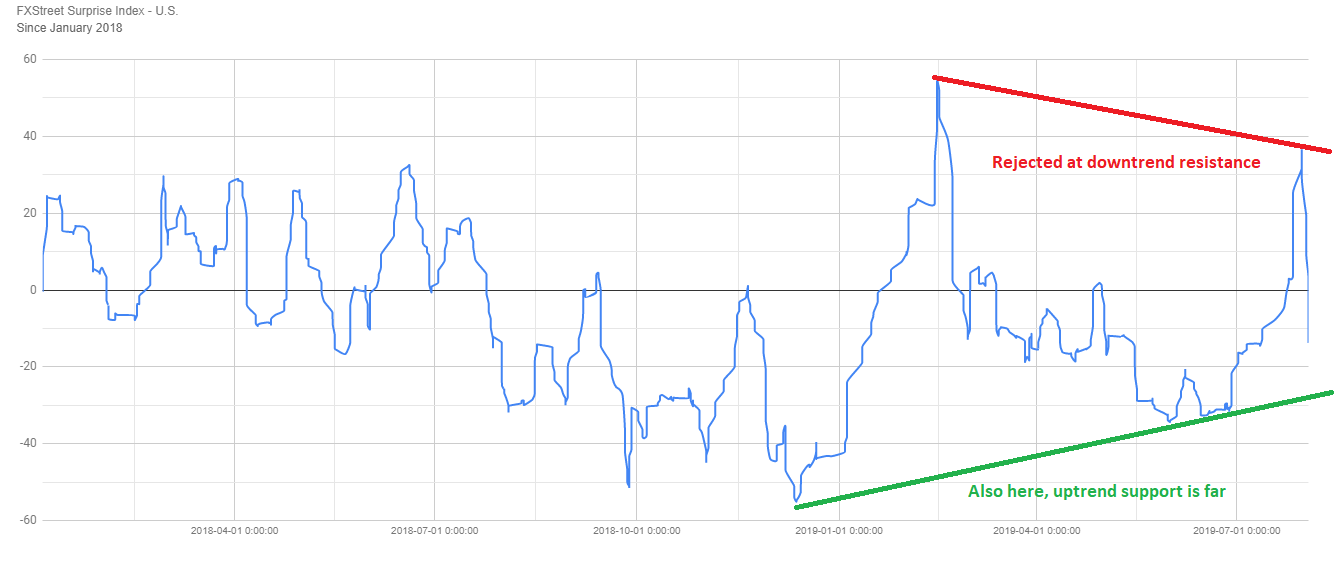

We will now take a closer look at FXStreet’s Surprise Index, with data dating back only to early 2018. Also here, an uptrend support line can be spotted and there is considerable room to fall in order to challenge it.

However, we examine a noteworthy difference on the upside. The chart clearly shows that upside surprises were rejected at the downtrend resistance line – the indicator will, therefore, have a hard time to recover from the recent blow.

Overall, FXStreet’s Surprise Index is pointing to a higher chance of a downside surprise than an upside one.

The economic calendar is showing that the consensus of economists is for the ISM Non-Manufacturing PMI to rise to 55.5 points in the upcoming report for July after 55.1 in June.

A potentially disappointing outcome such as a score of 55 points or lower will indicate a slowdown in America’s largest sector, raising expectations for the central bank to cut the interest rate. In this scenario, the US dollar has room to decline against its peers.

Get the 5 most predictable currency pairs