Brexiteers build on a robust trade agreement with America after the UK leaves the EU – and the pound had a taste of US trade relations with China. Intensifying trade wars have weighed on the dollar and allowed GBP/USD a recovery of sorts. Apart from the main themes, the UK jobs report, inflation, and retail sales compete for attention. Will cable resume its falls?

What just happened: Fears of a post-Brexit election, yuan devaluation

The US dollar has been on the back foot against several currencies – including the pound – as it was gaining ground against the yuan. The People’s Bank of China has allowed markets to push the exchange currency of its yuan lower in what seems like retaliation to America’s new tariffs. The ensuing sell-off in global shares sent money to the safety of bonds, including US Treasuries.

Lower yields now reflect higher chances of an imminent rate cut by the Federal Reserve – thus weighing on the dollar. Fed officials have been sending mixed messages, and it remains unclear if they act. The US has labeled China as a currency manipulator, and both currencies exchanged angry rhetoric. Nevertheless, new trade talks are still on the cards for September.

Weak US ISM Non-Manufacturing Purchasing Managers’ Index – which dropped to 53.7 points – has also weighed on the dollar. GBP/USD’s recovery has also been underpinned by the UK’s Services PMI for July which beat expectations with 51.4 points – reflecting ongoing growth in the UK’s largest sector.

The soft data for July was forgotten when the hard data for the second quarter has come out. The British economy has squeezed by 0.2% – the first contraction since 2012. The Q2 contraction came after stockpiling in the first quarter – but still stokes fears of a recession and sent sterling to challenge the lows.

Moreover, nothing has improved on political the Brexit front. Senior UK ministers such as Michael Gove and Dominic Raab have blamed the European Union of intransigence. They said the ball to preventing a hard Brexit is in the EU’s court. The bloc has refused to open the Brexit Withdrawal Agreement signed with former PM Theresa May.

Parliament is currently on a break, but politicians are gearing up for a rocky return in early September – with a vote of no-confidence on the cards. Reports suggest that PM Boris Johnson’s government is contemplating elections on November 1st – one day after the Brexit deadline. Johnson’s senior adviser Dominic Cumming has not ruled out bypassing the House of Commons to ram through a hard exit.

Pro-Remain rebels in the ruling Conservative Party have been considering a government of national unity with the opposition in order to prevent a no-deal Brexit, but reaching an accord with opposition parties seems unlikely.

UK events: Brexit politicking and three top-tier events

Further political developments around Brexit will likely dominate sterling trading. Additional preparations for a no-deal exit and reports about elections or parliamentary plots may have the most significant impact on GBP/USD.

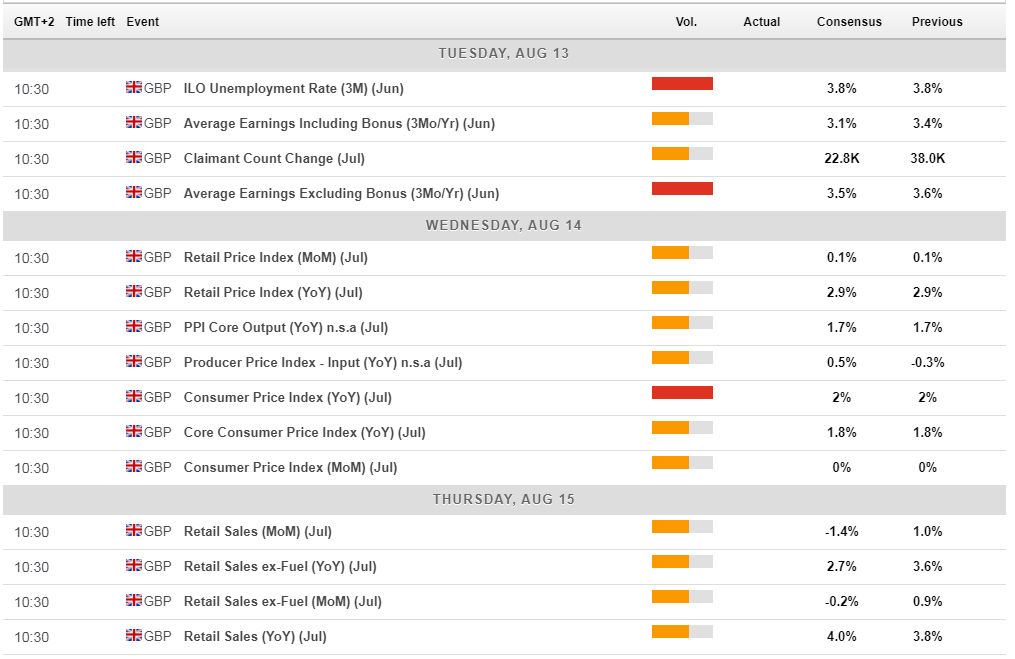

However, pound traders and the Bank of England will also be eyeing economic data. The UK’s jobs report kicks off the week on Tuesday with an expected slowdown in wage growth for June – which has been robust at 3.4% in June. The unemployment rate is set to remain at the lows of 3.8% despite an ongoing increase in the Claimant Count Change – or jobless claims – which is projected to advance again in July.

Inflation figures stand out on Wednesday. Headline Consumer Price Index (CPI) has been bang on the BOE’s target of 2% year on year in June – and July carries expectations for a repeat of this figure. Core CPI is also forecast to remain unchanged at 1.8%. BOE Governor Mark Carney and his colleagues at the bank would like to raise interest rates amid stable inflation and rising salaries ~ but Brexit paralyzes all policymaking.

Retail sales stand out on Thursday. Economists expect a drop in British consumptions in July after a robust rise of 1% % in June. Sales excluding fuel are also projected to fall.

Here are the upcoming UK macro events, as they appear on the economic calendar:

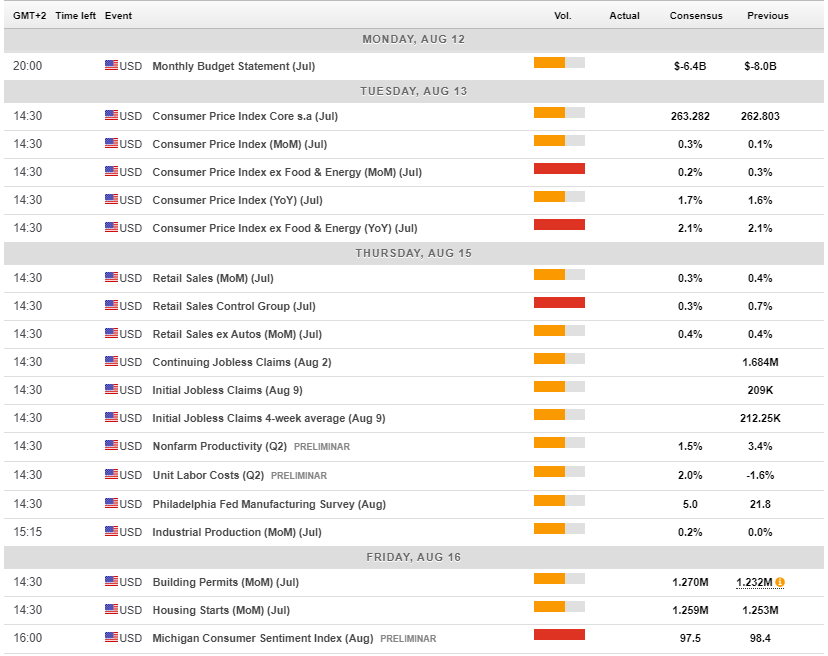

US events: Inflation and retail sales as well

Further developments in relations between the US and China – the world’s largest economies – are set to set the tone once again. Any sign of defusion in tensions – fresh falls in the yuan exchange rate, expressions of optimism, or potentially a delay in the upcoming imposition of US tariffs on China – may boost markets and the dollar. Any further deterioration – an official cancellation of talks, a new spat around technology, or any other adverse developments – may send stocks plunging and the greenback may suffer.

Macro-economic releases in the US are similar to those in the UK. Core CPI is expected to remain unchanged also in the US – holding at 2.1% YoY in July. Weak inflation has been one of the reasons for the rate cut, and any deviation is set to move markets.

Consumption data – which is critical in the world’s largest economy – are due out on Thursday. The American consumer has probably slowed down the pace of shopping last month after a leap in June. The control group is the most substantial figure to watch.

The University of Michigan’s Consumer Sentiment Index may also have a significant impact. The preliminary survey for August is set to decline but remain at elevated levels. Consumer confidence indices are correlated with future spending.

Here is the list of US events from the FXStreet calendar:

GBP/USD Technical Analysis

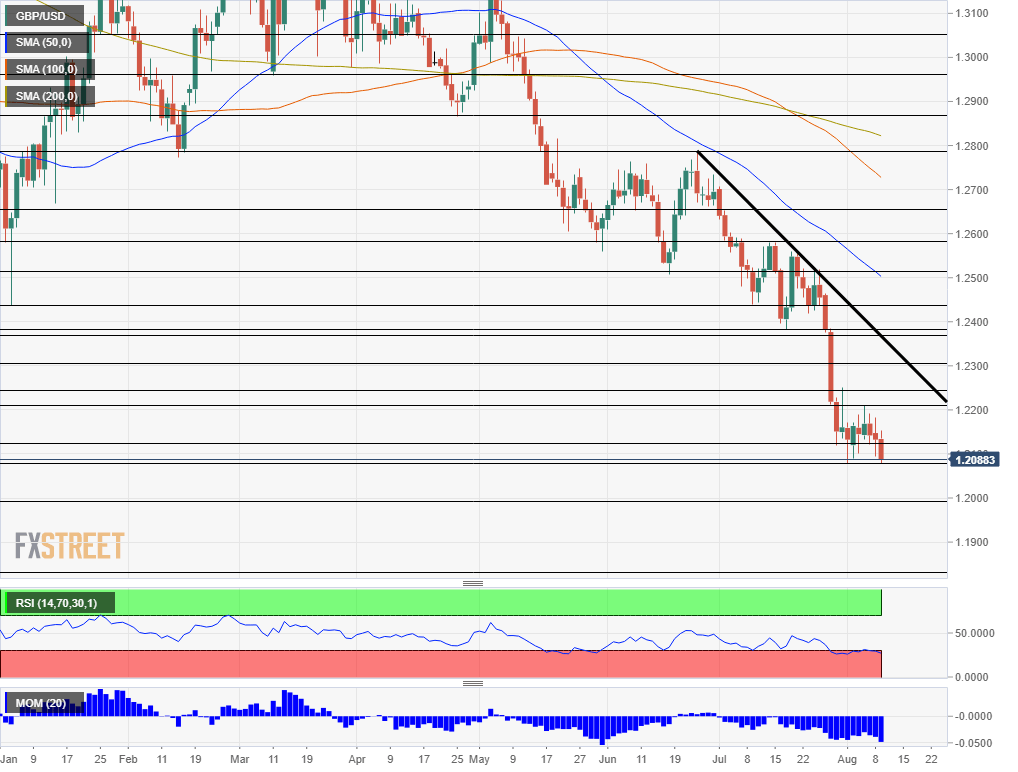

The Relative Strength Index has dipped below 30 – indicating oversold conditions. This is the sole solace on the daily chart – implying a temporary bounce. On the other hand, downside momentum remains robust, and GBP/USD trades below the 50, 100, and 200 Simple Moving Averages.

Early August’s trough of 1.2075 is a critical battle line. The round number of 1.2000 is psychologically essential, and it is closely followed by 1.1985 – a flash crash low from early 2017. The next line is the lowest ever for cable – 1.1866 seen in late 2016.

Looking up, the past week’s peak of 1.2210 caps the pair. The post-crash recovery high of 1.2250 follows it. The next lines are from late July: 1.2380 and 1.2420, which have both provided support. The round number of 1.2500 is next.

GBP/USD Sentiment

The limited recovery of GBP/USD may come to an end. A dose of profit-taking was probably necessary after the previous week’s downfall, but the lack of progress on Brexit may push the pound lower – even if falling US yields hold the greenback back.

Get the 5 most predictable currency pairs

GBP/USD has yet to see the bottom as Boris’s Brexit weighs heavily