The US dollar is mixed at the end of the trading week as a new lower-than-expected July jobs report highlighted how robust the national economy is as a diverse array of industries enjoyed gains and more people entered the workforce. But the greenback contended with renewed trade tensions between the US and China, which sent leading stock indexes into negative territory in the early part of the trading session. According to the Bureau of Labor Statistics (BLS), the US … “US Dollar Mixed As Economy Adds 164k Jobs, Faces Renewed Trade Tensions”

Month: August 2019

Risk Aversion Prevents Aussie from Gaining on Positive Data

The Australian dollar dropped against other most-traded currencies today despite better-than-expected domestic data. Risk aversion, which prevailed on the Forex market after the announcement of new US tariffs on Chinese goods, did not allow the Aussie to profit from positive macroeconomic reports. The Australian Bureau of Statistics released a couple of economic indicators today. Retail sales rose 0.4% in June from the previous month, seasonally adjusted, after increasing 0.1% … “Risk Aversion Prevents Aussie from Gaining on Positive Data”

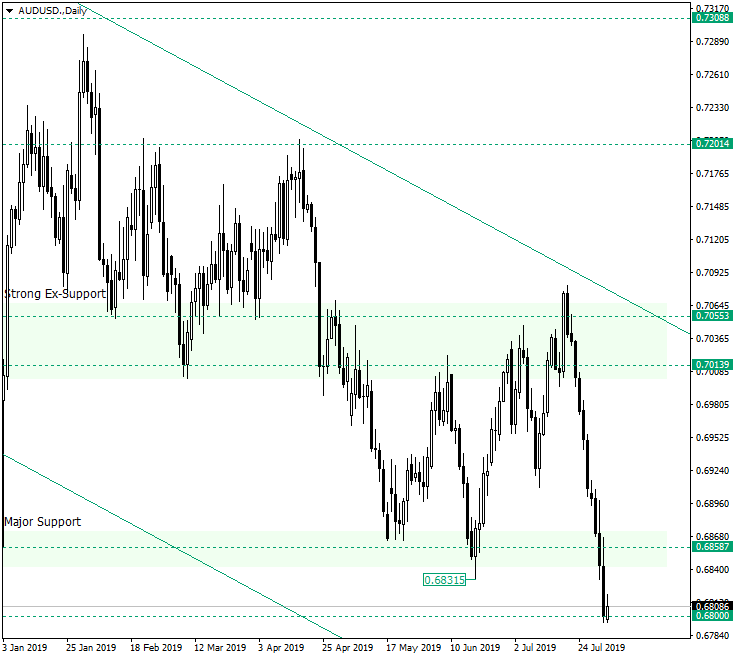

AUD/USD at the Possible Fragile 0.6800 Support

After such a strong decline, would the 0.6858 still be able to offer a surprise? Long-term perspective The steep decline that came after the confirmation of the double resistance etched by the upper line of the descending channel and the 0.7055 with 0.7013 resistance area managed to bring the price under the 0.6858 major support level, pausing at the 0.6800 psychological level. This movement, besides taking out the previous low that falsely pierced the 0.6858 level, … “AUD/USD at the Possible Fragile 0.6800 Support”

Australian Dollar Suffers from Risk Aversion

The Australian dollar tumbled today. While macroeconomic data, both domestic and from China, was not particularly bad, risk aversion on the Forex market hurt the Australian currency. The Australian Industry Group Australian Performance of Manufacturing Index climbed to 51.3 in July from 49.4 in June. Climbing above the 50.0 level, the indicator suggests that the sector returned to expansion. The import price index rose 0.9% in the June quarter from the previous three … “Australian Dollar Suffers from Risk Aversion”

US Dollar Higher on Fed Rate Cut Fallout, Capped by New Trump Tariffs

The US dollar is gaining on several major currency rivals in public trading on Thursday. But the US Dollar Index is heading in the opposite direction, falling below 98.5. The Federal Reserveâs cut to interest rates, President Donald Trumpâs new tariffs on China, and economic data are driving the greenbackâs trade. President Trump announced on Twitter that he will impose 10% tariffs on an additional $300 billion of Chinese goods, effective … “US Dollar Higher on Fed Rate Cut Fallout, Capped by New Trump Tariffs”

Japanese Yen Rallies Despite Negative Domestic News

The Japanese yen climbed against other most-traded currencies today despite domestic news that was not favorable to the currency. Some market analysts explained the rally by risk aversion among investors. Markit reported that the Jibun Bank Japan Manufacturing Purchasing Managers’ Index was at 49.4 in July, almost unchanged from June’s figure of 49.3. Being below the neutral 50.0 level, the indicator was showing a decline of the sector. … “Japanese Yen Rallies Despite Negative Domestic News”

Pound Falls to 2.5-Year Lows, Ignores BoE and Rallies on USD Weakness

The British pound today fell to 2.5-year lows against the much stronger US dollar, which was boosted by yesterday’s FOMC rate decision. The GBP/USD currency pair was barely affected by the Bank of England‘s interest rate decision before rallying higher later driven by the weak greenback. The GBP/USD currency pair today fell to a low … “Pound Falls to 2.5-Year Lows, Ignores BoE and Rallies on USD Weakness”

Euro Falls to Multi-Year Lows on FOMC, Recovers on Weak US Data

The euro today recovered most of its daily losses against the US dollar following the release of weak US manufacturing data in the early American session. The EUR/USD currency pair had fallen to a multi-year low in the Asian session following the Federal Reserve‘s hawkish rate cut before rallying higher later. The EUR/USD currency pair … “Euro Falls to Multi-Year Lows on FOMC, Recovers on Weak US Data”

NZD/CAD Under the Weekly Support of 0.8692

The New Zealand dollar versus the Canadian dollar currency pair is in a spot from where it could go either way for a considerable amount of time and pips. Long-term perspective After falsely piercing 0.8692, the low of 0.8628 favored the bulls who managed to bring the price very close to the local support level of 0.8915. The next step would have been a consolidation and the continuation of the ascending move, as the bulls had the situation in their favor. … “NZD/CAD Under the Weekly Support of 0.8692”

NFP Preview: 5 scenarios for EUR/USD, mostly downbeat

US Non-Farm Payrolls are set to provide a fresh direction after markets digested the Fed decision. Low expectations may lead to a positive surprise. The US dollar is well-positioned into the release. The historic rate cut by the Federal Reserve – which turned out to be hawkish and dollar-positive – may be behind us. However, the next … “NFP Preview: 5 scenarios for EUR/USD, mostly downbeat”