Super Mario supercharged EUR/USD – triggering a range of 120 and sending it plunging. Mario Draghi, president of the European Central Bank, has presided over a dramatic policy announcement in his penultimate decision.

Mario Draghi

On the one hand, the ECB has cut interest rates by only ten basis points from -0.40% to 0.50%. Moreover, the bank accompanied the reduction with a tiering system which exempts some banks from the punitive, negative rates.

On the other hand, the bank has announced it will resume its bond-buying scheme – less than a year after ending it. The Frankfurt-based institution will buy €20 billion worth of euro-zone bonds every month, starting from November 1.

The sum of monthly buys as it the low end of expectations. Moreover, the ECB bought €80 worth of bonds at the peak of the Quantitative Easing (QE) program and €60 billion throughout long periods between 2015 to 2018.

But the ECB shocked markets with one critical decision – QE will be open-ended – no time limit.

The previous programs included time limits. While these limits were then extended and quantities changed – they always had an expiry date. This time is different, and that is why the euro is crashing. The ECB may buy bonds forever, and more euros in circulation devalue the currency.

Draghi and his colleagues at the Governing Council also changed their guidance regarding interest rates – they will stay at current rates or lower as needed. Also here, the ECB has departed from setting time limits. The previous statement pledged to keep low rates through the first half of 2020.

Low or lower rates combined with open-ended buying promise persistent pressure on EUR/USD.

How low can EUR/USD go?

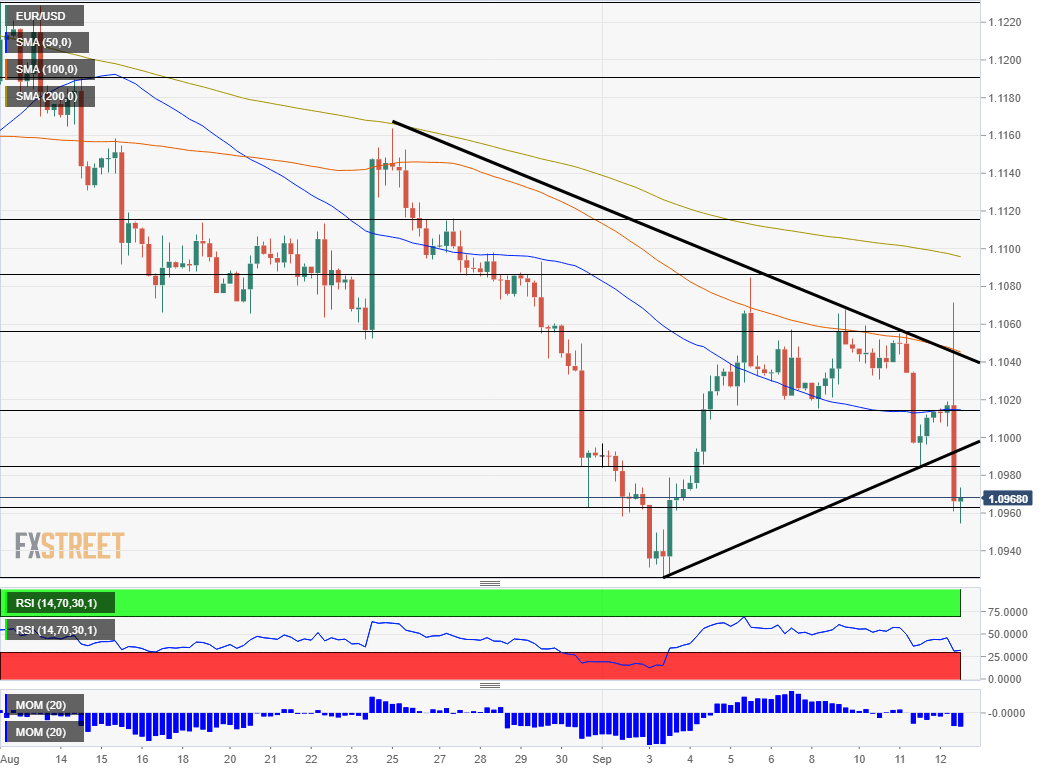

Immediate support awaits at 1.0926, the 2019 low seen in late August. Further down, we are back to levels last ween in 2017. The round number of 1.0900 is close by.

Further down, 1.0820 was the gap line from April 2017. It is followed by 1.0780, which is the other side of the gap. Lower, 1.0720 worked in both ways back then.

Looking up, resistance awaits at the psychologically important level of 1.10. It is followed by 1.1030, which capped the pair before the Mario Draghi decision. Next, the fresh peak of 1.1070 awaits.

Get the 5 most predictable currency pairs

EUR/USD has room to fall as ECB QE may never end