The holy grail of central bankers is 2% inflation – and Mark Carney, Governor of the Bank of England, may leave his post with that level – almost to the pip. However, Carney’s potentially perfect legacy may be undermined by Brexit – which has been pushing prices higher before even happening.

The case for an upside surprise

The UK depends on imports of fresh food, medicine, components for its finished goods, and other products. The rule of thumb is that for every 10% change in the pound, consumer prices move by 2-3%. While there is a lag between the change in the exchange rates and prices at stores – August’s fall of the pound was significant.

Sterling dropped by around 3$ at the end of July and at the beginning of August, right after Boris Johnson became prime minister. The growing speculation of a hard Brexit pushed the pound lower. This weakness persisted during the month and may affect prices.

It is, therefore, puzzling to see the economic calendar point to a deceleration in prices – from 2.1% YoY in July to 1.9% in August in the headline Consumer Price Index. CPI surprised to the upside in the previous report – and may do again now. A repeat of 2.1% or even higher cannot be ruled out.

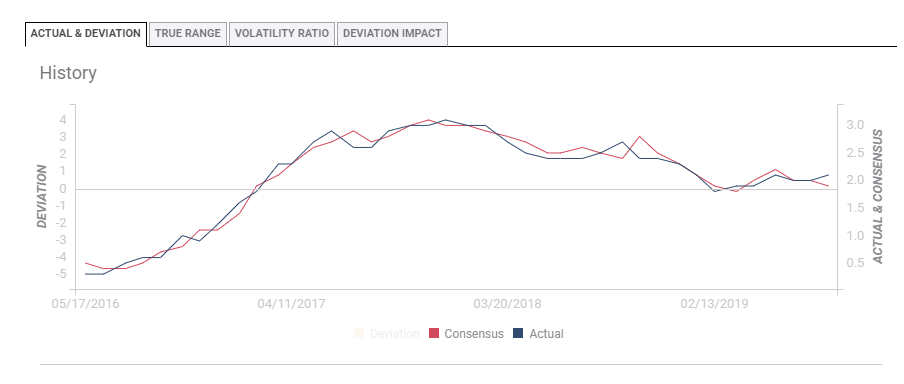

Here is how inflation developed in recent months and how actual prices diverged to the upside from expectations recently.

GBP/USD reactions and opportunities

Inflation is a top-tier indicator and tends to move the pound – and the upcoming release is due out just one day before the BOE announces its rate decision. However, Brexit not only moves inflation numbers via pound movements – but it also impacts the reaction to these figures – adversely.

Every development in the Brexit saga has a substantial effect on sterling, crowding out economic figures. If the analysis above is correct, GBP/USD is set to rise – but only temporarily. For a considerable and sustainable upside move, CPI would probably have to leap to 2.4% YoY – highly unlikely. The same goes for a downside surprise. It would probably take a deceleration of CPI to below 1.5% to weigh heavily on the pound.

In the more likely scenarios of a small surprise to either side, GBP/USD is set to move – yet it is likely to be an ephemeral move. In this case, any move that contradicts the current trend may serve as an opportunity. If the pound is falling on disappointing Brexit news and inflation beats expectations – the rise may serve as a selling opportunity. And if sterling is shining amid positive developments but inflation misses – a “buy the dip” scenario opens up.

Conclusion

UK CPI is expected to fall from 2.1% to 1.9% but the weaker pound in August makes the case for an upside surprise. The focus on Brexit means that any surprise may trigger only a short-lived and limited reaction – providing a trading opportunity if it goes against the trend.

Get the 5 most predictable currency pairs

UK inflation figures may help the pound