“We’ve got a great new deal,” tweeted UK Prime Minister Boris Johnson and set alight sterling’s surge. GBP/USD has risen some 800 pips within a week as a deal became a reality. The next move depends on the parliament approving the agreement. The critical vote on Saturday and also the events that follow are crucial.

This week in Brexit: Deal in Brussels

Intensive Brexit negotiations seemed to be losing the momentum it early in the week. Cautious comments from negotiators in Brussels were unable to seal a quick deal after last week’s breakthrough made by Johnson and his Irish counterpart Leo Varadkar. Chief EU Negotiator Michel Barnier called on the UK to inject fresh “political impulse – and that arrived on Wednesday. ” Reports of a draft deal then helped cable top 1.28.

The focus shifted from Brussels to London, where the PM tried to convince the Democratic Unionist Party (DUP) to back the accord. The small party from Northern Ireland (NI) was unhappy with keeping the province – at least de-facto – within the EU. The party’s raison d’etre is holding up the union of the United Kingdom, and having a customs border in the Irish Sea was hard to swallow. Moreover, the accord includes a new mechanism for changing the current arrangements – stripping unionists from their veto.

And then, on the morning of the EU Summit, Johnson decided to ignore the DUP’s reservations and sign off on a deal. GBP/USD nearly hit 1.30 before falling as the DUP vowed to vote against the accord. On the other hand, the PM has secured the support of some of the hardliners in his party, known as the “Spartans.” A handful of opposition Labour MPs also announced they would back the PM. But will it be enough to muster a majority?

European Commission President Jean-Claude Juncker seemed to rule out an extension to Brexit, perhaps trying to help Johnson push MPs to support for a deal. However, it is up to heads of states – not Juncker – to accept or reject an extension.

The focus now shifts to Westminster.

Next in Brexit: All eyes on Saturday’s vote and its aftermath

For the first time since the Falklands war of 1982, the House of Commons will sit on a Saturday. Speaker of the House John Bercow has allowed for an ample debate of the deal and finally vote on it. The stakes are high, and the latest estimations are showing that the vote will be extremely tight. Various media outlets have calculated that the government may lose by two to nine votes, and Johnson is set to work around the clock to convince MPs to get behind the Brexit deal.

When talking to hardline Brexiteers, the PM will likely praise the “clean” Brexit that the deal provides for the UK – or more precisely to Great Britain. After the transition period, the country may sign any free trade deal it wants. He will likely play down the danger to the union – not only from the customs border in the Irish Sea – but also due to rising support for independence in Scotland and even in Wales.

Johnson will also pressure Labour MPs from Leave constituencies. He may promise them support for their region or perhaps more money to the National Health Service (NHS). Some are reluctant to support an agreement that is a “Tory Brexit” – allowing the UK to strip down labor and environment protections.

While the government bureaucracy has announced it is unable to produce an economic analysis of the deal, other assessments point to significantly worse standards of living. The UK in a Changing Europe, an academic research network, has published an assessment stating:

Relative to staying in the EU, income per capita in the UK would be 2.5% lower under Mr. Johnson’s proposals, compared to 1.7% under Mrs. May’s deal and 3.3% in the WTO scenario.

MPs will weigh economic damage against being able to strike independent trade deals, as well as other factors. The most likely scenario is that the agreement is rejected, and the government asks for delaying Brexit to have time for elections. Under the Benn Act, the PM must send a letter to the EU, asking for a three-month Brexit extension by the end of the day on Saturday. Another option in case parliament rejects the deal is a confirmatory vote on the accord – a second referendum – which some in the opposition are considering.

GBP/USD is set to surge if his deal is approved and react differently to the other potential outcomes.

See Brexit: Four scenarios and GBP/USD reactions as the deal reaches parliament

A Sunday gap – to one direction or the other – is almost inevitable. It is essential to note that politicians’ responses in both the UK and the EU will continue moving GBP/USD as the new week begins. Votes on elections, amendments, and comments from EU leaders on an extension are all in play.

Other events: US-Sino partial deal fallout, mixed data

Brexit overshadowed Top-tier UK data, but they will likely have an impact once the dust settles. UK Average Earnings rose by 3.8% both when including and excluding bonuses in August, within expectations. The Consumer Price Index (CPI) missed with an annual increase of 1.7% in September, below expectations. Other inflation measures also pointed to a slowdown. Retail sales met expectations by remaining flat in September, and excluding fuel, they surprised to the upside with 0.2%.

In the US, Consumer Price Index disappointed with the all-important control group remaining flat in September. The US consumer has been carrying the economy forward, and signs of a slowdown may push the Federal Reserve toward cutting interest rates on October 30. Several Fed officials spoke out during the week and refrained from straying from their regular opinions – the doves were dovish and hawks hawkish. The bank enters its “quiet period” without a clear message on the next move.

China expressed its anger after the US required Chinese diplomats to notify Washington of its movements – a move that came in retaliation to similar moves by Beijing. Trade talks continue, aiming to conclude the first phase of a trade deal before December. Investors would like to see the US abandon its plans to slap new tariffs on December 15.

The US Dollar has generally been on the back foot.

UK events: Light agenda leaves focus on Brexit

After a week packed with significant releases, the calendar is light. Andy Haldane, Chief Economist at the Bank of England, may have a chance to respond to the vote in parliament in his speech. He has been one of the more dovish members of the BOE. Public Sector Net Borrowing will likely show a rise in funding.

Here are the upcoming UK macro events, as they appear on the economic calendar:

US events: Durable goods orders and trade developments

Any significant headline related to US-Sino trade talks – or tensions between the world’s largest economies – may rock markets. While no specific event is scheduled, tweets from President Donald Trump and from Hu Xijin, the editor of the Chinese outlet Global Times, may move markets.

The Consumer Price Index features home sales figures, which are expected to show an ongoing recovery in the sector, as interest rates are lower. The main release of the week is Durable Goods Orders for September due out on Thursday. The figures feed into third-quarter growth estimates and are watched by the Fed.

Last but not least, Markit´s Purchasing Managers’ Indexes (PMIs) may have an impact if they fall below 50 – thus indicating contraction. While ISM’s PMIs tend to have a more substantial effect, any fresh fear of a recession may move markets.

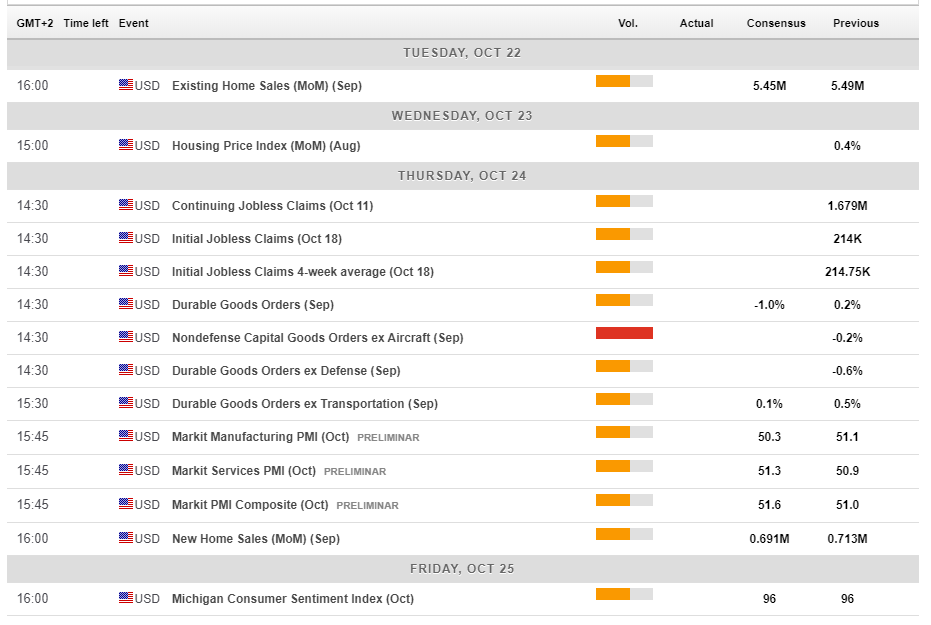

Here is the list of US events from the FXStreet calendar:

GBP/USD Technical Analysis

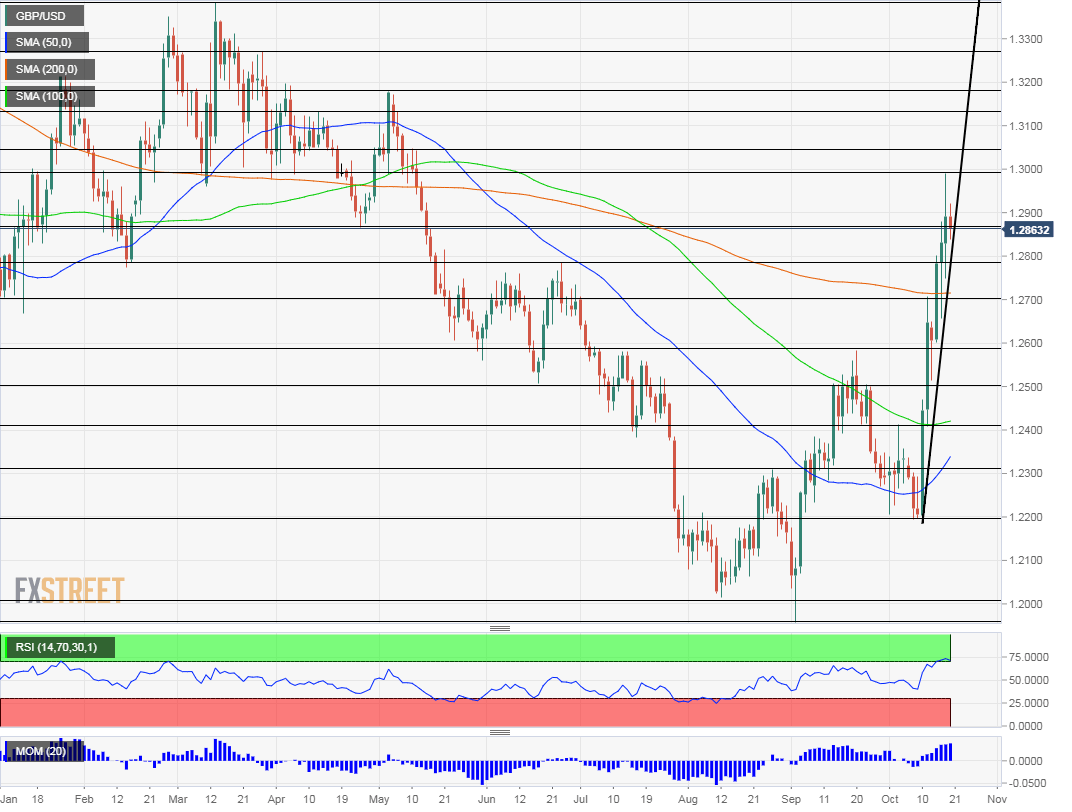

The Relative Strength Index on the daily chart has crossed the 70 level – indicating overbought conditions. Does this imply an imminent fall? If the Brexit deal is approved, GBP/USD is set to extend its gains regardless of the RSI. Momentum remains upbeat, and the pair has crossed the closely-watched 200-day Simple Moving Average.

The currency pair is trading alongside a steep uptrend support line, which seems unsustainable. However, as mentioned earlier, the exceptional Brexit circumstances mean that the rally may continue.

Resistance awaits at 1.2989, which was the high point in mid-October. It is followed by 1.3050, which capped cable in MAy. Next, we find 1.3130, a stubborn resistance line dating to April, followed by 1.3175 – the high point in May. The next lines are 1.3270 and 1.3380.

Support awaits at 1.2780, which held GBP/USD in mid-June,1.2706, which held was a swing high in mid-October, and cable, a high point in September. Next, 1.25 provided support in June, and it is followed by 1.2420, 1.2310, and 1.22.

GBP/USD Sentiment

It is hard to predict how parliament will vote, but if pushed, the PM may have momentum on his side, leading to a small victory that would unleash the upside in cable.

Get the 5 most predictable currency pairs