The Australian dollar versus the New Zealand dollar currency pair is, slowly but surely, heading towards higher prices. Are there any possible obstacles?

Long-term perspective

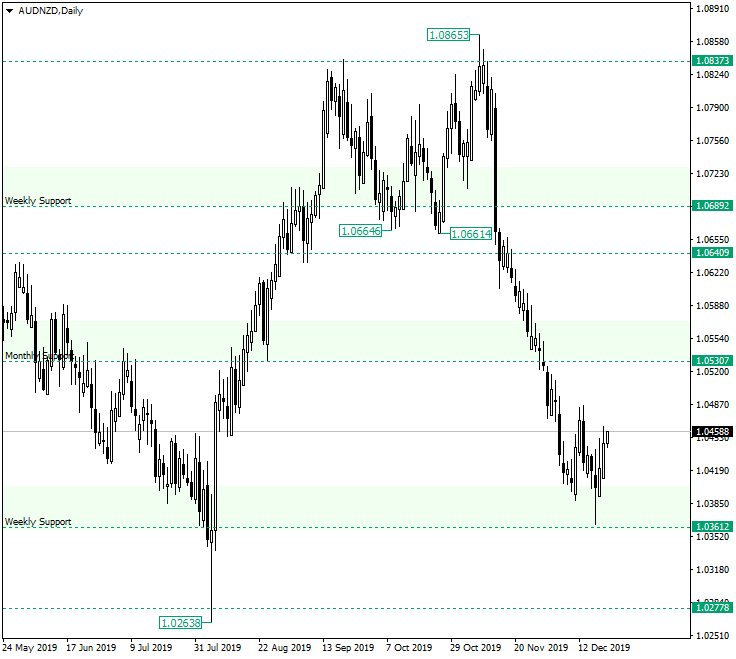

After falsely piercing the 1.0837 resistance and peaking at 1.0865, the price began a very bearish movement, one that brought it at the weekly support of 1.0361. On its way here it also pierced another important support, namely 1.0530.

For the time being, the bulls seem to be gaining momentum. This can be ascribed to — this being an important aspect, but not the only one — the strong retracement from 1.0361 area. Put another way, the bulls guarded their territory in a very decisive manner, firstly on December 11, and then on December 18.

On December 11, as the bulls noticed that the bears are extending a little bit to much — as they passed into the bullish green marked area — they immediately responded with a strong appreciation. The bears thought that this is their chance to short at better prices and, as a consequence, they pushed the prices lower, trying to breach the 1.0361 level. But as that area was packed with bulls and as they were unwilling to give the bears any other opportunity, the result was a strong rejection, one that also boosted the bullish morale — December 18.

The fact that the price was strongly rejected two times in a row, cements the bullish stance. As an outgrowth, further advancement towards 1.0530 is in the cards. That may materialize in the form of a continuation of the current appreciation or of a revisit of the highlighted green area above 1.0361.

What is important for the bulls is not to allow any oscillations under 1.0361, as only if this happens the situation turns neutral.

Short-term perspective

After confirming the 1.0368 support, the price recovered, confirmed 1.0404 as support, and then went above 1.0440.

As long as it sits beyond 1.0440, the next target is represented by 1.0500, which is followed by 1.0534. Even if the price revisits 1.0404, appreciations are still possible, the targets remaining the same.

A bearish threat would be represented by the price establishing under 1.0404. In this case, 1.0368 will be the main target for the short term.

Levels to keep an eye on:

D1: 1.0361 1.0530 1.0277 1.0640

H4: 1.0440 1.0550 1.0534 1.0368

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.