The Australian dollar versus the Canadian dollar currency pair is driven by the bulls. Will the bears be able to make their presence felt?

Long-term perspective

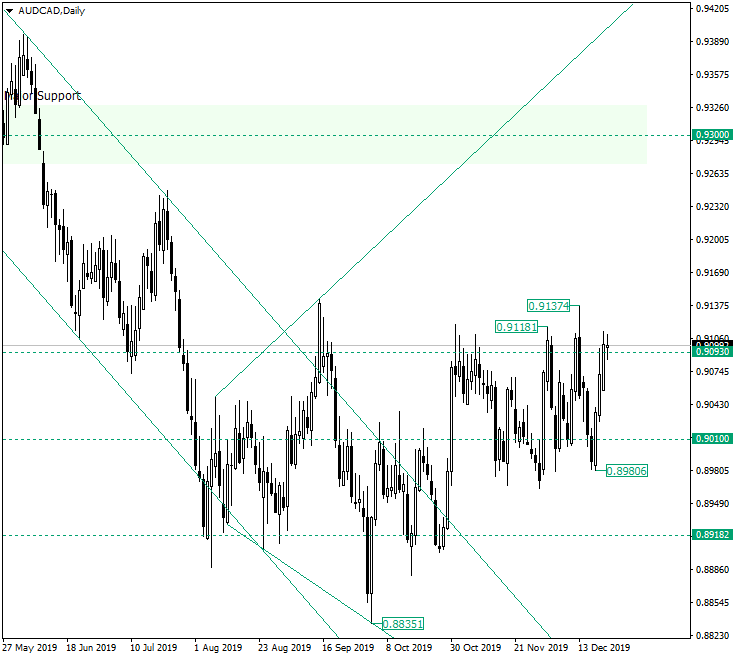

After the rotation that unfolded above the 0.8918 level and which led to the termination of the descending trend, the price entered into a consolidation phase that stretches between the 0.9137 high and 0.8963 low.

But this range has some bullish marks attached to it. Firstly, most of the highs are higher highs, and most of the lows are higher lows, respectively — see 0.9118 with 0.9137 and 0.8963 with 0.8980, respectively. The only deviation is made by the low on December 11, concerning 0.8980.

However, this is balanced out by another bullish trait — the engulfing candle on December 19. It wears some important characteristics that signal the bullish potential. Considering the lows, it did not allowed for a lower low to be printed, with respect to the low on December 5, and when a lower low was printed — the aforementioned deviation — the price recovered in a short while and with a lot of determination. The pattern was further enriched by the fact that it closed above a psychological level, 0.9000 respetively — not highlighted on the chart.

This fueled a bullish momentum that overpowered the bearish opposition that can be traced within the upper shadow of the candle on December 20. In other words, as the price approached the 0.9093 level, the bears tried to drive it down, but the next candle — December 23 — closed above the previous candle and oscillated above 0.9093.

Given these, the bulls have all the reasons to continue their march towards 0.9300. So, as long as the price oscillates above — or falsely pierces — the 0.9093 level, the main target is 0.9300, with an intermediary target at the 0.9200 psychological level — not highlighted on the chart. Only a confirmation of 0.9093 as resistance will open the door 0.9010.

Short-term perspective

The price is in a flat lined up by 0.8985 as support and 0.9105 as resistance. An intermediary level — 0.9041 — is also present.

If the bulls manage to confirm 0.9105 as support, then 0.9204 is the main target. The same target also applies for the scenario in which the price retraces towards 0.9041 to confirm it as support once more, a movement that is to be followed by the conquering of 0.9105, with the discussed outcome.

Levels to keep an eye on:

D1: 0.9093 0.9300 0.9010

H4: 0.9105 0.9204 0.9041

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.