The Australian dollar versus the Japanese yen currency pair seems determined to challenge the 76.02 resistance. Will it make it?

Long-term perspective

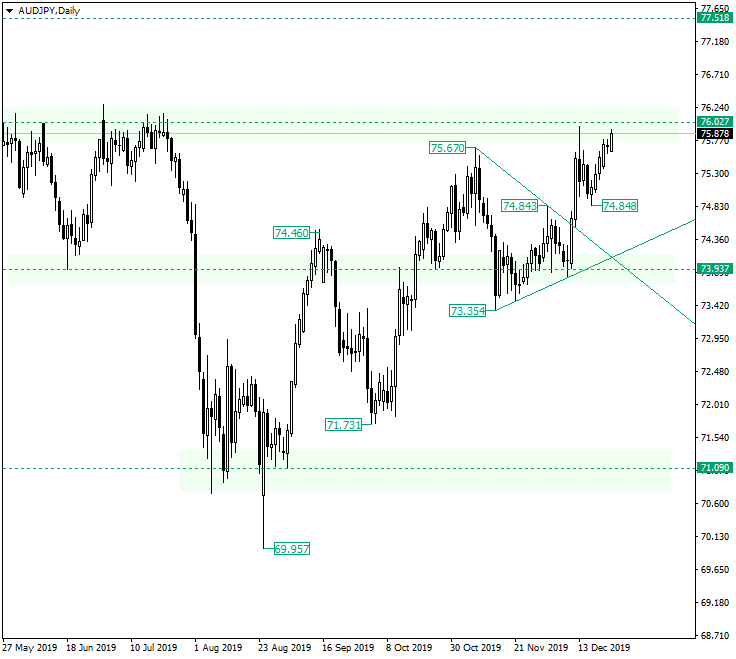

The price is contained within the ascending trend that started after the confirmation of 71.09 as support, and there are reasons for the bulls to have no worries with regards to a possible change.

The reasons for such an expectation are sustained by the very structure that the bulls beat into shape.

For a first instance, the corrections of the ascending movement — 74.46 with 71.73 and the triangle with the base that stretches between 75.67 and 73.53, respectively — allowed impulsive swings that, in a relatively short amount of time, managed to engulf the depreciations carved by them. To this adds the fact that, by doing so, new higher highs were printed, a flagship of bullish dominance.

Concentrating on the latter part of the chart, the candle of December 13, retraced sharply from the resistance of 76.02. So, even if it recorded a higher high, the strong retracement should have been handled by the bears with a lot of consideration, because it just might have been their only chance — for the time being — to turn the market around at an important resistance area, that is 76.02.

Instead, the price was allowed to confirm the previous high of 74.84 as support, a price action that nullified the bearish opportunity and, of course, grew the bullish optimism. So, as long as that low — 74.84 — is not taken out, overcoming 76.02 is just a matter of time. This will open the door to 77.51.

Only if the price trades lower than 74.84, then 73.93 might be revisited.

Short-term perspective

The price is limited by the support of 74.96 and the resistance of 75.99. In its path between the two, the price confirmed as support intermediary levels such as 75.33 and 75.62.

Being closer to 75.99 makes it easier for the bulls to pierce and confirm it as support. If this happens, 76.34 is exposed.

Only if 75.62 is confirmed as resistance, then the price might reach 74.96.

Levels to keep an eye on:

D1: 76.02 77.51 73.93

H4: 75.99 76.34 75.62 74.96

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.