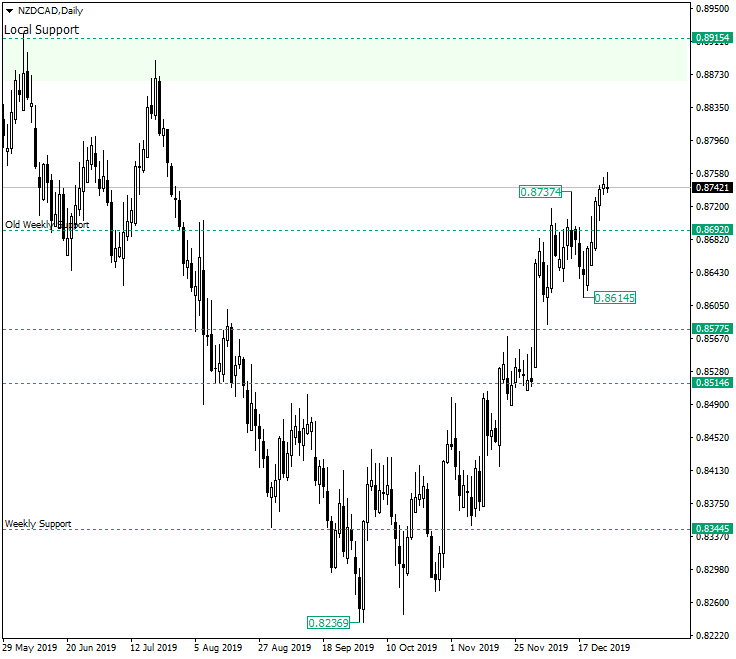

The New Zealand dollar versus the Canadian dollar currency pair managed to conquer the 0.8692 level. The continuation towards 0.8915 might come after a corrective phase.

Long-term perspective

The low at 0.8236 started an ascending movement that did not allow any bearish victory. In its ascension, the price won important levels, the last one being 0.8692, an old but important weekly support.

The current swing, which started at 0.8614, took out the previous high — 0.8737. By doing so, not only that it departed from 0.8692 sufficiently enough to validate its piercing of 0.8692, but it also created a new higher high in relation to 0.8737, which gives credit to the bulls.

In this context, the first possibility is for the appreciation to simply continue. If things unfold like so, then the appreciation may be followed by a short term consolidation pattern — like a pennant or flag — that, eventually, is able to allow the price to reach that target of 0.8915.

A second possibility is to see a retracement that will try to confirm the previous peak — 0.8737 — as support, allowing in the end the same outcome — 0.8915 to be reached. This scenario can extend with the case in which the price revisits 0.8692. If it does so, the appreciation might be postponed.

Only if 0.8692 gets confirmed as resistance, then the situation turns neutral.

Short-term perspective

The price managed to pierce the resistance of 0.8716, confirm it as support, and start a new upwards pointing leg.

The first target is 0.8782, which is being followed by 0.8825. The expectations remain like so as long as the price trades above 0.8716. Only if 0.8716 gets confirmed as resistance, then 0.8667 would be a suitable target.

Levels to keep an eye on:

D1: 0.8915 0.8692

H4: 0.8782 0.8825 0.8716 0.8667

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.