The Australian dollar versus the New Zealand dollar currency pair is having a hard time in its efforts to conquer higher prices.

Long-term perspective

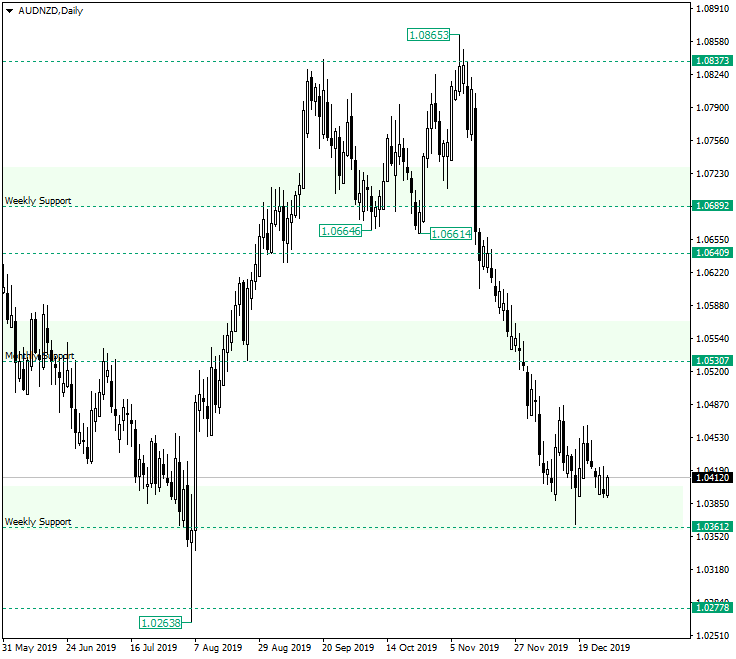

The depreciation that started from 1.0865, after the price falsely pierced 1.0837, reached the weekly support of 1.0361.

On December 11, the bulls pulled off a strong retracement that extended midway of the path from 1.0361 to 1.0530. But very soon, the bears managed to invalidate that appreciation by generating a downwards pointing leg, one that almost touched the weekly support.

The bulls quickly reacted and pushed the price to the north. The bears caught up and tried yet another depreciation. This led to the formation of a lower high on December 23, with respect to December 13.

Still, the bulls did not give up, but, on the contrary, on December 27 they printed an inverted hammer. It is not one of the strongest bullish patterns, but the fact that it was crystallized in an important bullish area — marked by the green rectangle that sits on the weekly level of 1.0361 — weights in favor of the buyers.

For the moment, the most important thing that could happen for the ones that are expecting the continuation of the appreciation is for the high on December 23 to be taken out. Once this happens, the price will aim for 1.0530.

On the other hand, if the bulls are not able to score and take out the aforementioned high, then the bears really have a chance of confirming 1.0361 as resistance. In this case, the door to 1.0277 is open.

Short-term perspective

The price is facing the support of 1.0404. Before joining the market, it is better to wait for it to be confirmed as support. That will happen after the price falsely pierces it or after it oscillates above 1.0440. Such a development would target 1.0500.

On the other hand, if the price reaches 1.0368, chances are for it to be confirmed as resistance which would allow further depreciation to 1.0332.

Levels to keep an eye on:

D1: 1.0530 1.0361 1.0277

H4: 1.0404 1.0440 1.0500 1.0368 1.0332

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.