The euro today rallied from its daily lows following the release of weak US durable goods orders in the early American session. The EUR/USD currency pair had fallen earlier in the session amid low liquidity ahead of the Christmas holiday break. The EUR/USD currency pair today fell to a low of 1.1070 in the mid-European session before rallying to a high of 1.1095 in the American … “Euro Falls on Low Liquidity and Market Sentiment, Rallies on US Data”

Month: December 2019

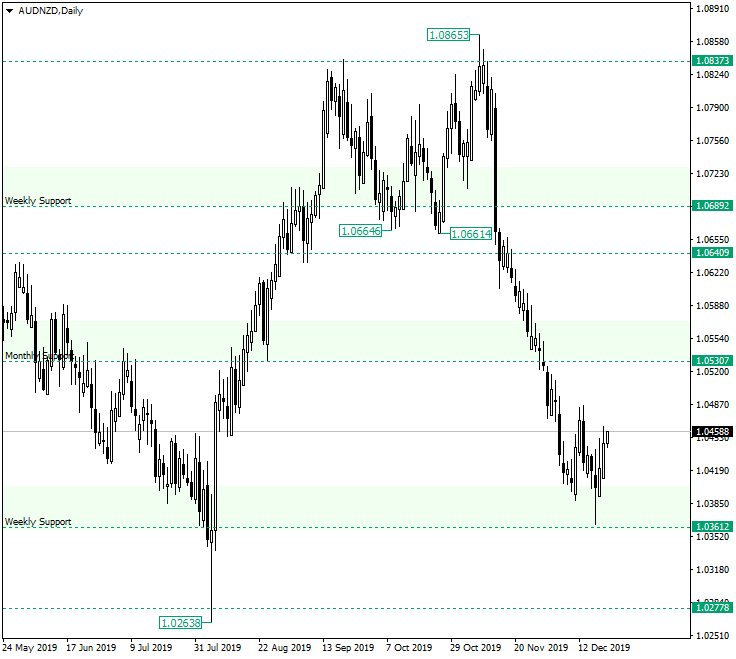

AUD/NZD on Its Way to 1.0530

The Australian dollar versus the New Zealand dollar currency pair is, slowly but surely, heading towards higher prices. Are there any possible obstacles? Long-term perspective After falsely piercing the 1.0837 resistance and peaking at 1.0865, the price began a very bearish movement, one that brought it at the weekly support of 1.0361. On its way here it also pierced another important support, namely 1.0530. For the time being, … “AUD/NZD on Its Way to 1.0530”

Mexican Peso Demonstrates Good Performance Despite Interest Rate Cut by Banxico

Friday’s performance of the Mexican peso was rather good considering that Mexico’s central bank decided to cut interest rates. The currency was about flat versus the US dollar and even managed to gain on the extremely weak euro. The good performance could be explained by the fact that the bank refrained from a deeper cut and its policy statement sounded less dovish than expected. The Bank of Mexico announced a cut of its key … “Mexican Peso Demonstrates Good Performance Despite Interest Rate Cut by Banxico”

Canadian Dollar Drops After Shockingly Poor Retail Sales

The Canadian dollar fell during Friday’s trading session due to surprisingly poor retail sales data and falling crude oil prices. The currency trimmed losses later, though, and even managed to gain on some of its rivals. Statistics Canada reported that retail sales dropped by 1.2% in October. That was a total surprise to market participants, who were counting on an increase of 0.5%. The main contributor to the decline were lower sales at motor … “Canadian Dollar Drops After Shockingly Poor Retail Sales”

Swedish Krona Mixed After Rallying on Interest Rate Hike

The Swedish krona fell a little against the strong currencies like the US dollar and the Great Britain pound but jumped versus the vulnerable euro today. Yesterday, the currency rallied thanks to the much-anticipated interest rate hike from Sweden’s central bank. Riksbank decided at yesterday’s monetary policy meeting to raise its benchmark interest rate from -0.25% to zero. That makes it the first central bank to exit negative interest rates … “Swedish Krona Mixed After Rallying on Interest Rate Hike”

Euro Crashes on Mixed Eurozone Reports and Upbeat US Prints

The euro today crashed against the US dollar following the release of mixed data from the euro area as market sentiment remained decisively bearish. The EUR/USD currency pair fell to new 1-week lows in the American session following the release of upbeat US Q3 GDP data. The EUR/USD currency pair today fell from a high of 1.1123 in the early European session to a low of 1.1081 … “Euro Crashes on Mixed Eurozone Reports and Upbeat US Prints”

US Dollar Spikes on Higher Q3 GDP Reading

The US dollar enjoyed a spike against several currency rivals at the end of the trading week, driven primarily by a higher final reading of the gross domestic product in the third quarter. The buck was further lifted on a decline in the cost of manufacturing goods consumed at home and exported to foreign markets. … “US Dollar Spikes on Higher Q3 GDP Reading”

Pound Rallies on Upbeat UK GDP Report, Falls Ahead of Brexit Vote

The Sterling pound today inched higher against the US dollar boosted by the release of the upbeat UK Q3 GDP data in the early London session. The GBP/USD currency pair barely reacted to the appointment of a new Bank of England Governor, which was expected by most analysts and investors. The GBP/USD currency pair today rose from an opening low of 1.3007 to a high of 1.3048 in … “Pound Rallies on Upbeat UK GDP Report, Falls Ahead of Brexit Vote”

Australian Dollar Extends Rally Caused by Stellar Employment Data

The Australian dollar continued to rise today following yesterday’s rally. The rally was a result of a very positive employment report that showed a bigger-than-expected employment growth and an unexpected drop of the unemployment rate. Released yesterday by the Australian Bureau of Statistics, the report showed that employment rose by 39,900 in November, exceeding the consensus forecast of an increase of 14,500 by a wide margin. Both full-time and part-time employment registered an increase, though the bulk of the increase consisted of part-time jobs. … “Australian Dollar Extends Rally Caused by Stellar Employment Data”

NZ Dollar Retreats After Rallying on Better-than-Expected GDP

The New Zealand dollar retreated today following yesterday’s gains. The rally was a result of a faster-than-expected growth demonstrated by New Zealand’s economy in the previous quarter. Statistics New Zealand reported yesterday that gross domestic product grew by 0.7% in the September quarter from the previous three months, beating the median forecast of a 0.5% increase. Year-on-year, the economy expanded by 2.7%. The main contributor to the growth of services industries, which make up two-thirds of the economy, … “NZ Dollar Retreats After Rallying on Better-than-Expected GDP”