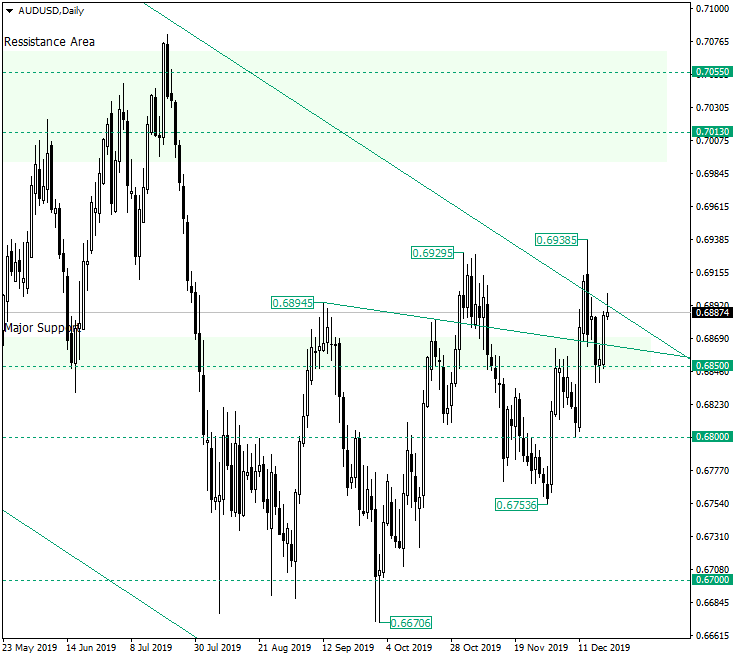

The Australian dollar versus the US dollar currency pair is at the resistance area of the daily descending channel. But why does it seems that something is not in place? Long-term perspective After bottoming at the 0.6700 psychological level, the price entered in an ascending movement that extended until 0.6938. By doing so, it pierced the resistance trendline of the descending channel. However, the break was rendered as a false one after the price went … “AUD/USD in a Very Interesting Spot Above 0.6850”

Month: December 2019

Japanese Yen Gains After Inflation Data, BoJ Monetary Policy Decision

The Japanese yen gained against other most-traded currencies after today’s release of inflation data and yesterday’s monetary policy decision of Japan’s central bank. The gains were limited, though, as markets are feeling the holiday mood and trading is slowing. The Statistics Bureau of Japan reported that the national core (excluding food) Consumer Price Index rose by 0.5% in November, year-on-year, accelerating from the previous month’s 0.4% rate of growth and matching … “Japanese Yen Gains After Inflation Data, BoJ Monetary Policy Decision”

Canadian Dollar Flat on Lower Weekly Earnings, Drop in Wholesale Sales

The Canadian dollar is trading relatively flat against most currency rivals on Thursday as traders digest the newest data that offer a mixed portrait of the national economy. The modest gain in crude oil prices could not lift the loonie higher toward the end of the trading week. According to Statistics Canada, average weekly earnings for non-farm payroll employees rose 3.3% year-on-year in October to $1,042. This is down from the 3.7% increase … “Canadian Dollar Flat on Lower Weekly Earnings, Drop in Wholesale Sales”

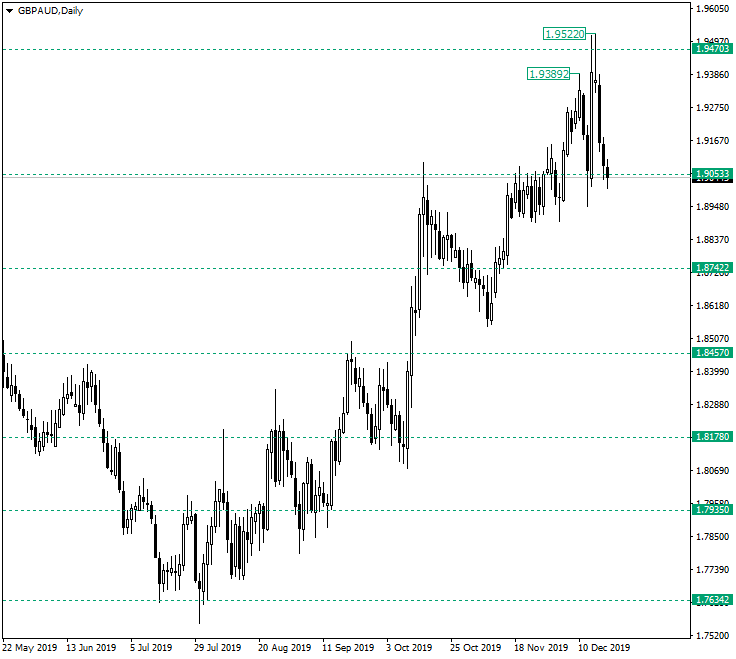

GBP/AUD Struggles with the Bears at 1.9053

The Great Britain pound versus the Australian dollar currency pair seems to have already been conquered by the bears. Are the bulls left with any chances? Long-term perspective The appreciation that started at 1.7634 may have already ended at 1.9470, as the price was repelled in a very strong manner. Even less beneficial for the bulls, the depreciation that came after 1.9470 was confirmed as resistance washed away most of the gains that were … “GBP/AUD Struggles with the Bears at 1.9053”

Canadian Dollar Gets Boost from CPI & Crude Oil Prices

The Canadian dollar climbed against its most-traded peers, emerging as the strongest major currency today. The combination of robust inflation and resilient prices for crude oil was the reason for the currency’s amazing performance. Statistics Canada reported that the seasonally adjusted Consumer Price Index rose by 2.2% in November, year-on-year, accelerating from October’s 1.9% rate of growth. The reading matched expectations. Excluding gasoline, the CPI rose by 2.3%. On a seasonally adjusted monthly basis, … “Canadian Dollar Gets Boost from CPI & Crude Oil Prices”

Japanese Yen Mixed As Exports Beat Forecasts

The Japanese yen is mixed against multiple major currency rivals midweek as economic data remained bearish. However, many of the numbers either improved from the previous month or beat market expectations. While it looked like a recession was imminent, the slight improvement may delay the recession a bit. According to the Ministry of Finance, the trade deficit narrowed sharply to $750 million in November, down from $6.75 billion in the same time a year … “Japanese Yen Mixed As Exports Beat Forecasts”

Great Britain Pound Falls Despite Positive Inflation Print

The Great Britain pound fell against other major currencies today despite the slightly better-than-expected inflation print. The threat of hard Brexit remains the main detrimental factor to the sterling. Producer prices were also a negative factor, falling last month unexpectedly. Britain’s Office for National Statistics reported that the annual inflation rate of the Consumer Price Index remained at 1.5% in November, unchanged from October. Ahead of the report, market participants were … “Great Britain Pound Falls Despite Positive Inflation Print”

Euro Falls Despite Upbeat German IFO and Eurozone CPI Data

The euro today fell against the US dollar in what could only be attributed to technical factors including major resistance levels posed by the 200-day MA. The EUR/USD currency pair kept falling despite the release of upbeat German IFO survey data and inflation data from the eurozone driven by a much stronger dollar. The EUR/USD … “Euro Falls Despite Upbeat German IFO and Eurozone CPI Data”

Australian Dollar Logs Gains, Analysts Skeptical

The Australian dollar logged gains against the majority of other most-traded currencies today. Market analysts explained gains of riskier commodity currencies by the rise of European stocks due to the preliminary trade agreement between the United States and China. Experts were skeptical, though, about the longevity of the gains as the US-China trade conflict is not over yet, and there are other reasons to worry, like the threat of hard Brexit and impeachment of US President Donald … “Australian Dollar Logs Gains, Analysts Skeptical”

NZ Dollar Reverses Earlier Losses amid Risk Aversion

The New Zealand dollar gained today after falling earlier due to mild risk aversion on the Forex market. Traders were nervous due to the threat of a hard Brexit as well as the impeachment of US President Donald Trump. There is no obvious reason why the New Zealand currency reversed its losses. Macroeconomic data released over the trading week did not paint a clear picture of the New Zealand economy as there were … “NZ Dollar Reverses Earlier Losses amid Risk Aversion”