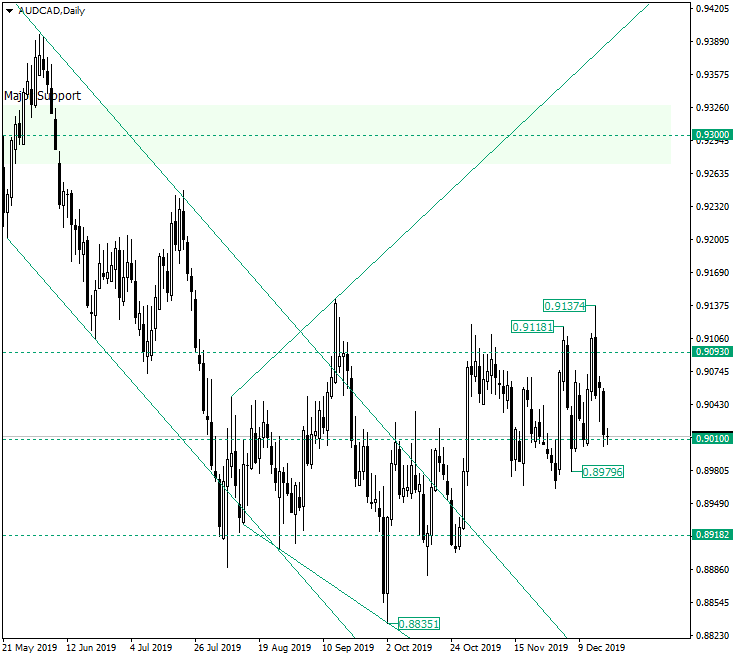

The Australian dollar versus the Canadian dollar currency pair looks as if it is delaying any appreciation attempts. Long-term perspective The low of 0.8835 marked the turning point for the evolution of the price, as it got out of the descending channel. But this step needs further work to be accomplished by the bulls, as exiting the descending channel is not enough in order for a healthy appreciation to be sustainable. The fact that the price was not able … “AUD/CAD Tests 0.9010 Yet Again”

Month: December 2019

US Dollar Flat Amid Higher Industrial Output, Housing Starts

The US dollar is relatively flat against most major currency rivals on Tuesday, despite some positive news for the worldâs largest economy. The latest data helped legitimize the bullsâ views that the US economy is strong and resilient, thanks to higher industrial production, housing starts, and manufacturing activity. With only two weeks left in the year, investors are bracing for the final gross domestic product (GDP) reading for the third quarter, … “US Dollar Flat Amid Higher Industrial Output, Housing Starts”

Pound Crashes as Johnsonâs Government Pushes for Hard Brexit

The Sterling pound today crashed against the US dollar amid fears that Boris Johnson‘s government was pushing for a hard Brexit despite his parliamentary majority. The GBP/USD currency pair today fell to its pre-election lows as investors sold the pair following the release of a mixed UK jobs report ahead of Friday’s Brexit bill tabling. … “Pound Crashes as Johnsonâs Government Pushes for Hard Brexit”

Australian Dollar Sinks After RBA Minutes Hint at Interest Rate Cut

The Australian dollar fell against all other of its most-traded rivals, including commodity currencies, after the minutes from the Reserve Bank of Australia made market participants believe that the central bank will cut interest rates in the near future. The RBA released minutes of its December 3 monetary policy meeting today. While Australian policymakers left interest rates unchanged at the meeting, the minutes were dovish enough for analysts to speculate … “Australian Dollar Sinks After RBA Minutes Hint at Interest Rate Cut”

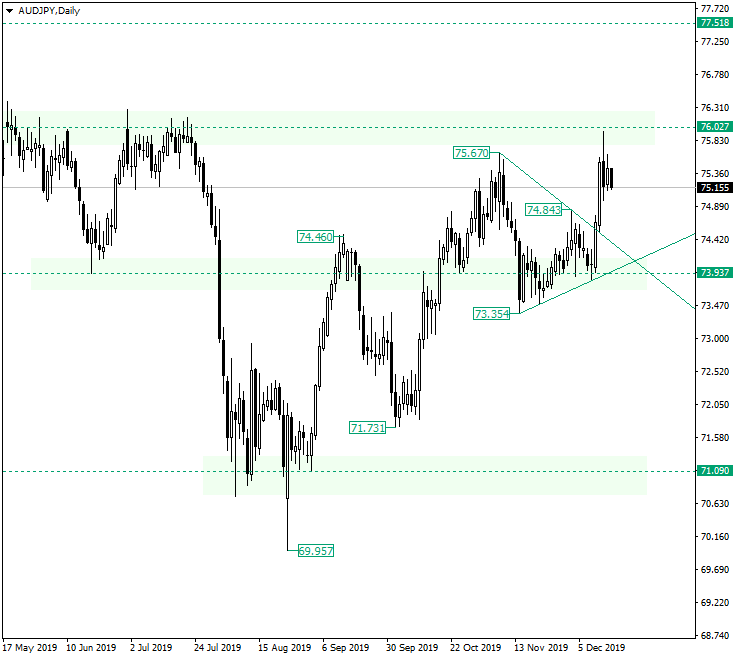

AUD/JPY Reached 76.02. Where to from Here?

The Australian dollar versus the Japanese yen currency pair retraced sharply from the 76.00 psychological area. Is this a bearish sign or is it only that the bulls are booking the profits? Long-term perspective From the support of 71.09, the market is in an ascending movement that extended — for now — until the 76.02 level. The appreciation came after a relatively long period of stagnation, as the price oscillated around the 73.93 level from the end of November … “AUD/JPY Reached 76.02. Where to from Here?”

Chinese Yuan Rallies As Industrial Output, Retail Sales Beat Forecasts

The Chinese yuan is rallying against multiple currencies to kick off the trading week, buoyed by industrial production and retail sales beating market expectations. With the first phase of a comprehensive US-China trade agreement established, global financial markets have been extended some certainty, which is good news for the worldâs second-largest economy and its currency. According to the National Bureau of Statistics, industrial output surged 6.2% year-on-year in November, up … “Chinese Yuan Rallies As Industrial Output, Retail Sales Beat Forecasts”

Pound Rallies Then Falls on Weak PMIs and Profit Taking

The pound today rallied briefly against the US dollar before falling to its daily lows as traders continued to take profits from the post-election rally. The GBP/USD currency pair was also affected by the weak PMI data released by Markit Economics in the London session and Brexit optimism. The GBP/USD currency pair today rallied to a high of 1.3422 before falling to a low of … “Pound Rallies Then Falls on Weak PMIs and Profit Taking”