The Canadian dollar is weakening against most major currency rivals to finish the trading week, despite the national economy beating market forecasts in November. The loonieâs fall is being mostly driven by a drop in energy prices caused by demand concerns amid the Wuhan coronavirus. The nationâs fiscal picture and inflation also rose more than what the market had projected. According to Statistics Canada, the gross domestic product (GDP) rose 0.1% … “Canadian Dollar Slides As Coronavirus Fears Hurt Energy Prices”

Month: January 2020

Euro Rallies Against the Dollar Ignores Weak Eurozone GDP Data

The euro today rallied to new weekly highs against the US dollar despite multiple disappointing macro reports from across the euro area. The weak dollar primarily drove the EUR/USD currency pair’s rally as US Treasury yields fell dragging the greenback lower. The EUR/USD currency pair today rallied from a low of 1.1017 in the early … “Euro Rallies Against the Dollar Ignores Weak Eurozone GDP Data”

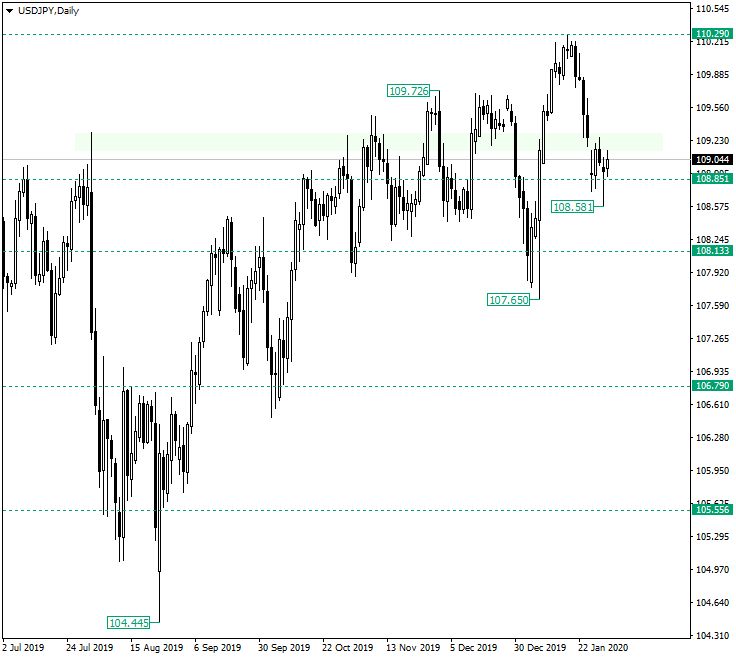

USD/JPY May Try to Aim for 110.29

The US dollar versus the Japanese yen currency pair looks like it is aiming to start a new appreciation. But isn’t that a little late for the bulls? Long-term perspective After printing the low of 107.65, the price went back above 108.13 and started an appreciation that rendered the piercing of the level as a false one, thus giving the bulls sufficient optimism to be able to reach 110.29. But from there a strong depreciation came … “USD/JPY May Try to Aim for 110.29”

Aussie Flat After Economic Data from China & Australia

The Australian dollar was trading sideways during Friday’s session as traders have paused sell-off of riskier currencies but remained cautious of the spreading coronavirus in China and its potential impact on the global economy. Australian domestic macroeconomic data was in line with expectations, and some of China’s reports were positive. While that provided a short-term boost to the Aussie, it did not last long. The Australian Bureau of Statistics reported that the Producer … “Aussie Flat After Economic Data from China & Australia”

Japanese Yen Halts Rally While Fears Persist

The Japanese yen halted its rally, trading flat today. For now, it does not seem that the market sentiment shifted much, and the pause in the rally was likely just a result of profit-taking following substantial gains of the currency. Domestic macroeconomic data was mixed, giving no clear picture of the Japanese economy. The situation with the coronavirus epidemic was not improving. The number of confirmed cases in China reached 9692, and the death toll … “Japanese Yen Halts Rally While Fears Persist”

Euro Rises on German Inflation Data and Flash US GDP Report

The euro today inched higher against the US dollar as it struggled to shake off the selling pressure that has kept the EUR/USD currency pair trading in a tight range. The single currency posted gains in the American session despite the release of mixed German inflation data accompanied by in-line preliminary US Q4 GDP figures. … “Euro Rises on German Inflation Data and Flash US GDP Report”

Japanese Yen Gains Despite Investors Selling Equities Amid Coronavirus

The Japanese yen is posting modest gains against multiple currency rivals on Thursday as investors appear to be ignoring equities while diving into the traditional safe-haven asset. The Wuhan coronavirus is reportedly worsening with deaths topping 100 and the number confirmed cases exceeding 7,000 in every region of China. Japanese officials are warning that the outbreak could significantly affect the worldâs third-largest economy in the near-term, hurting the countryâs attempts … “Japanese Yen Gains Despite Investors Selling Equities Amid Coronavirus”

Sterling Pound Spikes to 3-Day Highs on Hawkish BoE Rate Decision

The sterling pound today spiked to its daily highs following the announcement of the Bank of England‘s interest rate decision, which was as expected. The GBP/USD currency pair rallied from its daily lows as investors interpreted the BoE’s decision as being hawkish. The GBP/USD currency pair today rallied from a daily low of 1.2978 in … “Sterling Pound Spikes to 3-Day Highs on Hawkish BoE Rate Decision”

Coronavirus Fears Make Swiss Franc Strongest on Forex Market

The Swiss franc was the strongest currency on the Forex market today, followed by the Japanese yen. Risk aversion was ruling markets as the coronavirus, which originated in China, continued to spread. Fears resulted in a rising demand for safe currencies, like the Swissie and the yen. Domestic economic data provided additional support for the currency of Switzerland. The KOF Economic Barometer rose to 100.1 in January from 96.2 in December. The actual figure was far above the median forecast … “Coronavirus Fears Make Swiss Franc Strongest on Forex Market”

NZ Dollar Among Weakest Currencies Despite Trade Surplus

The New Zealand dollar, together with its Australian counterpart, was the weakest among most-traded currencies on the Forex market today. Like the Aussie, the kiwi was unable to profit from better-than-expected domestic macroeconomic data. Statistics New Zealand reported that the trade balance turned to a surplus of NZ$547 million in December from a deficit of NZ$791 million in the preceding month. Economists had predicted a much smaller surplus of NZ$100 million. Exports rose … “NZ Dollar Among Weakest Currencies Despite Trade Surplus”