The Australian dollar versus the Canadian dollar currency pair turned around from its initial path towards the 0.9300 level. Are the bulls only recharging or did they allow a bearish victory?

Long-term perspective

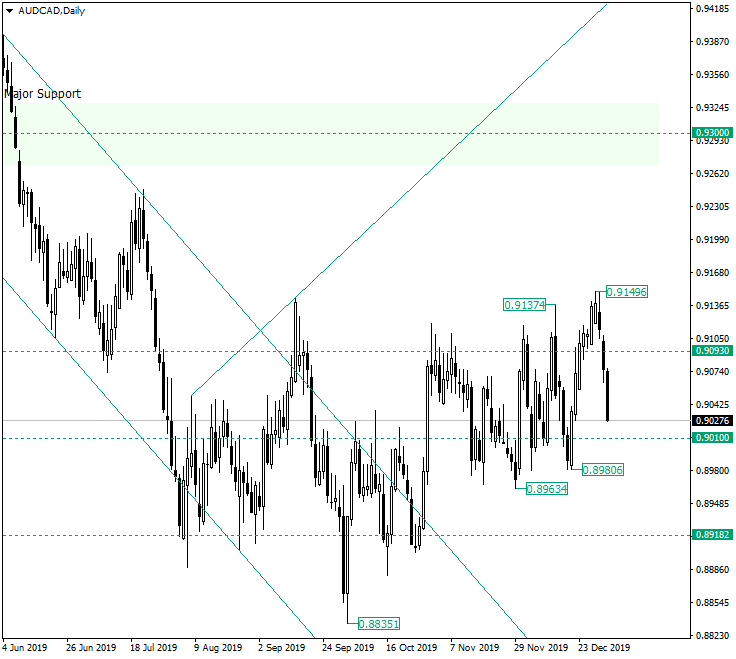

After printing the low of 0.8835, the price appreciated and exited from the descending channel, but it was limited by the resistance of 0.9093.

The bullish attempts were put on hold every time, but the resulting depreciations were finding support around the 0.9010 level.

This balance led to the formation of a flat bounded by the two — 0.9010 and 0.9093, respectively. But the highs of the flat — at least the last three — assumed the role of higher highs — see them highlighted on the chart, 0.9149 being the third one. This translates into the bulls keeping the situation under pressure.

However, the bears also look very determined to keep the bulls in place at any cost. This can be seen in the fact that the price, after taking out the previous high of 0.9137 and making a departure from the 0.9093 level, was turned around — thus peaking at 0.9149 — and sent under the level, a development that fueled the bearish optimism.

But the situation still is on the bullish side, given the higher lows — 0.8963 and 0.8980, respectively — and the fact that the price approaches an important support area, namely 0.9010.

If the price manages to confirm 0.9010 as support and also to print a higher low, then a new appreciation may unfold, one that — at least — might extend beyond 0.9149. So, if this scenario takes place, then 0.9093 is the first reachable target.

Of course, if the price confirms 0.9010 as resistance — which would automatically take out the low of 0.8980 — the expectation is for 0.8918 to receive a visit.

Short-term perspective

The price appreciated form the support of 0.8985 and managed to pierce 0.9105 and depart from it. But the bulls were not able to sustain the gains. As a result, a depreciation that missed the potential support of 0.9041 began.

If, in the end, 0.9041 will be only falsely pierced, thus assuming the role of a support, then 0.9105 could very well be a good target, followed by 0.9204.

On the other hand, if the depreciation continues, then 0.8985 is in reach and could serve as a first target. If it is confirmed as resistance, then 0.8923 would be the second target.

Levels to keep an eye on:

D1: 0.9010 0.9093 0.8918

H4: 0.9041 0.9105 0.9204 0.8985 0.8923

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.