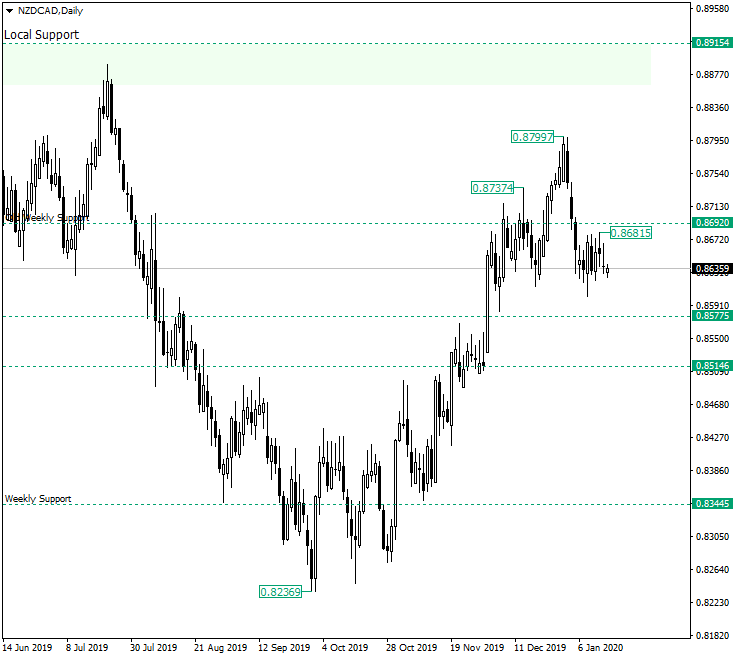

The New Zealand dollar versus the Canadian dollar currency pair is very consistent in its determination of reaching 0.8514 once more.

Long-term perspective

After confirming the weekly level of 0.8344 as support, the price headed for higher values. The first important level to be reached was the old weekly support of 0.8692.

Even if the bears managed a departure on December 13, after piercing the level, the bulls acted quickly and, by closing the day under the level, rendered the movement as a false piercing.

The false piercing on December 13, that peaked at 0.8737, was followed by a second run and this time the bulls were able to print a high at 0.8799. But that was their only victory, as the price plumbed once more under the 0.8692 level.

After this, the price kept oscillating under 0.8692. The highest point of this phase is represented — as for January 15 — by 0.8681.

The first two peaks — 0.8737 and 0.8799, respectively — alongside 0.8681, make up a chart pattern that shares a lot of resemblance with what can be called a head and shoulders. And this pattern is placed in the right spot, as it is following an appreciation. In other words, it is a pattern that signals the end of an ascending movement — and it is preceded by one — and the potential start of a descending one.

Considering the context, as long as the price keeps oscillating under 0.8692, the target that still remains valid is 0.8514.

Only if the price manages to confirm 0.8692 as support, then the bulls may have a new chance to reach 0.8915.

Short-term perspective

After the depreciation that started with the confirmation of 0.8782 as resistance reached the 0.8600 psychological level on January 8, the price entered in a consolidation phase.

This consolidation has higher lows and highs and thus is pointing in the opposite direction — ascending — than the one of the movement that prefaces it — which, as mentioned, is descending.

All this sets the plot for the continuation of the movement towards the south. So, as long as the price does not confirm 0.8667 as support, further decline is in the cards. The first target is 0.8600, followed by 0.8516.

On the other hand, if 0.8667 does become a support, the first limit of the movement would be 0.8716.

Levels to keep an eye on:

D1: 0.8692 0.8514 0.8915

H4: 0.8667 0.8600 0.8516 0.8716

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.