The Australian dollar versus the New Zealand dollar currency pair gives some signs that an appreciation is not that far from the realm of possibility. Is it so, or the bears are trying to persuade the bulls?

Long-term perspective

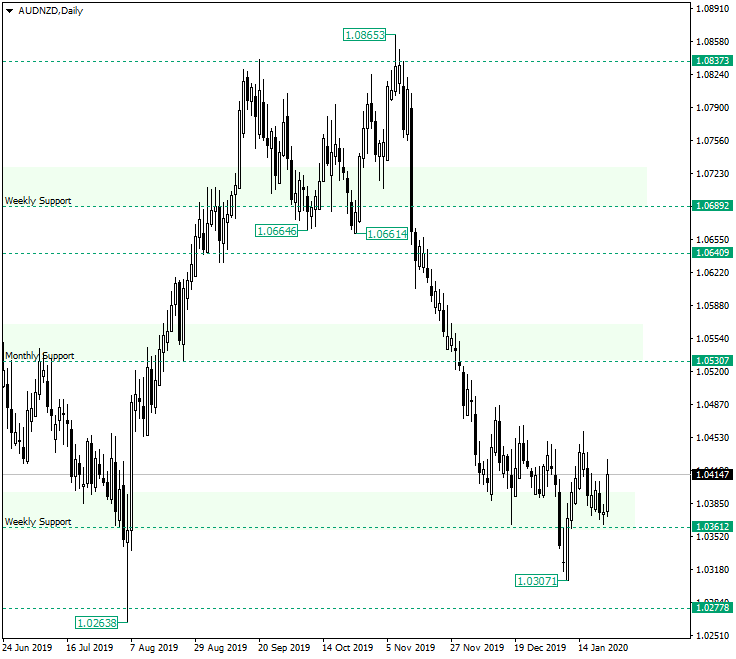

The depreciation that started after the price peaked at 1.0865 and confirmed as resistance the level of 1.0837 reached the area of 1.0361.

Upon arriving at 1.0361, it tried to bottom, but the bears pushed it further towards the south. The result was that the support level was breached. However, the bulls held their ground and printed the low of 1.0307. After that, they sent the price back above 1.0361 and extended sufficiently enough to draw a higher high, on January 15.

From there, the price retraced and oscillated above 1.0361. The fundamental news sparkled an appreciation that, in essence, tries to confirm the level as support.

If today’s candle closes in a bullish fashion, the bulls will be joining the market, eyeing 1.0530. Some of them, the more conservative ones, may wait for a second run — that is, a second confirmation of 1.0361 as support.

Only if the price manages, in the end, to confirm the weekly level of 1.0361 as resistance, then 1.0277 will serve as the main target.

Short-term perspective

The price confirmed 1.0368 as support and extended above 1.0404. If the latter level will be confirmed as support, then the price could extend until 1.0440.

On the other hand, if 1.0404 fails to sustain the price, then 1.0368 is to be paid a visit. In this case, 1.0368 may also fail, thus opening the path towards 1.0332.

Levels to keep an eye on:

D1: 1.0361 1.0530 1.0277

H4: 1.0404 1.0440 1.0368 1.0332

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.