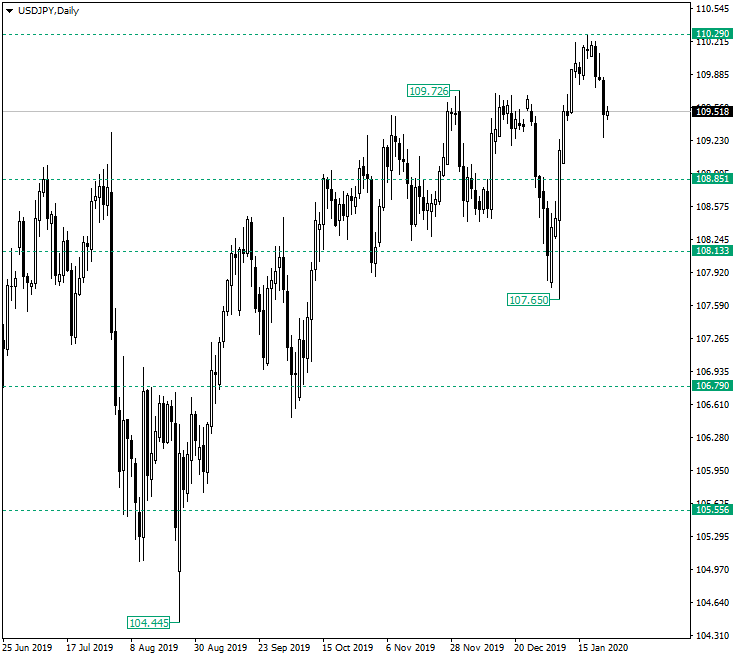

The US dollar versus the Japanese yen currency pair retraced quite strongly from the 110.29 resistance level. Is this a clue that the bulls are out of the game for a while?

Long-term perspective

The ascending trend that started after the low of 104.44 was printed managed to touch the resistance of 110.29. The level of 110.29 was expected to serve as a profit booking area for the buyers that entered from 108.13.

However, the resulting retracement was more powerful then the bulls would have liked it to. On one hand, they are glad for the better prices that they can buy from, but on the other, this deep decline could also be a sign of the bears trying to get hold of the situation.

The fact that the price traded under the high of 109.72 is not something that the bulls enjoy. But, in the end, the situation could turn into their favor. The first bullish scenario is the one in which the price appreciates and closes a daily candle above the 109.72 reference point.

The second scenario allows a depreciation until 108.85, with the expectation that — under a great bullish pressure — the price will appreciate and take out 110.29. So, both of these scenarios aim for the same 110.29 target.

The only barrier for the continuation of the appreciation is 108.85 turning into resistance, a situation in which the objective will be represented by 108.13.

Short-term perspective

The appreciation that started at 107.92 was able to get above 109.75, but couldn’t maintain its influence beyond that.

As a rounding top formed, the price depreciated and almost touched the support of 109.19. If this level is able to keep the bears in check, then 109.75 is the first target and, once conquered, opens the door towards 110.63.

If just the opposite unfolds and 109.19 align with the bearish plans, then 108.43 is to be paid a visit.

Levels to keep an eye on:

D1: 108.85 110.29 108.13

H4: 109.19 109.75 110.63 108.43

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.