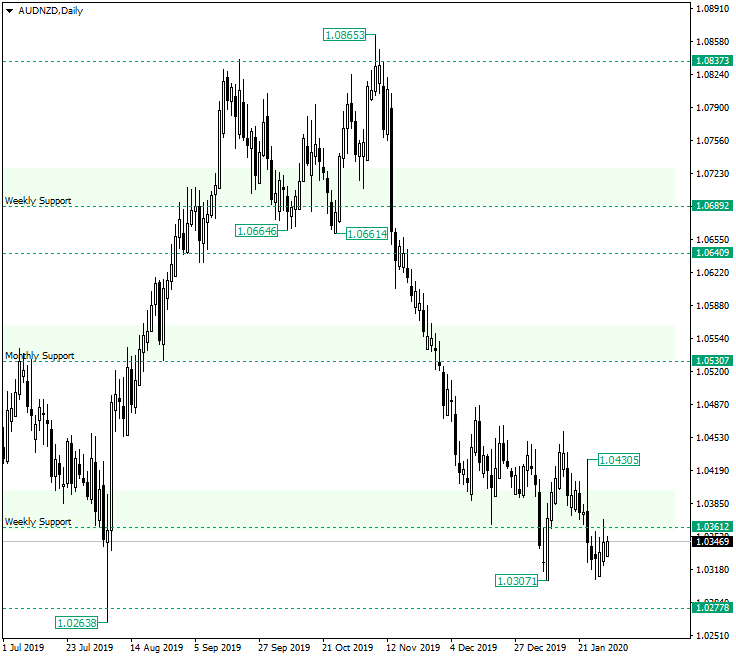

The Australian dollar versus the New Zealand dollar currency pair seems to have a hard time gaining further momentum towards the upside. Are the bulls not ready yet or it’s just that they don’t have the power?

Long-term perspective

The depreciation that began from the peak of 1.0865 extended beyond the weekly support of 1.0361, reaching 1.0307. But that low was a very short-lived event, as the bulls quickly sent the price back above the 1.0361 level.

However, the expected throwback — that should have confirmed 1.0361 as support — failed to deliver its mission, as the candle on January 23 pierced the level and closed under it.

The fact that a strong depreciation did not follow this event gave the bulls some hope that they might still get back in the game. Their first attempt in this direction was consumed on January 29, after the 1.0361 level rejected the price.

So, as long as the price oscillates under this weekly support — even if the low on January 27, is a little higher than the low at 1.0307 — expectations are for it to go towards the south, a context in which the first target is represented by 1.0277.

Even if the price tries to establish itself above 1.0361, as long as it does not manage to confirm it as support, the only thing it does is to offer sellers better prices to short the market.

In the event of a successful conquering of 1.0361, the level of 1.0430 remains a first instance destination, being followed by 1.0530.

Short-term perspective

After confirming the resistance of 1.0440, the price entered in a depreciation phase that, in its current form, oscillates between 1.0368 as resistance and 1.0332 as support, respectively.

As long as 1.0368 limits any bullish attempt, 1.0332 is destined in becoming a resistance, which would lead to the price touching the 1.0282 level.

On the other hand, if the bulls manage to conquer 1.0368, then 1.0440 is the main target.

Levels to keep an eye on:

D1: 1.0361 1.0277 1.0530

H4: 1.0368 1.0332 1.0282 1.0440

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.