The Australian dollar has been on the back foot amid geopolitical tensions. Where next? Here is their view, courtesy of eFXdata: TD Research discusses AUD outlook and adopts a buy-on dips bias in AUD/USD, and AUD/NZD. TD is long AUD/NZD* strategically as one of its top trades for 2020. “AUD remains topical following the collapse … “AUD/USD: A Buy On Dips In The 0.6800/50 Zone; AUD/NZD: Attractive Entry Levels For Longs – TD”

Month: January 2020

Loonie Extremely Weak on Negative Housing Data & Oil Prices

The Canadian dollar was among the weakest currencies today, dragged down by negative domestic housing data. Both housing starts and building permits fell unexpectedly. The falling prices for crude oil, Canada’s biggest export, were weighing on the currency as well. According to a report from Canada Mortgage and Housing Corporation, housing starts dropped to a monthly seasonally adjusted annual rate of 197,329 units in December, down by 3% from 204,320 units in November. … “Loonie Extremely Weak on Negative Housing Data & Oil Prices”

Euro Range-Bound as Selling Pressure Abates Despite USD Strength

The euro today traded sideways against the US dollar as the selling pressure abated as investors reacted to the calming of tensions between the US and Iran. The EUR/USD currency pair today attempted to rally unsuccessfully and was mostly stuck in slightly negative territory for most of today’s session despite upbeat German industrial data. The … “Euro Range-Bound as Selling Pressure Abates Despite USD Strength”

Great Britain Pound Soft After BoE Governor Hints at Interest Rate Cut

The Great Britain pound dropped today, though by now it has managed to trim losses against some of its rivals. The main reason for the decline were comments from Bank of England Governor Mark Carney that suggested a possible interest rate cut. Continuing Brexit uncertainty was also hurting the currency. BoE chief Mark Carney delivered a speech today. While it had optimistic remarks, traders focused on negative ones. … “Great Britain Pound Soft After BoE Governor Hints at Interest Rate Cut”

Japanese Yen Weakens As Household Confidence, Foreign Investment Wanes

The Japanese yen is weakening against most of its currency rivals on Thursday as consumer confidence tumbled in December and recent investment numbers turned heads in Tokyo. The yen had rallied in the wake of the escalation in the US-Iran conflict, but with Middle East tensions abating investors resuscitated their risk appetites. A new Bank of Japan (BoJ) survey discovered that householdsâ confidence in the national economy slumped to its lowest level in five years … “Japanese Yen Weakens As Household Confidence, Foreign Investment Wanes”

Australian Dollar Mixed After Positive Australian Data, Disappointing Chinese Reports

The Australian dollar gained on other commodity currencies but was mixed against other most-traded peers today. The market sentiment was calm and domestic macroeconomic data was helpful to the Aussie. But economic reports in China, Australia’s biggest trading partner, were not particularly impressive, weighing on the Aussie a bit. The Australian Bureau of Statistics reported that the seasonally adjusted trade balance surplus widened to A$5.8 billion in November from A$4.08 … “Australian Dollar Mixed After Positive Australian Data, Disappointing Chinese Reports”

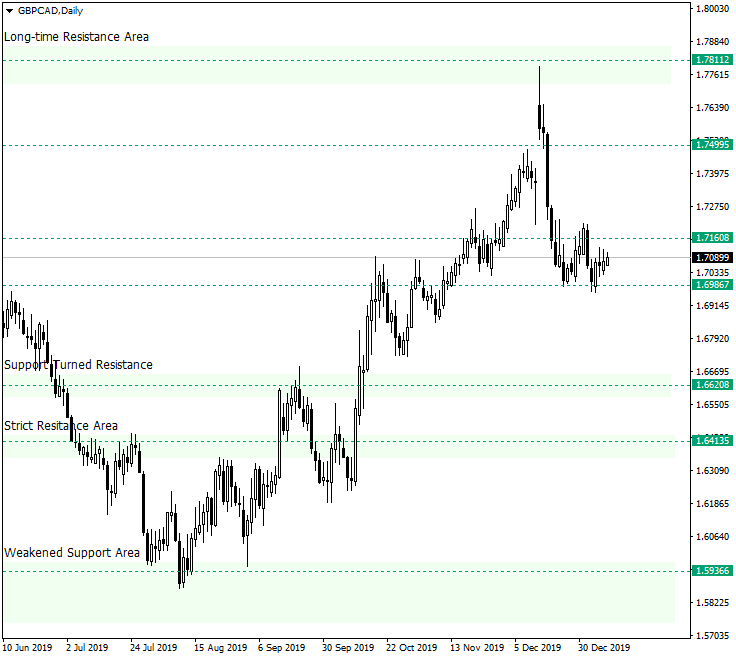

GBP/CAD Could Prepare for 1.7811

The Great Britain pound versus the Canadian dollar currency pair seems to have limited the bearish attempts to further induce a depreciation. Long-term perspective After confirming the support area of 1.5936, the price commenced an upwards pointing trend, one that extended until the long-time resistance area of 1.7811. From there, a strong retracement took place, so strong that it was able to cross two levels with ease: 1.7499 and 1.7160. … “GBP/CAD Could Prepare for 1.7811”

Canadian Dollar Weakens on Falling Crude Prices, Disappointing Exports

The Canadian dollar is weakening against multiple currency rivals midweek as energy prices are hitting the loonie. President Donald Trump confirmed that Iran is âstanding downâ in the intense Middle East conflict, sending futures plunging. The loonie was also impacted by disappointing export data. Despite being one of the top-performing G20 currencies, the Canadian dollar has had a rough start to 2020. Speaking at the White House on Wednesday, President … “Canadian Dollar Weakens on Falling Crude Prices, Disappointing Exports”

Euro Falls to 7-Day Lows on Depressed Market Risk Sentiment

The euro today fell to new weekly lows against the US dollar as the risk-off market sentiment persisted after Iran attacked US bases in Iraq. The EUR/USD currency pair’s decline was accelerated further by the release of weak data from the euro area earlier today. The EUR/USD currency pair today fell from an Asian session … “Euro Falls to 7-Day Lows on Depressed Market Risk Sentiment”

Australian Dollar Rebounds as Market Sentiment Calms Down

The Australian dollar fell intraday amid risk aversion caused by Iran’s missile attack on US military bases. But by now, the Aussie has managed to recover as investors continued to hope that the conflict will not result in a full-blown war. Currently, the Australian currency is trading about flat against most of its peers, though managed to gain on the euro and the Japanese yen. Domestic macroeconomic data was mixed, but building permits, … “Australian Dollar Rebounds as Market Sentiment Calms Down”