The Japanese yen surged intraday on the news that Iran attacked US military bases in Iraq. But the resulting risk aversion waned quickly as investors continued to hope that the United States and Iran will avoid war. Reacting to such hopes, the yen reversed its gains and is now trading below the opening level. Domestic macroeconomic data was not helpful either as reports were not particularly good, and some of them … “Yen Loses Gains Caused by Iran’s Attack on US Military Bases”

Month: January 2020

Bubbles in 2020: The five potential bursts to watch and dollar impact

Five financial bubbles are looming and may burst in 2020. Each one may have a different impact on the US dollar. The direction of travel depends on the magnitude. The highest market volatility happens when bubbles burst – but which one will it be? The froth in the housing market that led to the Great Recession is unlikely to … “Bubbles in 2020: The five potential bursts to watch and dollar impact”

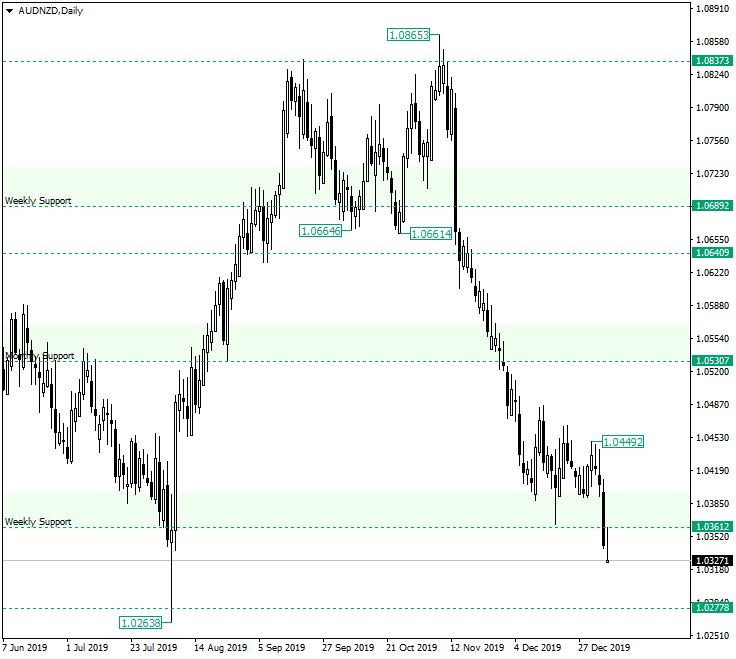

AUD/NZD Was Failed by the Weekly 1.0361 Support

The Australian dollar versus the New Zealand dollar currency pair passed under an important support. Is this break destined to be a false one? Long-term perspective The depreciation that started after the false break of 1.0837 breached important support areas along its way. The first one was the 1.0689 weekly and the second one the 1.0530 monthly. The downwards movement stopped just above the 1.0361 area in the form of a consolidation pattern. During … “AUD/NZD Was Failed by the Weekly 1.0361 Support”

Loonie Shows Good Performance Despite Adverse Fundamentals

The Canadian dollar fared rather well today, rising against other most-traded currencies or at least staying flat against them. The notable exceptions were the US dollar and the Japanese yen. Losses versus the strong greenback were especially big. But overall, the loonie showed a rather decent performance considering negative macroeconomic data and falling prices for crude oil. Crude oil rallied yesterday on fears of supply disruptions that could be … “Loonie Shows Good Performance Despite Adverse Fundamentals”

Euro Falls on Middle East Tensions, Ignores Upbeat Eurozone Data

The euro today fell against the much stronger US dollar amid heightened political tensions in the Middle East as investors bought the safe-haven greenback. The EUR/USD currency pair was on a downward spiral from the start of the session ignoring upbeat eurozone releases, which accelerated after the release of upbeat US data. The EUR/USD currency … “Euro Falls on Middle East Tensions, Ignores Upbeat Eurozone Data”

Franc Mixed as Market Sentiment Stabilizes, Domestic Data Supports

The Swiss franc was mixed today, rising against some currencies, staying flat versus others, and crashing against the US dollar and the Japanese yen. The market sentiment was stabilizing following yesterday’s risk aversion, limiting the appeal of safe currencies. Domestic macroeconomic data was positive and helpful to the Swissie. Markets started the week in a risk-off mode due to escalating tensions between the United States and Iran. But fears have started to wane … “Franc Mixed as Market Sentiment Stabilizes, Domestic Data Supports”

US Dollar Rallies As Trade Deficit Sinks to Three-Year Low

The US dollar is gaining momentum on Tuesday as new data revealed that the trade deficit fell to its lowest level in more than three years in November. With the US and Iran conflict potentially peaking, investors are gradually returning to equities and the greenback, which is evident in the slump in crude oil prices. A better-than-expected reading in the purchasing managersâ indexes (PMIs) also enhanced the buck’s strength. According to the Bureau of Economic Analysis (BEA), … “US Dollar Rallies As Trade Deficit Sinks to Three-Year Low”

How these five currencies may react to rising unemployment in 2020

Global employment is nearing a peak, and downfall cannot be ruled out. A rise in unemployment may not necessarily have an adverse impact on the local currency. We examine five countries and their impact on currencies, local or foreign. Wages have become all the rage for central banks – and that is a sign that employment … “How these five currencies may react to rising unemployment in 2020”

Macroeconomic Data Makes Aussie Fall for Third Straight Session

The Australian dollar declined against all of its most-traded peers today despite the stabilizing market sentiment that was helping riskier currencies linked to commodities. The Aussie fell for third consecutive trading session versus most of its rivals, while against some it posted even a longer stretch of declines. Macroeconomic data was negative to the currency. ANZ Australian Jobs Advertisements fell by 6.7% in December on a seasonally adjusted monthly basis. … “Macroeconomic Data Makes Aussie Fall for Third Straight Session”

EUR/USD may extend gains on inflation figures – preview

Preliminary inflation figures for December 2019 are set to show healthy price development. A 0.1% increase in core inflation would send it to the highest in over six years. EUR/USD bias is to the upside leading into the event. Mario may be like Moses – former European Central Bank President Mario Draghi fought to raise inflation but may … “EUR/USD may extend gains on inflation figures – preview”