The Australian dollar fell against its most-traded rivals today despite the better-than-expected domestic macroeconomic data. The Aussie, as well as other commodity currencies, continued to be dragged down by fears of the coronavirus that has started in China but is now spreading across the world. The Australian Bureau of Statistics reported that import prices rose by 0.7% in the December quarter of 2019, whereas analysts had expected the same 0.4% rate of increase as in the previous … “Australian Macroeconomic Data Beats Expectations, Aussie Unimpressed”

Month: January 2020

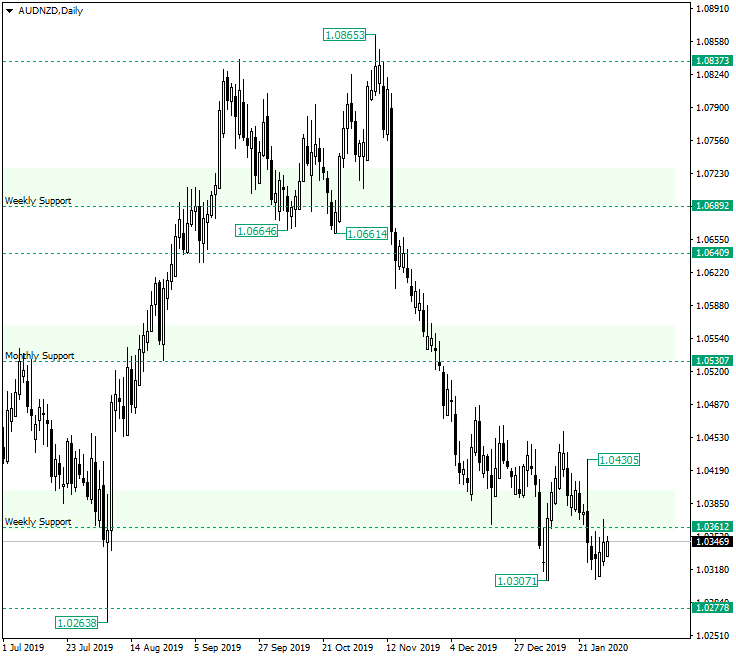

AUD/NZD Delays the Advancement Towards 1.0530

The Australian dollar versus the New Zealand dollar currency pair seems to have a hard time gaining further momentum towards the upside. Are the bulls not ready yet or it’s just that they don’t have the power? Long-term perspective The depreciation that began from the peak of 1.0865 extended beyond the weekly support of 1.0361, reaching 1.0307. But that low was a very short-lived event, as the bulls quickly sent the price … “AUD/NZD Delays the Advancement Towards 1.0530”

Euro Trades at 3-Month Lows Against US Dollar Ahead of FOMC

The euro today fell against the US dollar reversing yesterday’s brief recovery despite mixed releases from the euro area, which were utterly ignored. The EUR/USD currency pair’s decline saw it erase breach the critical 1.10 level as the bearish pressure mounted driven primarily by the stronger greenback. The EUR/USD currency pair today fell from an … “Euro Trades at 3-Month Lows Against US Dollar Ahead of FOMC”

Swiss Franc Gains on Record Trade Surplus in 2019

The Swiss franc is strengthening against several currency rivals midweek as the country recorded its highest ever trade surplus in 2019. The latest data may give the central bank a headache as it attempts to justify its depreciating efforts after accusations of being a currency manipulator. With chaos in global financial markets, will investors continue to pour into the traditional safe-haven asset? According to the Federal Customs Administration, Switzerlandâs trade surplus … “Swiss Franc Gains on Record Trade Surplus in 2019”

AUD/JPY Could Head for 71.09

The Australian dollar versus the Japanese yen currency pair sits just under an important support area. Will this phase be rendered as a false break or is the price preparing to confirm the level as resistance? Long-term perspective The ascending trend that started after the 71.09 level was confirmed as support managed to reach the 76.02 area. After printing the high of 76.54 by trying to stabilize the price above 76.02, the bulls had to take a step … “AUD/JPY Could Head for 71.09”

US Dollar Falls Against Rivals on Weaker Business Investment in 2019

The US dollar is falling against its major currency rivals on Tuesday as new data highlights an uncomfortable truth for the worldâs largest economy: Business investment is weakening. That has not stopped the consumer from being bullish as confidence in the US economy has not been this high in more than 20 years. In December, durable goods orders soared 2.4%, beating market forecasts of a 0.3% drop. However, the report … “US Dollar Falls Against Rivals on Weaker Business Investment in 2019”

Euro Breaks Below 1.10 on Mixed US Data and Risk-Off Sentiment

The euro today fell for the fourth consecutive session against the US dollar as the risk-off sentiment dominated the markets in the face of new coronavirus infections. The EUR/USD currency pair today broke below the critical 1.10 level despite European equities closing higher as investor risk aversion ebbed later in the session. The EUR/USD currency pair today fell from a high of 1.1025 in the Asian session to a low of 1.0998 in the American session having breached the crucial 1.10 … “Euro Breaks Below 1.10 on Mixed US Data and Risk-Off Sentiment”

USD: Fed To Maintain A Cautious Outlook; What’s Next For USD? – MUFG

After three consecutive cuts, the Fed is expected to hold its rates unchanged. What does this mean for the US dollar? Here is their view, courtesy of eFXdata: MUFG Research discusses its expectations for tomorrow’s FOMC policy meeting and for the Fed policy trajectory throughout the year. “The emergence of the coronavirus and building signs … “USD: Fed To Maintain A Cautious Outlook; What’s Next For USD? – MUFG”

Australian Dollar Falls on Risk Aversion, Deteriorating Business Confidence & Conditions

The Australian dollar fell against most major currencies today, with the exception of the Great Britain pound and the New Zealand dollar. The market sentiment remained in the risk-off mode, and domestic macroeconomic data was unfavorable to the currency of Australia as well. National Australia Bank reported that both business conditions and business confidence fell in December. Conditions fell from +4 to +3. Confidence dropped from 0 to -2, touching the lowest level since … “Australian Dollar Falls on Risk Aversion, Deteriorating Business Confidence & Conditions”

Japanese Yen Halts Rally, Risk Aversion Persists

The Japanese yen fell against a range of currencies today, even including some commodity-related ones. The possible reason for the retreat was profit-taking after the previous big gains. The market sentiment remained fragile as the coronavirus continues to spread, and investors are concerned about its impact on the global economy. The dangerous infection continues to spread, with the number of confirmed cases exceeding 4,500 and the death toll climbing to 106, up from 81 yesterday. There … “Japanese Yen Halts Rally, Risk Aversion Persists”