The lives of humans and animals have been entwined for hundreds of years, and we rely on them to assist us in our work including, search and rescue, recovery, security and biosecurity. The dog’s sense of smell is also indispensable for detecting prohibited substances like narcotics, so they’re at work in airports, correctional facilities and … “5 Benefits Of Having A Dog At The Office”

Month: January 2020

Canadian Dollar Weakens Despite Strong November Retail Sales

The Canadian dollar is weakening against most major currency competitors to close out the trading week. Despite retail sales coming in stronger than expected and inflation matching market expectations, the loonieâs decline could still be driven by the central bank leaving interest rates unchanged. Is the market signaling that a rate cut is needed to resuscitate economic growth? In November, retail sales climbed 0.95%, rebounding from the 1.1% … “Canadian Dollar Weakens Despite Strong November Retail Sales”

Pound Falls on BoE Rate Cut Fears, Despite Positive UK Flash PMIs

The Sterling pound today succumbed to pressure and fell from its daily highs despite the release of upbeat UK flash PMIs by Markit Economics in the early London session. The GBP/USD currency pair spiked higher briefly before falling as investors fear a rate cut by the Bank of England at their monetary policy meeting next week. The GBP/USD currency pair today spiked … “Pound Falls on BoE Rate Cut Fears, Despite Positive UK Flash PMIs”

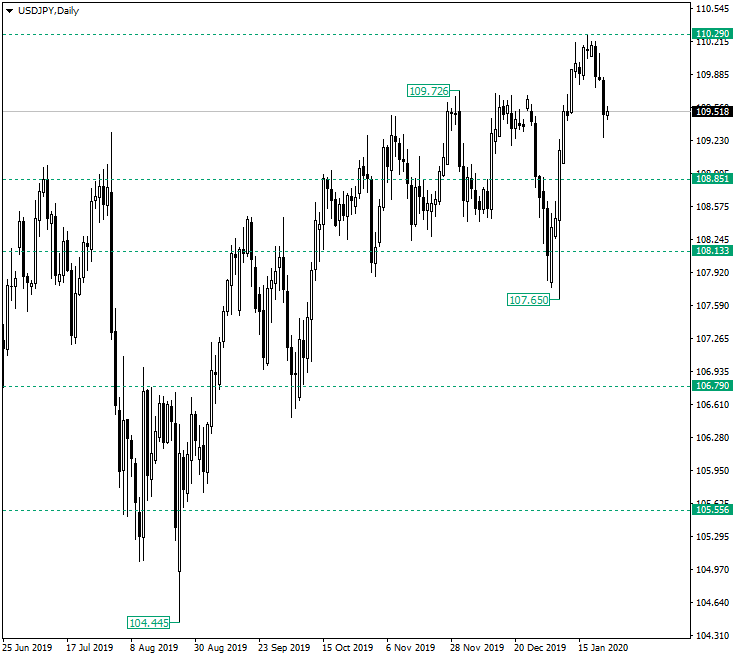

USD/JPY Halted by 110.29

The US dollar versus the Japanese yen currency pair retraced quite strongly from the 110.29 resistance level. Is this a clue that the bulls are out of the game for a while? Long-term perspective The ascending trend that started after the low of 104.44 was printed managed to touch the resistance of 110.29. The level of 110.29 was expected to serve as a profit booking area for the buyers that entered from 108.13. However, the resulting retracement was … “USD/JPY Halted by 110.29”

Five scenarios for trading UK PMIs with GBP/USD

Economists expect an improvement in Markit’s preliminary UK PMIs for January. The data is critical for the Bank of England’s upcoming decision. GBP/USD may react in five different ways in reaction to the data. To cut or not cut – this is still an open question for the Bank of England after Tuesday’s jobs report beat expectations with 3.2% annual … “Five scenarios for trading UK PMIs with GBP/USD”

Euro Falls on ECB Rate Decision and Dovish ECB Strategic Review

The euro today crashed to new monthly lows against the US dollar after the European Central Bank announced its rate decision and strategic review. The EUR/USD currency pair today fell to lows last seen on 2nd December 2019 amid a risk-averse market environment that saw most European equity indices close the day lower. The EUR/USD currency pair today spiked to a daily high of 1.1109 in the European session before falling … “Euro Falls on ECB Rate Decision and Dovish ECB Strategic Review”

Mexican Peso Weakens As IMF Slashes Growth Estimates

The Mexican peso is weakening against several currencies on Thursday as the International Monetary Fund (IMF) cut its growth projections for the country. This comes as the unemployment rate fell last month to its lowest level in nearly two years and inflation came higher than expected. Earlier this week, the IMF issued its World Economic Outlook (WEO) update and warned that Mexicoâs gross domestic product (GDP) will rise … “Mexican Peso Weakens As IMF Slashes Growth Estimates”

Lagarde is different than Draghi, but she also knows how to drag the euro down

The European Central Bank has left rates unchanged as expected. ECB President Lagarde has been cautious in her press conference. The ECB’s reluctance to cheer recent developments leaves EUR/USD exposed. A wise owl – that is what Christine Lagarde, President of the European Central Bank aspires to be. She said that back in December and … “Lagarde is different than Draghi, but she also knows how to drag the euro down”

Australian Dollar Emerges Strongest After Employment Report

The Australian dollar rallied against all other of its most-traded rivals, even the Japanese yen, which itself was rather strong. The main reason for the Aussie’s great performance was a surprisingly good domestic employment report, which improved the outlook for monetary policy a bit. Even risk aversion prevailing on the market was unable to stop the Australian currency from rallying. The Australian Bureau of Statistics reported that the number of employed people in Australia … “Australian Dollar Emerges Strongest After Employment Report”

Japanese Yen Rallies on Returning Fears of Coronavirus

The Japanese yen gained against most other major currencies today, with the exception of the Australian dollar, which got a boost from domestic employment data. The resurging fears about the spread of the coronavirus from China were the main driver for the yen’s rally. Domestic macroeconomic data was also supportive of the Japanese currency. Markets were cautious after the news that China basically quarantined Wuhan, halting travel to the city. The city of 11 … “Japanese Yen Rallies on Returning Fears of Coronavirus”