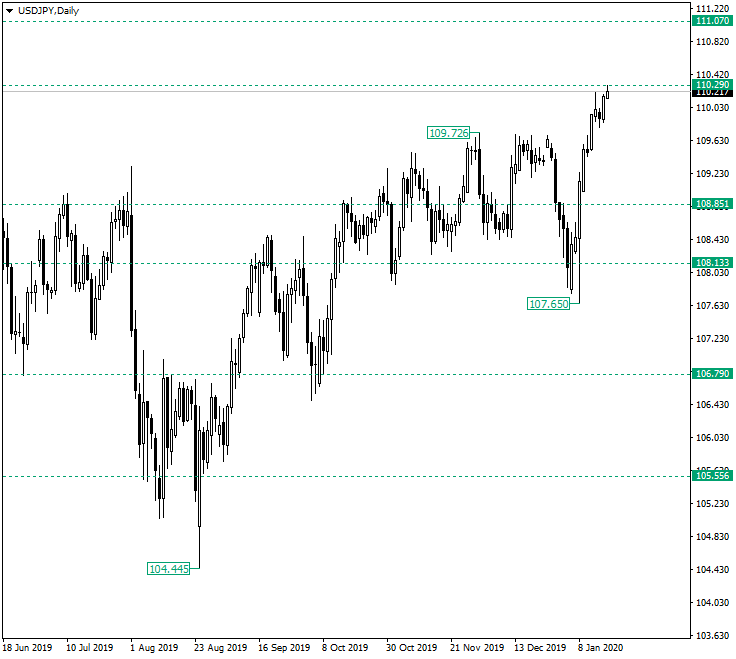

The US dollar versus the Japanese yen currency pair is at a point in which it should draw a correction, otherwise it might be considered that it is overextending. Long-term perspective After falsely piercing the level of 105.55 and printing the 104.44 low, the price began an upwards pointing trend. But beginning with December 2019, the bulls were challenged, as the price began to have a hard time gaining any advancement. This … “USD/JPY Might Correct Before Further Appreciation”

Month: January 2020

EUR/USD Pair Falls From Daily Highs on Upbeat US Retail Sales

The euro today fell against the US dollar in the American session following the release of upbeat US retail sales data. The EUR/USD currency pair fell from its daily highs giving up all the gains made earlier in the session as the Dollar Index soared. The EUR/USD currency pair today fell from a high of 1.1173 in the mid-European session to … “EUR/USD Pair Falls From Daily Highs on Upbeat US Retail Sales”

Japanese Yen Weakens on Slide in Machine Tool Orders, Bump in PPI

The Japanese yen is weakening against most of its currency rivals on Thursday after a mix of economic data that highlighted both gains and weaknesses in the worldâs third-largest economy. Is the federal governmentâs stimulus enough to prevent Tokyo from slipping into the long-awaited recession? According to the Japan Machine Tool Builders Association (JMTBA), machine tool orders plummeted 33.6% in December from the same time a year ago. This is a slight … “Japanese Yen Weakens on Slide in Machine Tool Orders, Bump in PPI”

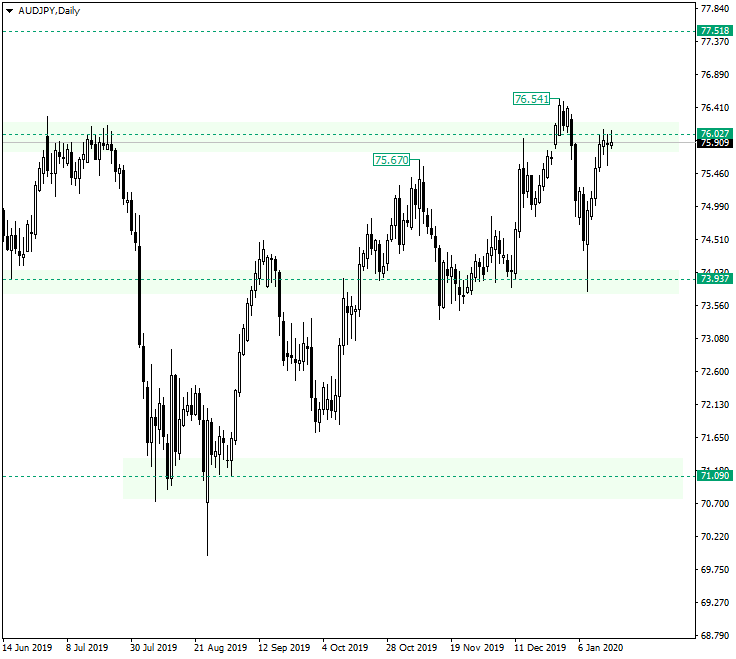

AUD/JPY Deciding at 76.02

The Australian dollar versus the Japanese yen currency pair is in a very interesting spot, one from where it could go either way and so establish the course for the long-term. Long-term perspective The ascending trend that started after the false piercing of the 71.09 support evolved in a very convincing manner, peaking at 76.54, just above the 76.02 level. The fact that the peak at 76.54 is part of a false break was, of course, welcomed … “AUD/JPY Deciding at 76.02”

US Dollar Sinks As Phase One US-China Trade Deal Signed

The US dollar slumped midweek as the US and China officially signed the first phase of a comprehensive trade agreement. This comes as December inflation was subdued and business optimism fell short of analystsâ expectations. Still, the greenback is trading relatively higher against a basket of currencies this month. It took 18 months, but Washington and Beijing finally signed phase one of a trade deal. President Donald Trump hosted Vice Premier … “US Dollar Sinks As Phase One US-China Trade Deal Signed”

Euro Rallies on Trade Deal Optimism and Hawkish ECB Strategic Review

The euro today rallied higher against the US dollar driven by upbeat investor risk sentiment in anticipation of the US-China phase one trade deal signing later today. The EUR/USD currency pair’s rally was also spurred by investor expectations that the European Central Bank could turn hawkish in the medium-term after a strategic review. The EUR/USD … “Euro Rallies on Trade Deal Optimism and Hawkish ECB Strategic Review”

Pound Falls on Disappointing UK Inflation Report and BoE Comments

The sterling pound today fell to new daily lows against the US dollar following the release of disappointing UK inflation data in the early London session. The GBP/USD currency pair’s decline was also fueled by dovish comments from a Bank of England policymaker increasing the likelihood of future rate cuts. The GBP/USD currency pair today fell … “Pound Falls on Disappointing UK Inflation Report and BoE Comments”

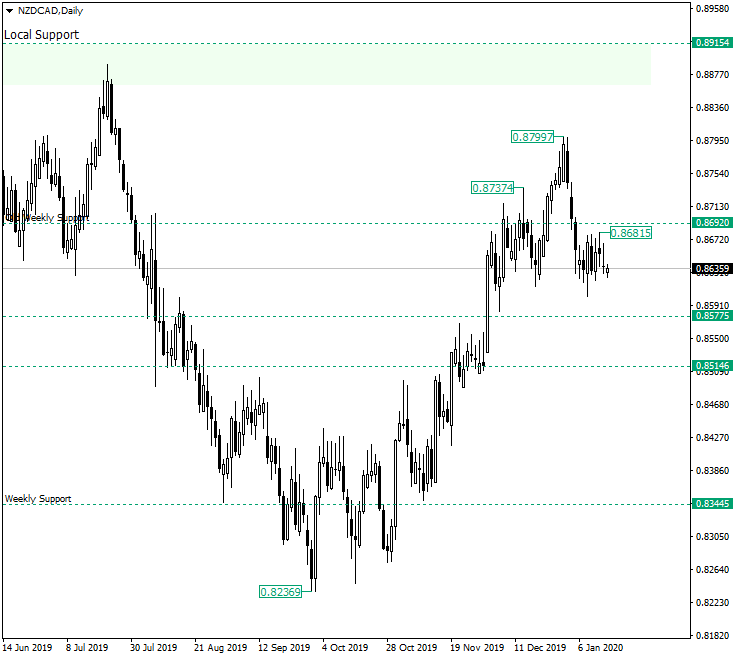

NZD/CAD Still Aiming for 0.8514

The New Zealand dollar versus the Canadian dollar currency pair is very consistent in its determination of reaching 0.8514 once more. Long-term perspective After confirming the weekly level of 0.8344 as support, the price headed for higher values. The first important level to be reached was the old weekly support of 0.8692. Even if the bears managed a departure on December 13, after piercing the level, the bulls acted quickly and, by closing the day … “NZD/CAD Still Aiming for 0.8514”

Euro Falls on Trade Headlines and US CPI Amid Empty European Dockets

The euro today fell against the US dollar driven by a lack of macro releases from across the euro area and the resurgent greenback. The EUR/USD currency pair later rallied from its daily lows despite the release of mostly in-line US inflation data in the American session. The EUR/USD currency pair today fell from a … “Euro Falls on Trade Headlines and US CPI Amid Empty European Dockets”

Chinese Yuan Weakens Despite Exports Beating Market Forecasts

The Chinese yuan is falling against several major currency competitors on Tuesday, despite positive trade data that suggest the US-China trade dispute winding down is proving already to be bullish for Beijing. The December numbers are beginning to roll in, and so far, it is good news for the worldâs second-largest economy. According to the … “Chinese Yuan Weakens Despite Exports Beating Market Forecasts”