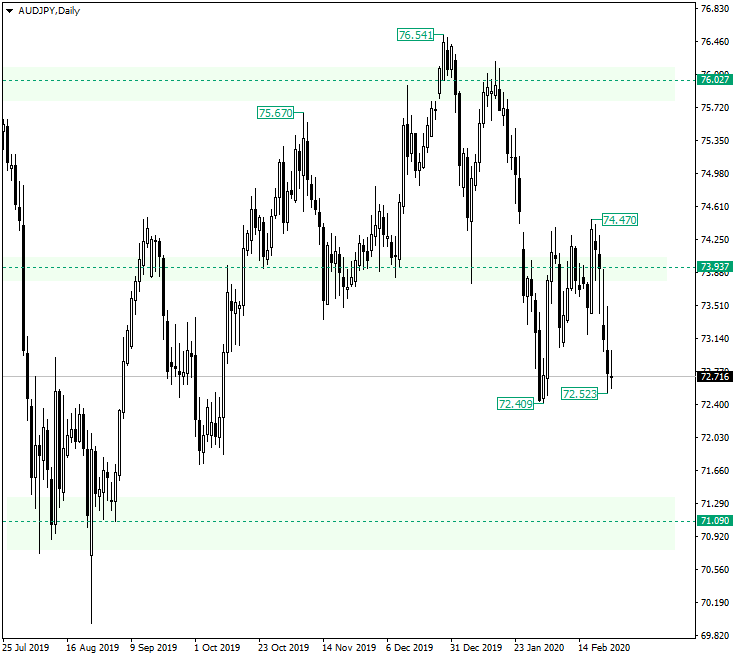

The Australian Dollar versus the Japanese yen currency pair is in a spot that may very well facilitate both a rally or a fall. But which one has more chances of becoming a reality? Long-term perspective The ascending trend that started after the confirmation of 71.09 as support peaked at 76.54 and looks as if it ended after the price slipped under an important support that later became resistance, 73.93, respectively. What is … “AUD/JPY Facing a Decision at 72.50”

Month: February 2020

Pound Rallies on US Dollar Weakness and Coronavirus Headlines

The Sterling pound today rallied against the US dollar in a turn of events that saw the dollar lose ground against most of its peers. The GBP/USD rallied above the crucial 1.30 level as demand for the greenback weakened despite new coronavirus infections. The GBP/USD currency pair today rallied from an opening low of 1.2914 … “Pound Rallies on US Dollar Weakness and Coronavirus Headlines”

Mexican Peso Drops As Economy Shrinks in 2019

The Mexican peso is trading relatively flat against several major currency competitors on Tuesday. With the latest economic data coming in mixed, the public and investors may be becoming increasingly impatient with President Andres Manuel Lopez Obradorâs policies. A cyber attack on the nationâs economy ministry did not help spur confidence in AMLOâs government either. In the fourth quarter, the final gross domestic product (GDP) growth rate reading … “Mexican Peso Drops As Economy Shrinks in 2019”

Euro Soft amid Raging Coronavirus Fear

The euro declined today against other most-traded currencies as markets remained in the grip of coronavirus epidemic fear, which made traders less willing to risk and prefer safer currencies to riskier ones. Germany released a report on its economic growth during today’s session but markets largely ignored it. Destatis, the German Federal Statistical Office, reported that gross domestic product was unchanged in the fourth quarter of 2019 from the previous … “Euro Soft amid Raging Coronavirus Fear”

Japanese Yen Continues to Profit from Coronavirus Fear

The Japanese yen gained against most of the other currencies today as coronavirus fears continued to drive investors to safer assets. The yen, being one of such assets, profited immensely from the demand for safety. Japan’s macroeconomic data released today was good but had a limited impact on the currency. The deadly COVID-19 disease continued to spread around the globe, with the total number of cases exceeding 80,000. The death toll continued to rise in China, … “Japanese Yen Continues to Profit from Coronavirus Fear”

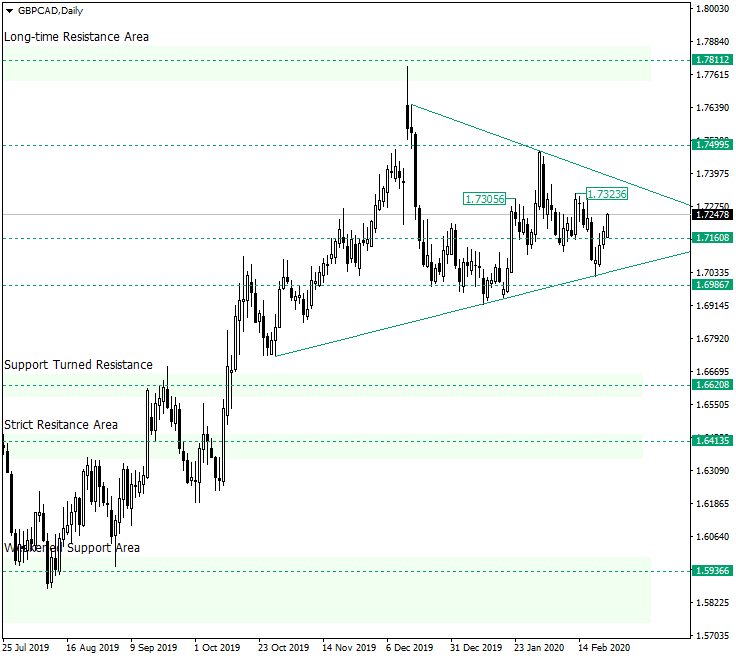

Bulls Back in Business on GBP/CAD?

The Great Britain pound versus the Canadian dollar currency pair made a twist. Long-term perspective The head and shoulders pattern seems to have been invalidated, as the price went back above the neck-line of the chart pattern, 1.7160, respectively. The most probable culprit is the support trendline o what becomes a well-formed symmetrical triangle. On February 20, the price stopped exactly in this trendline. The confirmation that followed caused a strong rise, the price piercing … “Bulls Back in Business on GBP/CAD?”

US Dollar Rally Sparked by Safe-Haven Demand Amid Coronavirus Crisis

The US dollar is surging to kick off the trading week, buoyed by renewed safe-haven demand as the coronavirus continues to extend outside China. While the situation has relatively stabilized in the worldâs second-largest economy, investors are in a panicky state because of how the outbreak is beginning to intensify all over the world. Despite a slight retreat on Friday, the greenback is looking to test multi-year highs in the coming sessions. The global death toll has surpassed … “US Dollar Rally Sparked by Safe-Haven Demand Amid Coronavirus Crisis”

Euro Falls on Coronavirus Fears, Ignores Upbeat German IFO Data

The euro today gapped lower against the US dollar to start of the week trading with a bearish bias amid the risk-off market sentiment created by coronavirus headlines. The EUR/USD currency pair oscillated between gains and losses during today’s session as bears fought to control the pair’s price despite the upbeat German macro reports. The EUR/USD currency pair ended up trading … “Euro Falls on Coronavirus Fears, Ignores Upbeat German IFO Data”

NZD Struggles to Bounce After Opening Lower on Coronavirus Panic

The New Zealand dollar opened sharply lower today as markets were in a panic mode as the coronavirus was spreading from China to other parts of the world. While the currency is trying to trim its losses, it is still trading far below Friday’s close. Mixed domestic macroeconomic data was not helping the kiwi. Investors were panicking after the reports that the deadly virus, which originated in the Chinese province of Wuhan, … “NZD Struggles to Bounce After Opening Lower on Coronavirus Panic”

Elliott wave analysis: EURUSD In a Downtrend

EURUSD has ended a big, bearish cycle down from 1.256 area, with an Elliott wave ending diagonal in the final piece of a bigger wave A impulse at the 1.087 low. Price then followed with a correction in a wave B and found resistance at the 1.122 level from where a new sharp drop is … “Elliott wave analysis: EURUSD In a Downtrend”