The Sterling pound today fell against the US dollar despite the release of upbeat UK inflation data in the early London session. The GBP/USD currency pair fell at a crucial support level, which has been cited by most analysts as the main reason for the pair’s decline. The GBP/USD currency pair today fell from an … “Pound Falls Despite Upbeat UK Inflation Data and Positive US Prints”

Month: February 2020

UK CPI data may be the straw that breaks cable’s back

UK inflation figures for January are set to show a rebound to 1.6%. GBP/USD has shown resilience to weak wage figures and worrying Brexit headlines. Downbeat CPI figures may be a breaking point for the pound. Sterling is strong – but for how long? GBP/USD has shown remarkable prowess in shrugging off adverse developments. It managed … “UK CPI data may be the straw that breaks cable’s back”

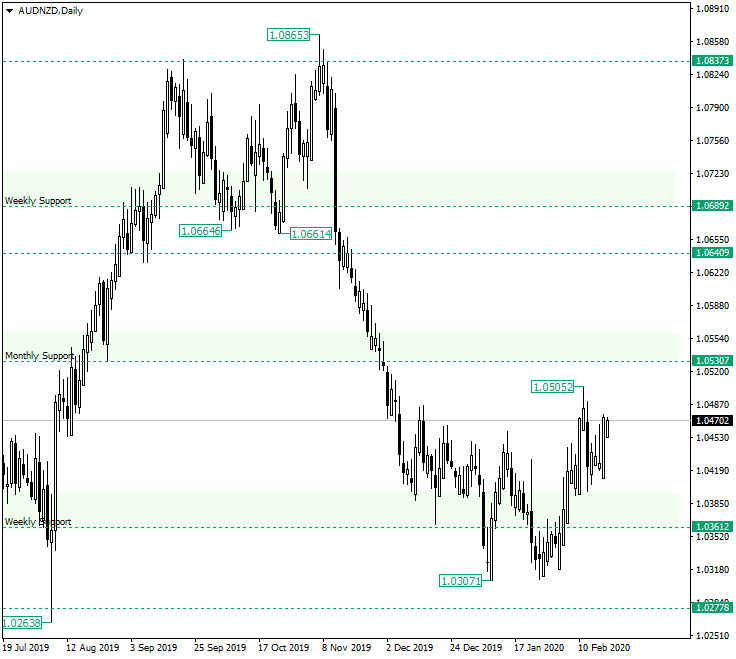

Looks like AUD/NZD Targets 1.0530

The Australian dollar versus the New Zealand dollar currency pair appears to be in bullish hands, even if the bears did all they could to send it towards the south. Long-term perspective After the confirmation of 1.0837 as resistance, the price started a strong depreciation that reached the area of 1.0361. Along this way, two important levels gave way: the weekly support of 1.0689 and the monthly support of 1.0640, respectively. But the next support, … “Looks like AUD/NZD Targets 1.0530”

Japanese Yen Rebounds Despite Heightened Recession Fears

The Japanese yen is rebounding on Tuesday after the safe-haven currency struggled to hold ground to kick off the trading week due to a disappointing gross domestic product reading. The yenâs jump, despite heightened recession fears, is being driven by decent industrial production in December. All eyes will now be on January trade data and machinery orders in December. According to government numbers, industrial production rose 1.2% in December, up from … “Japanese Yen Rebounds Despite Heightened Recession Fears”

Euro Drops to Multi-Year Lows on Weak German ZEW Survey Data

The euro today fell against the US dollar during the European session following the release of weak German ZEW survey data early in the session. The EUR/USD currency pair traded at 34-month lows as the coronavirus headlines continue to dampen investor risk appetite. The EUR/USD currency pair today fell from an opening high of 1.0838 to a low of 1.0786 in the … “Euro Drops to Multi-Year Lows on Weak German ZEW Survey Data”

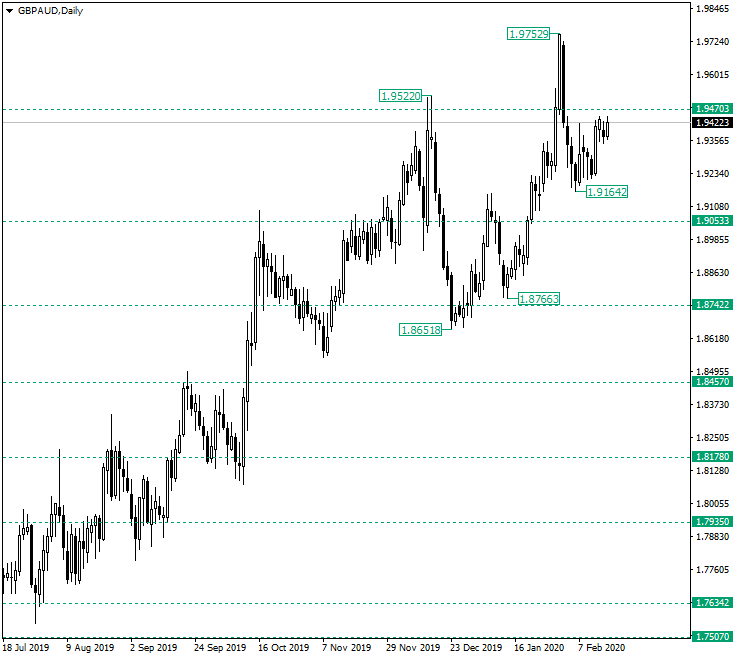

GBPAUD Could Challenge 1.9752

The Great Britain pound versus the Australian dollar currency pair seems to try climbing bigger prices. Are the bears in the search for a good spot to short from? Long-term perspective The ascending trend that began after the confirmation of 1.7634 as support, extended until the peak of 1.9752. From there, it retraced under the previous peak — of 1.9555 — and under the level of 1.9470. The fact that the price went beneath the level, can be seen by the bears … “GBPAUD Could Challenge 1.9752”

Pound Falls on Johnsonâs Brexit Comments Amid Low Liquidity

The Sterling pound today fell against the US dollar as the UK and the European Union continue to play hardball with each other ahead of the official Brexit negotiations. The GBP/USD fell for most of today’s session amid low-liquidity conditions, given that the US markets remained closed even as the country celebrates President’s Day. The … “Pound Falls on Johnsonâs Brexit Comments Amid Low Liquidity”

Chinese Yuan Gains As PBoC Cuts Rates, Hints at More Stimulus

The Chinese yuan is strengthening against the major currency rivals to kick off the trading week, buoyed by investorsâ hopes that Beijing will launch additional fiscal and monetary stimulus to protect the economy from the Wuhan coronavirus fallout. Over the last two weeks, policymakers have unveiled economic measures to limit the damage from Covid-19, and financial markets have been ebullient over the announcements. On Monday, the Peopleâs Bank of China (PBoC) lowered … “Chinese Yuan Gains As PBoC Cuts Rates, Hints at More Stimulus”

Japanese Yen Struggles to Hold Ground After Awful GDP Print

The Japanese yen was vulnerable today after the release of an awful report on the country’s gross domestic product. Furthermore, investors were moderately hopeful that China’s efforts to battle the deadly epidemic of a coronavirus will bear fruit. Nevertheless, the yen did not perform that bad considering the circumstances, even managing to gain on some of its rivals. Japan’s Cabinet Office reported that GDP dropped by 1.6% in the fourth quarter of 2020, much … “Japanese Yen Struggles to Hold Ground After Awful GDP Print”

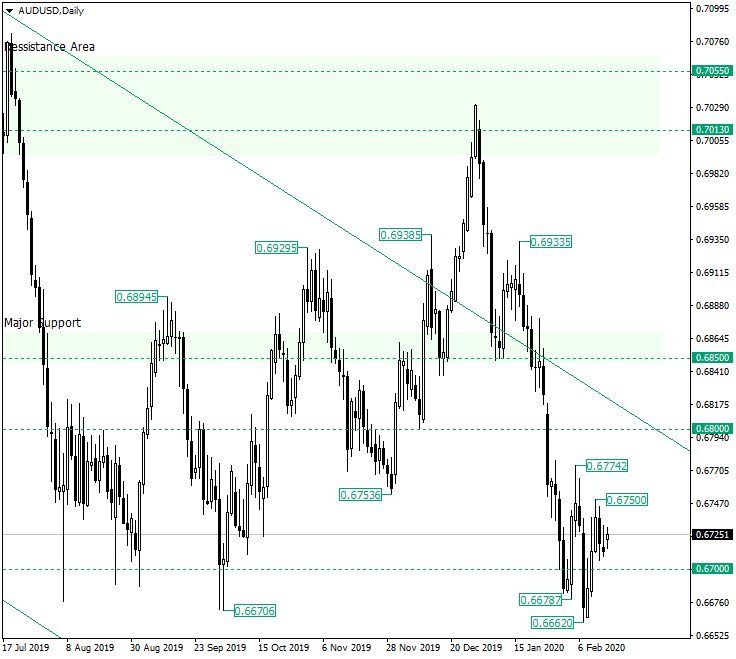

Are the Bulls Really in Control of 0.6700 on AUDUSD?

The Australian dollar versus the US dollar currency pair seems to be part of both bullish and bearish sides. But on which side is it, actually? Long-term perspective After printing the head and shoulders pattern marked by the highs of 0.6938 and 0.6933, respectively, the price dropped under the major support of 0.6850. By doing so, it also re-entered the descending channel, which fueled the decline even more. As a result, the price reached the area of the 0.6700 … “Are the Bulls Really in Control of 0.6700 on AUDUSD?”