AUD/USD has been on the rise amid a calmer market mood. Australia’s jobs report and further coronavirus headlines are set to dominate trading. Mid-February’s daily chart is painting a bullish picture. The FX Poll is showing short-term drop and higher levels later on. The Australian dollar has benefited from receding fears about the coronavirus and … “AUD/USD: Coronavirus not over, Australian labor data awaited”

Month: February 2020

US Dollar Slips on Mixed Data, Coronavirus Uncertainty

The US dollar is falling against multiple currency competitors to finish the trading week. The greenback could not find a concrete direction on Friday as the key economic reports were mixed. There is still a great deal of uncertainty in global financial markets surrounding the coronavirus, which was recently named Covid-19 by the World Health Organization (WHO). Despite the hiccup at the end of the trading week, the US dollar is still having an incredible start … “US Dollar Slips on Mixed Data, Coronavirus Uncertainty”

After the reshuffle, GBP/USD now faces the hard data

GBP/USD has been able to overcome Brexit concerns and move higher after the cabinet reshuffle. A busy week including inflation, employment, retail sales, and PMIs awaits pound traders. Mid-February’s daily chart is more bullish. but points to a critical double-top. The FX Poll is showing a bullish bias on all timeframes. Keep calm and carry … “After the reshuffle, GBP/USD now faces the hard data”

Macron Gap may result in 50-100 pip fall in EUR/USD

EUR/USD has been extending its slide amid economic divergence and other factors. It is nearing the chart gap created by French President Macron’s victory in April 2017. The slow grind lower may turn into an avalanche. Is EUR/USD moving too slowly? The world’s most popular currency pair has been stuck for months and even when … “Macron Gap may result in 50-100 pip fall in EUR/USD”

Euro Range-Bound on Mixed German and Eurozone GDP Reports

The euro today continued to trade near 3-year lows against the US dollar after the release of mixed GDP data from Germany and the greater euro area. The EUR/USD currency pair extended its losing streak, which has been in place since the start of the year, as the risk-off sentiment dominated the markets in the face of the coronavirus outbreak. The EUR/USD currency pair today traded in a tight … “Euro Range-Bound on Mixed German and Eurozone GDP Reports”

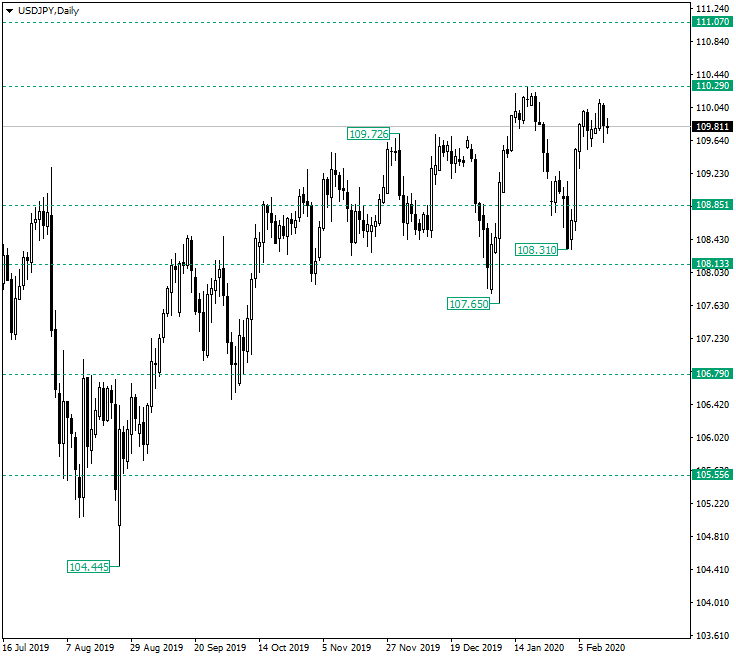

Bears Packed at 110.00 on USDJPY?

The US dollar versus the Japanese yen currency pair seems to have a hard time extending beyond the 110.00 psychological level. Is it that the price stalled or the bulls are catching their breath? Long-term perspective From the low of 104.44, the price commenced an ascending trend that, beginning with November 2019, showed signs of deceleration. The area signed by the peak of 109.72 began to look like a possible strong resistance, and after the depreciation … “Bears Packed at 110.00 on USDJPY?”

Japanese Yen Strengthens on Safe-Haven Demand Despite Bearish Outlook

The Japanese yen is strengthening against major currency rivals on Thursday, despite a myriad of bearish outlooks by both the federal government and international bodies. A string of weak economic data also could not affect the yen toward the end of the trading week as investors continued to pour into the traditional safe-haven asset amid global uncertainty due to the Wuhan coronavirus outbreak. Earlier this week, the January Eco Watchers Outlook survey plunged from … “Japanese Yen Strengthens on Safe-Haven Demand Despite Bearish Outlook”

Pound Rallies to 1-Week Highs as PM Johnson Reshuffles His Cabinet

The Sterling pound today rallied to 1-week highs as the British Prime Minister Boris Johnson announced a major cabinet reshuffle that saw several ministers replaced. The GBP/USD currency pair started rallying hours before the official announcement as some ministers such as Sajid Javid resigned ahead of the reshuffle. The GBP/USD currency pair today rallied to … “Pound Rallies to 1-Week Highs as PM Johnson Reshuffles His Cabinet”

Scandinavian Capital Markets: Dan Blystone assumes the role of Chief Market Strategist

Dan Blystone has been named Chief Strategist at Scandinavian Capital Markets. Here are more details: STOCKHOLM, February 13, 2020. Dan began his career in the trading industry working as an arb clerk on the floor of the Chicago Mercantile Exchange (CME), flashing orders into the currency futures pits. From there he went upstairs and did … “Scandinavian Capital Markets: Dan Blystone assumes the role of Chief Market Strategist”

Euro Falls to Three-Year Low vs. Franc on Coronavirus Fears, Economic Data

The euro was weak today, falling for the sixth consecutive day to the lowest level in three years against the Swiss franc. Risk aversion caused by an unexpected surge of infected people in China was weighing on the shared 19-nation currency, while eurozone macroeconomic data was not helping as well. The coronavirus disease named COVID-19 continued to spread across China, and the sudden surge of the number of infected people concerned investors greatly. Chinaâs Hubei province, … “Euro Falls to Three-Year Low vs. Franc on Coronavirus Fears, Economic Data”