The Great Britain pound was about flat against other major currencies and trimmed losses versus commodity currencies today after the release of a bunch of macroeconomic indicators in Britain. The data was not extremely positive, but apparently, markets considered it to be good enough to support the sterling. Britain’s Office for National Statistics reported that according to the preliminary estimate gross domestic product was flat in the fourth quarter of 2019 compared … “Great Britain Pound Stable After GDP, Other Economic Indicators”

Month: February 2020

Australian Dollar Extends Rise After Business Confidence Improves

The Australian dollar continued to rise today after the business confidence improved. Other commodity currencies were trying to recover as well even though investors remained cautious as the deadly coronavirus continued to spread across China. National Australia Bank reported that business confidence improved slightly from -2 in December to -1 in January. Business conditions remained unchanged at +3. Alan Oster, NAB Group Chief Economist, commented on the results: The survey … “Australian Dollar Extends Rise After Business Confidence Improves”

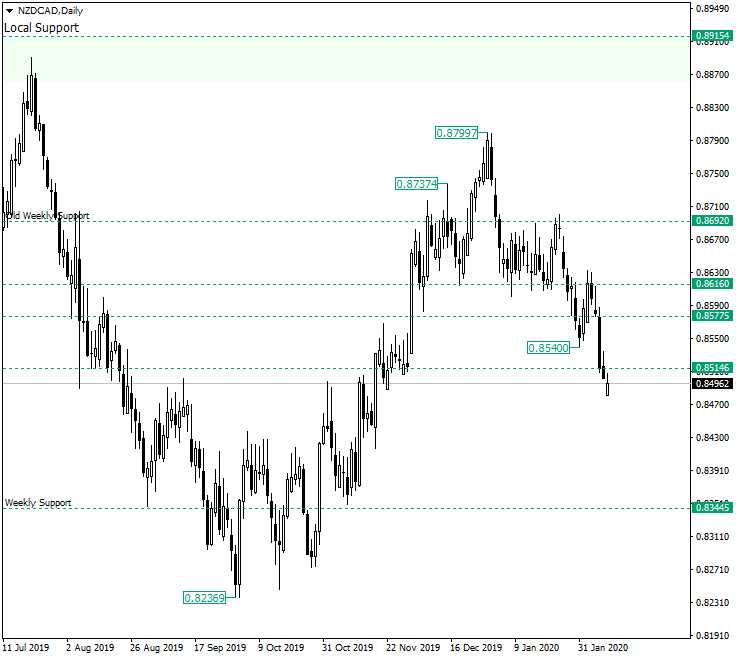

NZD/CAD Made It to 0.8514. Where Now?

The New Zealand dollar versus the Canadian dollar currency pair reached the 0.8514 level. Is this only a met target or is the depreciation about to continue? Long-term perspective The depreciation that started from the peak of 0.8799, which is a part of the head and shoulders pattern with the left-side shoulder marked by 0.8737, extended to 0.8540, retraced, confirmed the level of 0.8616 — which is also the neck-line of the aforementioned chart pattern — as resistance, and continued towards … “NZD/CAD Made It to 0.8514. Where Now?”

Euro Falls on Coronavirus News and US-EU Economic Divergence

The euro today fell to new 2020 lows against the much stronger US amid a risk-off market environment dominated by headlines of new coronavirus infections. The EUR/USD currency pair’s decline was accelerated by Friday’s positive US non-farm payrolls report, which showed diverging performance between the two economies. The EUR/USD currency pair today fell from an Asian session high of 1.0958 to a low of 1.0909 in the American session and was near these … “Euro Falls on Coronavirus News and US-EU Economic Divergence”

Canadian Dollar Mixed As Housing, Jobs Data Unable to Trigger Momentum

The Canadian dollar is trading mixed against multiple currency rivals to kick off the trading week, despite bullish housing and jobs data that should have buoyed the loonie. The paucity of momentum will be more pronounced as the Canadian dollar may trade sideways ahead of the central bankâs policy announcement later this week. Will the currency reverse its downward trend? According to the Canada Mortgage and Housing Corporation (CMHC), seasonally … “Canadian Dollar Mixed As Housing, Jobs Data Unable to Trigger Momentum”

Australian Dollar Trades Higher After China’s CPI Beats Expectations

The Australian dollar rose today after China’s consumer inflation accelerated more than was expected by markets. The market sentiment was still cautious as the Wuhan coronavirus continued to spread across China. According to data from the National Bureau of Statistics of China, the Consumer Price Index climbed by 5.4% in January, year-on-year. That is compared with the median forecast of a 4.9% increase and a 4.5% gain registered in the prior month. The Producer Price Index … “Australian Dollar Trades Higher After China’s CPI Beats Expectations”

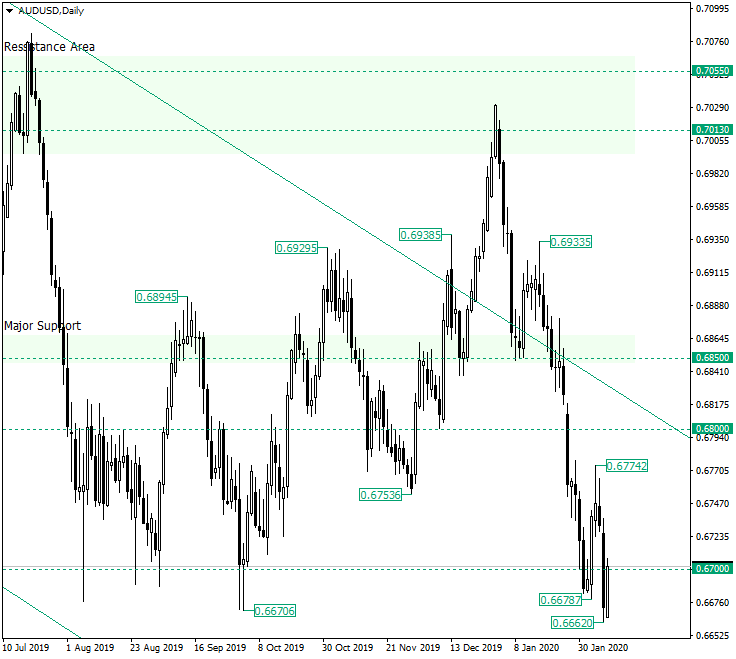

AUD/USD Might Be Ready for 0.6500

The Australian dollar versus the US dollar currency pair, although it may be still receiving some bullish support, seems to be in bearish hands. Long-term perspective The decline that followed the head and shoulders pattern — shoulders market by the peaks of 0.6938 and 0.6933, respectively — reached the area of the 0.6700 psychological level. From there, after bottoming at 0.6678, the price climbed at 0.6774. Further appreciation was halted as the price confirmed the area corresponding … “AUD/USD Might Be Ready for 0.6500”

Canadian Dollar Falls on Weak Oil Prices, Despite Upbeat Jobs Report

The Canadian dollar today fell against the US dollar following the release of mixed Canadian jobs data and the upbeat US non-farm payrolls report. The USD/CAD currency pair’s rally was also fueled by the decline in global crude oil prices, which dragged the commodity-linked loonie lower. The USD/CAD currency pair today spiked to a daily low of … “Canadian Dollar Falls on Weak Oil Prices, Despite Upbeat Jobs Report”

US Dollar Jumps on Strong January Jobs Report

The US dollar is soaring against many major currency rivals to close out the trading week, driven by a better-than-expected January jobs report. This comes as the US economy enjoyed a plethora of positive numbers this week that have made investors question if the slowdown is as prevalent as analysts say it is. According to the Bureau of Labor Statistics (BLS), the US economy added 225,000 jobs in January, up from an upwardly … “US Dollar Jumps on Strong January Jobs Report”

Euro Hits New 2020 Lows on Mixed German Data, Ahead of US NFP

The euro today fell to new 2020 lows against the US dollar in the early European session following the release fo mixed data from the German docket. The EUR/USD currency pair fell through significant support levels to hit a 4-month low driven by a risk-averse market environment ahead of the crucial US non-farm payrolls report. … “Euro Hits New 2020 Lows on Mixed German Data, Ahead of US NFP”