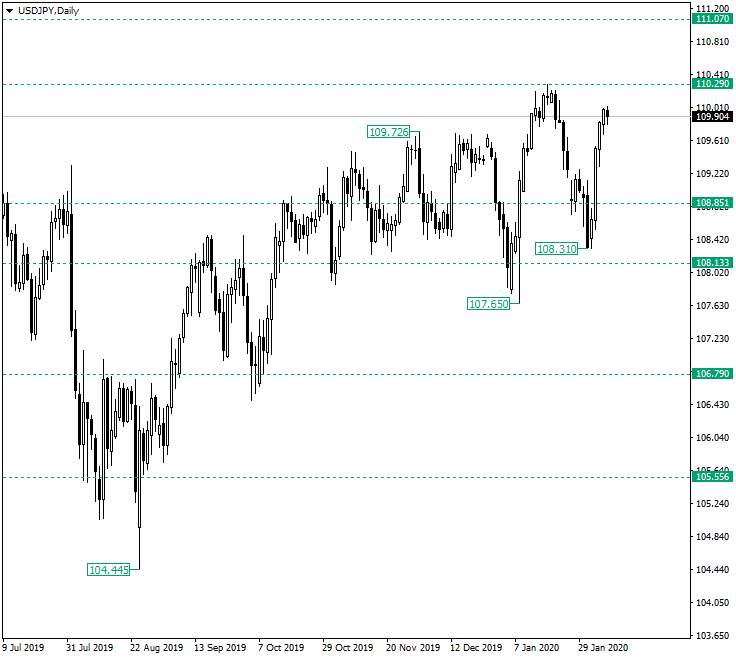

The US dollar versus the Japanese yen currency pair may have extended a little too much in a very short timespan. Long-term perspective After confirming the 108.13 level via the false break that impressed the low at 107.65, the price appreciated until the 110.29 resistance level. From there, a depreciation that extended until 108.31 came into play, thus printing a higher low with respect to the previous one, 107.65, respectively. … “USDJPY Rally Challenged by the 110.00 Level”

Month: February 2020

Pound Falls to New 2020 Lows as the Dollar Hits Multi-Month Highs

The Sterling pound today edged lower against the US dollar for the second consecutive session as investors remained worried about a hard Brexit. The GBP/USD currency pair fell amid a lack of significant releases from the UK docket and was fueled by the much stronger greenback. The GBP/USD currency pair today fell from a high … “Pound Falls to New 2020 Lows as the Dollar Hits Multi-Month Highs”

US Dollar Gains After Positive Economic Reports

The US dollar rallied today following better-than-expected macroeconomic releases in the United States. Now, traders wait for tomorrow’s nonfarm payrolls. The major piece of news today was the tariff cut by China on $75 billion worth of US goods. Tariffs of 10% on some goods will be reduced to 5%, and 5% tariffs will be reduced to 2.5%. The retaliatory tariffs, implemented in response to the similar levies slapped by the United States on Chinese imports, were … “US Dollar Gains After Positive Economic Reports”

Czech Koruna Rallies After Interest Rate Hike

The Czech koruna rallied today after the nation’s central bank surprised markets, raising interest rates despite the threat of a global economic slowdown. Currently, the currency has backed off from the day’s highs but is still trading above the opening level. The Czech National Bank boosted its benchmark interest rate by a quarter of a percentage point to 2.25%. Other interest rates were lifted as well. The decision surprised market participants. … “Czech Koruna Rallies After Interest Rate Hike”

Chinese Yuan Rebounds on Expected Stimulus, Cut in Tariffs

The Chinese yuan is rebounding on Thursday as reports suggest that the central bank will unleash additional stimulus to contain the Wuhan coronavirusâ impact on the worldâs second-largest economy. While the death toll and number of confirmed cases have risen in China, global financial markets believe that the outbreak is waning. These reports come as Beijing is set to cut tariffs on US goods and report crucial trade data on Friday. According to Reuters, … “Chinese Yuan Rebounds on Expected Stimulus, Cut in Tariffs”

Euro Flat-to-Higher Despite Slump of German Manufacturing Orders

The euro was flat today and even gained on some of its rivals despite the slump of German manufacturing orders. The likely reason for the decent performance was the positive market sentiment. The Federal Statistical Office reported the German manufacturing orders dropped by 2.1% in December from the previous month. The actual reading was far worse than an increase of 0.6% predicted by analysts. On a more positive note, the previous month’s decline got a revision from 1.3% … “Euro Flat-to-Higher Despite Slump of German Manufacturing Orders”

NZ Dollar Little Changed After Mixed Employment Data

The New Zealand dollar was little changed today as local markets were closed for a holiday. The currency did not show a clear trend yesterday either after the release of mixed employment data in New Zealand. Statistics New Zealand reported that the number of employed people remained unchanged in the December quarter of 2019 versus expectations of a 0.3% increase. Employment grew by 0.2% in the previous three months. The unemployment rate fell from 4.1% … “NZ Dollar Little Changed After Mixed Employment Data”

Australian Dollar Strongest, Rising for Fourth Session

The Australian dollar was the strongest currency on the Forex market today, rallying for the fourth consecutive day thanks to the improving investors’ sentiment. The currency managed to rally even though domestic macroeconomic data failed to meet expectations for the most part. The Wuhan coronavirus continues to spread as the number of confirmed cases in China climbed by 3694 to 28018, while the death toll increased by 73 to 563. Yet it looks like investors hope that the measures to contain … “Australian Dollar Strongest, Rising for Fourth Session”

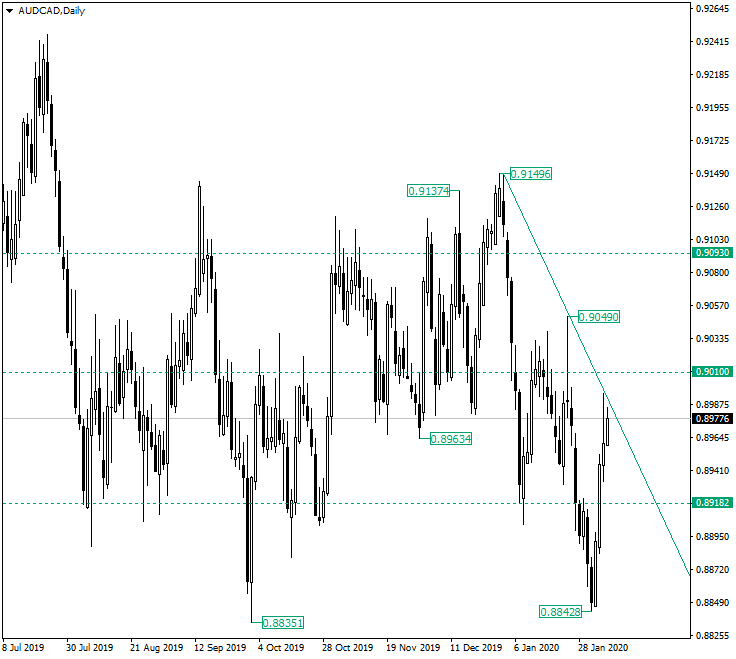

Trendline on AUD/CAD May Send It to 0.8918

The Australian dollar versus the Canadian dollar currency pair is at a very interesting spot. Long-term perspective After printing the high of 0.9149, the price retraced under the 0.9093 resistance level and continued a descent that pierced the potential support of 0.9010 and extended all the way to 0.8918. From 0.8918 an appreciation commenced, one that tried to conquer 0.9010, but ended up confirming it as resistance. In the process, a false piercing of the 0.9010 level took … “Trendline on AUD/CAD May Send It to 0.8918”

US Dollar Rises on Decline in Trade Deficit, Jobs Data

The US dollar is rising midweek on strong economic data and the rebound in global financial markets. Despite the Wuhan coronavirus significantly affecting China and spreading to other countries, traders are confident that the outbreak will be contained. The greenback is mirroring its performance from early last year as it is already up close to 2% so far in 2020. According to the Bureau of Economic Analysis (BEA), the trade deficit jumped … “US Dollar Rises on Decline in Trade Deficit, Jobs Data”