The euro today fell against the US dollar earlier in the session and was on track to book a loss for the second straight session as the greenback rebounded. The EUR/USD currency pair sold off amid end of month/quarter outflows in favour of the dollar, which could see the pair close lower for the month. The EUR/USD currency pair today fell from an opening high of 1.1043 to a low of 1.0926 but had recovered most of its losses at the time of writing. Most … “Euro Falls Against US Dollar Due to Quarterly/End-Month Outflows”

Month: March 2020

Chinese Yuan Jumps on Surprising Manufacturing Growth in March

The Chinese yuan is rallying against many currency competitors on Tuesday as the worldâs second-largest economy surprised global financial markets by reporting manufacturing growth in March. The yuan is also benefiting from additional easing efforts by the Peopleâs Bank of China (PBoC). According to the National Bureau of Statistics (NBS), the manufacturing purchasing managersâ index (PMI) surged from 35.7 in February to 52 in March. This beat market expectations of a 45 reading and is … “Chinese Yuan Jumps on Surprising Manufacturing Growth in March”

AUD/JPY at the 67.03 Resistance

The Australian dollar versus the Japanese Yen currency pair is being given a test by the 67.03 level. Long-term perspective The confirmation of the 76.01 level by the bears started a downwards movement that extended to as low as 59.87. But as the bears overextended, by departing too much and too fast from the important support of 64.12, the bulls saw the opportunity and sent the price back above it. After that, the buyers managed to bring the price to the next resistance area, … “AUD/JPY at the 67.03 Resistance”

Japanese Yen Gains As Abe Prepares for âBoldest-Everâ Stimulus

The Japanese yen is gaining against its biggest currency competitors to kick off the trading week as the nation braces for details surrounding the governmentâs âboldest-everâ stimulus package. Japanâs economic situation had been bearish prior to the coronavirus pandemic, but the outbreak has negatively affected the worldâs third-largest economy. With the Tokyo Olympic Games postponed until the end of July, it is unclear how Japan can avoid slipping into … “Japanese Yen Gains As Abe Prepares for âBoldest-Everâ Stimulus”

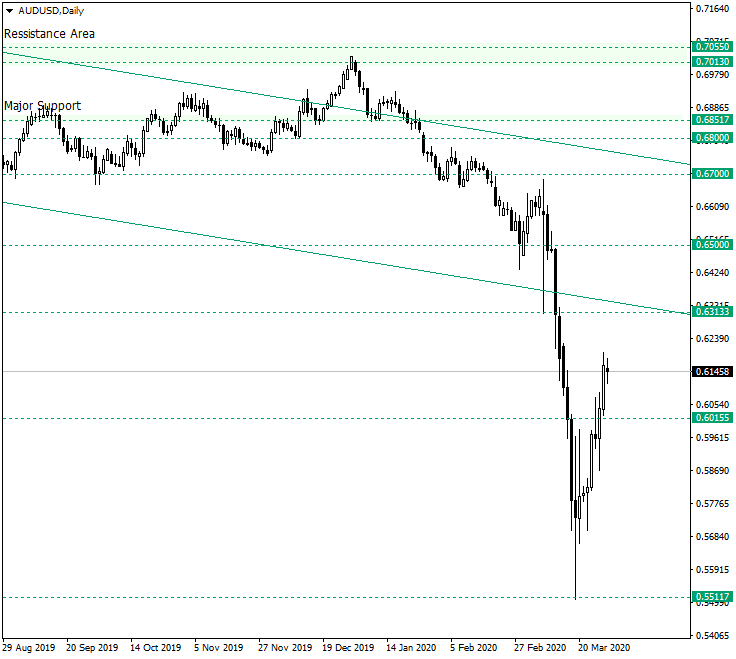

Can AUD/USD Recover 0.6313?

The Australian dollar versus the US dollar currency pair seems to be in bullish hands. Are the bears just around the corner? Long-term perspective After the Head and Shoulders with the neckline at the 0.6851 major support level played out, the price depreciated in a very pronounced manner, extending until the level of 0.5511. From there, a retracement equally as strong as the depreciation manifested itself, leading the price above the 0.6015 level. In one scenario, the price could … “Can AUD/USD Recover 0.6313?”

Canadian Dollar Weakens As BoC Imposes Emergency Interest Rate Cut

The Canadian dollar is weakening against many currency rivals to finish out the trading week. Following a week of modest gains, the loonie is falling on the central bank announcing an emergency cut to interest rates as the economy gets battered by coronavirus outbreak and tumbling energy prices. For the second time in less than a month, the Bank of Canada (BoC) made an unscheduled reduction to its benchmark interest rate in response to the COVID-19 pandemic. The central bank lowered … “Canadian Dollar Weakens As BoC Imposes Emergency Interest Rate Cut”

TopBrokers.com Portal Creates a Section About US Forex Companies

The U.S. dollar is the most traded currency globally, taking up over 80% of the trading volume. If you are a trader or investor residing in the U.S., you’ve probably gained an interest in trading the USD because of it being the most liquid currency. However, you might have noticed there are only a few … “TopBrokers.com Portal Creates a Section About US Forex Companies”

Euro Falls After 4-Day Rally Amid Rising European Coronavirus Cases

The euro today fell against the US dollar as traders took their profits following 4-day rally marked by steady gains driven by positive investor sentiment. The EUR/USD currency pair headed lower as the greenback rallied higher amid rising coronavirus cases and deaths in Spain and Italy. The EUR/USD currency pair today fell from a high of 1.1086 in the … “Euro Falls After 4-Day Rally Amid Rising European Coronavirus Cases”

Japanese Yen Flat-to-Higher as Coronavirus Continues to Spread

The Japanese yen was trading either flat or higher against its most-traded rivals today as the coronavirus pandemic continued to spread across the world, causing panic and expectations of a global economic recession. While it looks like China has managed to successfully halt the spread of the COVID-19 disease, the situation in other countries worsens every day. UK Prime Minister Boris Johnson entered self-isolation after testing positive for the coronavirus. Meanwhile, the United … “Japanese Yen Flat-to-Higher as Coronavirus Continues to Spread”

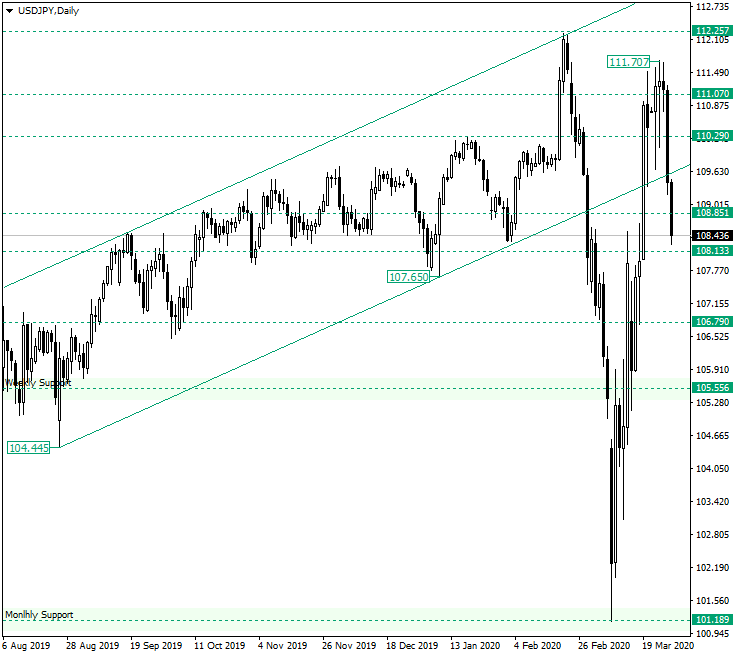

USD/JPY Dropped from 111.70

The US dollar versus the Japanese yen currency pair stalled around the 112.00 psychological level. Is this only a correction? Long-term perspective After confirming the monthly support of 101.18, the price rallied all the way up to the 111.07 level, peaking at the 111.70 high. The rally also took the price back into the ascending channel, whose support trendline starts from the 104.44 low. This led to the bulls hoping that, after a corrective … “USD/JPY Dropped from 111.70”