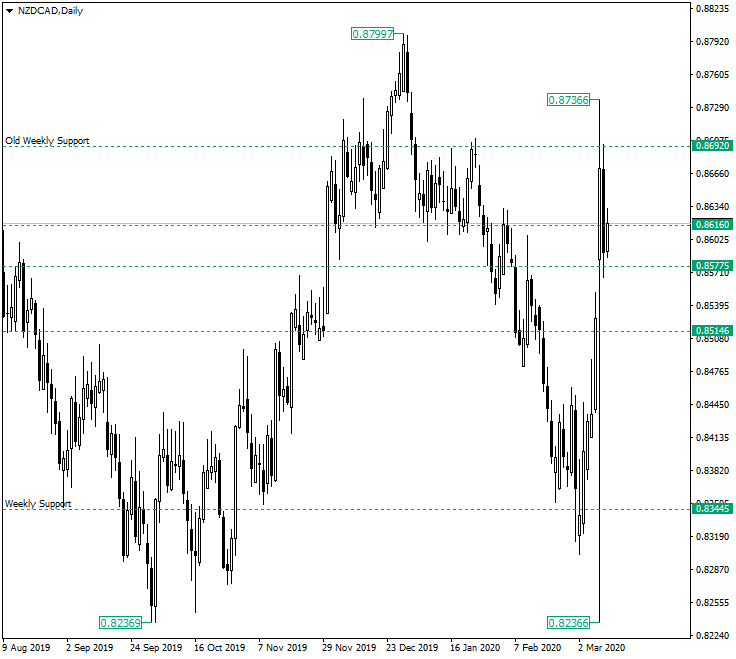

The New Zealand dollar versus the Canadian dollar currency pair sits just above the neckline level of the head & shoulders that started the year and fueled the strong depreciation that followed. Might it happen again?

Long-term perspective

The peak of 0.8799 marks the height of the head and shoulders pattern. The chart formation, after its neckline at 0.8616 was pierced and confirmed as resistance, allowed the bears to push the prices to the weekly support of 0.8344.

At the beginning of this week, the price printed the low of 0.8236 and then sharply recovered, peaking at 0.8736, but retracing beneath the important level of 0.8692, which is an old weekly ex-support.

The candle of March 10, respected some important reference points, its low being limited by 0.8577, and the high by 0.8692. However, its body almost engulfs the body of the previous candle, the one with the lower tail extending to as low as 0.8236, respectively.

In this context, if the price confirms 0.8616 as resistance, then a new depreciation might be expected. This would target 0.8577, followed by 0.8514.

However, the retracement afferent to the candle on March 10, could be a sign that the bulls are recharging, preparing for a new upwards leg. As a consequence, if the bulls manage to conquer the old neckline at 0.8616, then the level of 0.8692 could be challenged. If 0.8692 does not give way, then a consolidation period, market by 0.8692 as resistance and 0.8616 as support, might be underway.

Short-term perspective

After the strong pullback from 0.8239, a consolidation phase emerged, lined up by the resistance of 0.8716 and support of that corresponds to the psychological level of 0.8600.

If 0.8600 gets confirmed as resistance, then 0.8516 can become a target, being followed by 0.8417. On the other hand, if 0.8600 is only falsely pierced, then the price could extend until 0.8716.

Levels to keep an eye on:

D1: 0.8616 0.8577 0.8514 0.8692

H4: 0.8600 0.8516 0.8417 0.8716

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.