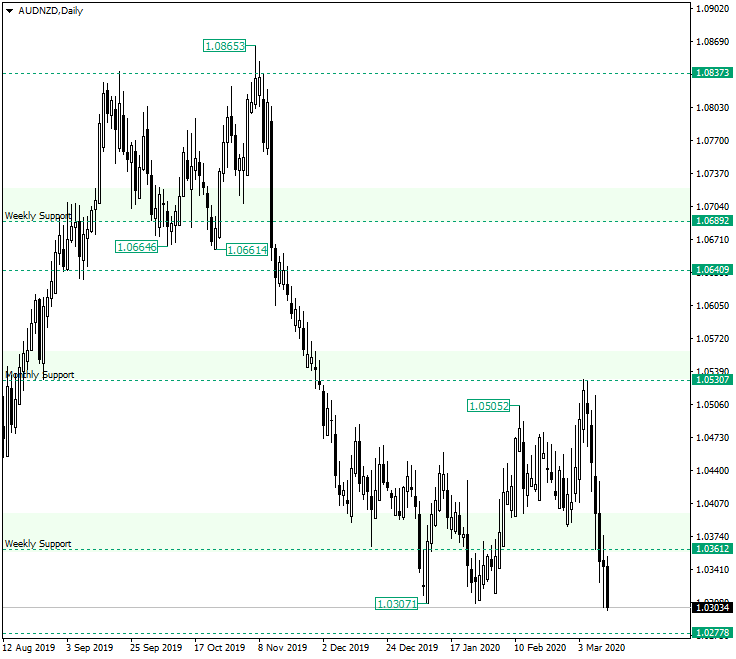

The Australian dollar versus the New Zealand dollar currency pair slid under the important support area of 1.0361. Will the previous lows hold afresh?

Long-term perspective

The depreciation that started after the level of 1.9837 was confirmed as resistance reached the weekly support of 1.0361. In January, the first bearish attempts were visible, as the low of 1.0307 was printed.

After two unsuccessful attempts to stabilize the price under 1.0361, the bears decided to pull back, allowing the bulls to etch the high of 1.0505 and then reach the old weekly support of 1.0530.

But as soon as 1.0530 was reached, the bears made their presence felt again, causing a sharp drop that sent the price under 1.0361 and challenges the previous low at 1.0307.

Being a movement that started at an important level (1.0530) and crossed another important one (1.0361, respectively), it is important — from the bearish perspective — not to overextend. In other words, a throwback that confirms 1.0361 as resistance would be a technical expectation. Such unfolding makes 1.0277 a prime target, with 1.0191 — not highlighted on the chart — following.

Of course, the throwback can also take the form of a consolidation phase that materializes under 1.0307. For such a scenario, the level of 1.0277 could play a good role as support, allowing a later piercing that will head on for the next support level, 1.0191, respectively — not highlighted on the chart.

Only if the bulls manage to pull it off again and reconquer 1.0361, then the profile switches to a bullish one.

Short-term perspective

From the resistance of 1.0534, the price is in a descending movement, marked by the trendline. As long as the price remains under the trendline, further movement towards the south is to be expected, with 1.0282 being the first target.

The fall may be halted if the double resistance — made possible by the trendline and the level of 1.0332 — is pierced and confirmed as support. In such a scenario 1.0362 becomes the first target.

Levels to keep an eye on:

D1: 1.0361 1.0277 1.0191

H4: 1.0332 1.0362 1.0368

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.