The Sterling pound today rallied higher against the US dollar driven by the dominant risk-off market sentiment, which triggered a sell-off in the greenback. The GBP/USD currency pair today rallied higher as investors reacted to the Bank of England‘s latest monetary policy decisions. The GBP/USD currency pair today rallied from a low of 1.1818 in the early London session to a high of 1.2181 in the American session and was near these highs at the time of writing. The currency pair traded … “Pound Rallies on Upbeat Sentiment and Hawkish BoE Rate Decision”

Month: March 2020

US Dollar Falls Amid Record 3.28 Million Initial Jobless Claims

The US dollar is sliding against multiple currency rivals on Thursday, but it is holding relatively steady. This might come as a surprise for market observers because the greenback and the broader financial market should be in freefall following record-breaking jobs numbers. It is the opposite. According to the Bureau of Labor Statistics (BLS), initial jobless claims soared to an all-time high of 3.283 million for the week ending March 21. This is … “US Dollar Falls Amid Record 3.28 Million Initial Jobless Claims”

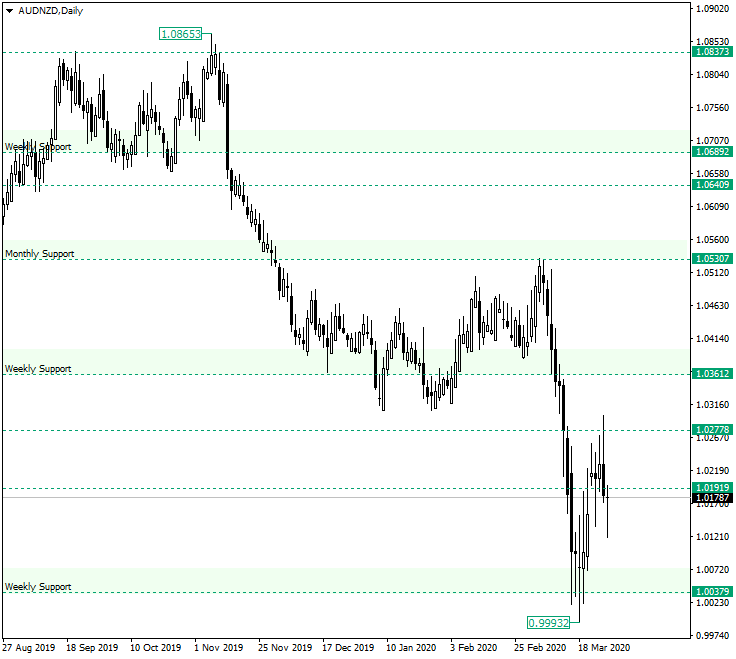

AUD/NZD Still Thinking at the 1.0200 Handle

The Australian dollar versus the New Zealand dollar currency pair seems to be undecided concerning what path to take. Long-term perspective After confirming the monthly support of 1.0530 as resistance, the price dropped until the weekly support of 1.0037, printing the low at 0.9993 and then retracing. The retracement got quite close to the next weekly support, 1.0361, respectively, but on March 25, the bears pushed the price lower, causing the candle to close under the intermediary … “AUD/NZD Still Thinking at the 1.0200 Handle”

Chinese Yuan Weakens As PBoC Mulls Additional Monetary Stimulus

The Chinese yuan is weakening against most major currency rivals midweek as reports suggest that the Peopleâs Bank of China (PBoC) is considering a reduction in interest rates that financial institutions are required to pay depositors. Analysts are still bearish on the worldâs second-largest economy, warning of double-digit economic contraction in the first quarter of 2020. Will the central bank implement more monetary stimulus measures? As China hits the reboot button … “Chinese Yuan Weakens As PBoC Mulls Additional Monetary Stimulus”

US Dollar Slips As $2 Trillion Stimulus Package Nears Agreement

The US dollar is continuing its streak of losses midweek as the federal government prepares to pass the $2 trillion stimulus package, which has sparked a rally in equities for two straight sessions. With a heightened risk appetite, investors are pouring into riskier currencies after liquidating everything to buy the greenback throughout the market turmoil. Is the buck set to plunge even further? On Tuesday evening, the White House and Senate struck a deal … “US Dollar Slips As $2 Trillion Stimulus Package Nears Agreement”

Euro Rallies on US Stimulus Package Despite Weak German IFO Data

The euro today rallied higher against the US dollar driven by the markets higher risk appetite after the US Senate agreed on a multi-trillion stimulus package. The EUR/USD currency pair’s gains were also helped in part by the easing demand for the US dollar after the Federal Reserve provided swap lines for the currency. The … “Euro Rallies on US Stimulus Package Despite Weak German IFO Data”

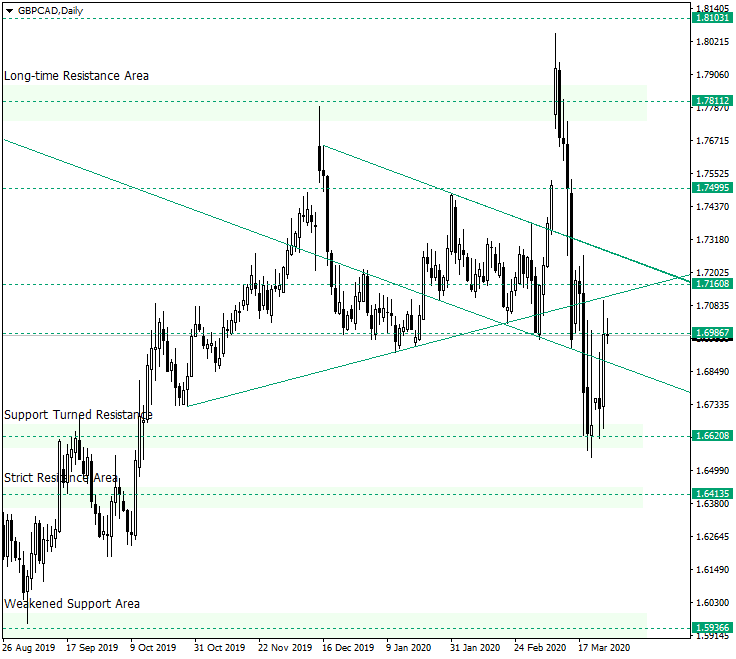

GBP/CAD May Target 1.7160

The Great Britain pound versus the Canadian dollar currency pair managed to appreciate from 1.6620. Would the pair be able to sustain the gains? Long-term perspective The false piercing of the long-time resistance area represented by the level of 1.7812 sent the price in a spiral, thus reaching the next important zone, 1.6620, respectively. But from there, the price retraced all the way to 1.6986. By doing so, it also reentered into the descending channel, but … “GBP/CAD May Target 1.7160”

Swiss Franc Extends Fall Against US Dollar on SNB Interventions

The Swiss franc is slumping on Tuesday as the central bank continues to intervene in foreign exchange markets and control the value of the currency. Despite being a conventional safe-haven asset for global investors, the francâs appeal might diminish as the nation potentially slips into a recession. Last week, the Swiss National Bank (SNB) confirmed that it would escalate its foreign currency acquisitions to prevent the further rise in the franc. With the COVID-19 global pandemic decimating … “Swiss Franc Extends Fall Against US Dollar on SNB Interventions”

Pound Rallies on Upbeat Sentiment Despite Mixed UK PMI Prints

The pound Sterling today posted gains against the US dollar ignoring the weak UK PMI data points released by Markit Economics in the early Londo session. The GBP/USD steadily inched higher from the new multi-year highs posted on Last week as the British government’s lockdown measures had a positive impact on investor sentiment. The GBP/USD … “Pound Rallies on Upbeat Sentiment Despite Mixed UK PMI Prints”

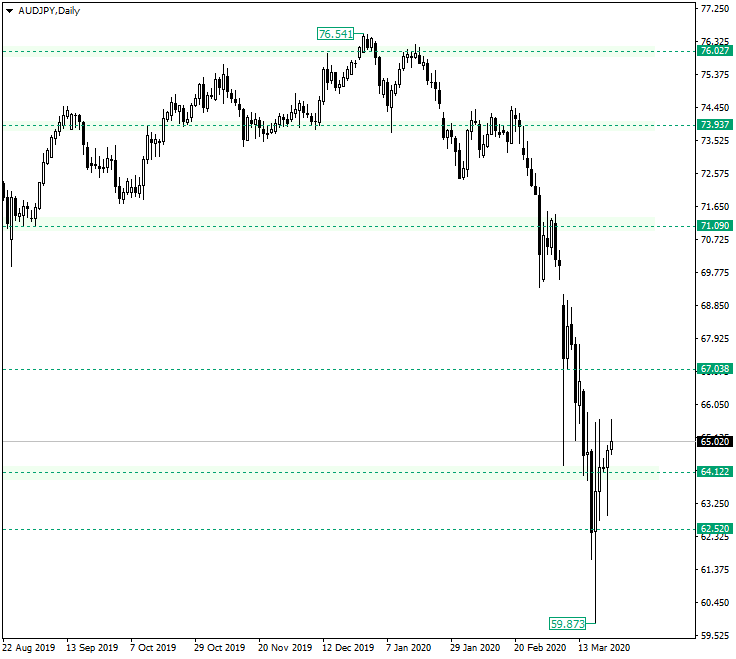

AUD/JPY Could Reach 67.03

The Australian dollar versus the Japanese yen currency pair may be heading towards the north. Is this just a bearish opportunity to get better shorting prices? Long-term perspective From the peak of 76.54, after the price confirmed 76.02 as resistance, a strong depreciation took place, one that crossed important support levels without much difficulty. The fall was so pronounced that, aside from gapping, it printed the low … “AUD/JPY Could Reach 67.03”