The British pound today fell against the much stronger US dollar as markets waited for a fiscal stimulus package to be announced by the US government. The GBP/USD currency pair was also weighed down by British politics as the government gave up its massive majority in a crunch vote on Huawei. The GBP/USD currency pair today fell from an initial high of 1.3088 to a low of 1.2899 in the … “Pound Falls on UK Politics and US Fiscal Stimulus Expectations”

Month: March 2020

US Dollar Rallies As Equities Bounce Back, Business Optimism Jumps

The US dollar is rallying against several currency competitors on Tuesday as the stock market bounces back following Black Monday 2020. But is the spark triggered by central bank stimulus and expected cuts to interest rates at next weekâs policy meeting or is it a dead cat bounce. Where does the greenback go from here? Financial markets are trying to pare Mondayâs steep losses. The Dow Jones, the S&P 500, … “US Dollar Rallies As Equities Bounce Back, Business Optimism Jumps”

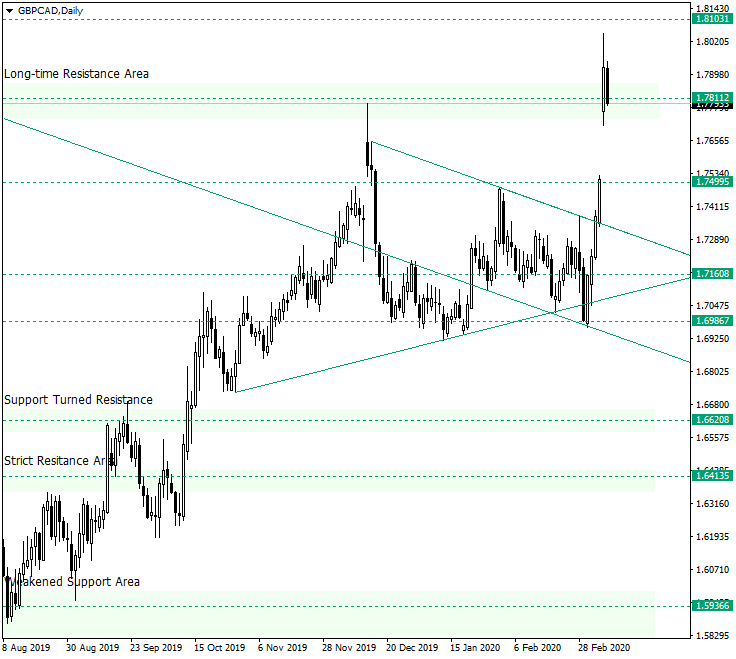

GBP/CAD Jumps Back Above 1.7811

The Great Britain pound versus the Canadian dollar currency pair gapped above the important long-time resistance area of 1.7811. Long-term perspective After confirming the weakened support area of 1.5936, the price started to move upward, passing two important levels, 1.6413 and 1.6620, respectively and confirming 1.7811 as resistance. After that, it went into a consolidation phase that began to look very alike a symmetrical triangle but towards its end … “GBP/CAD Jumps Back Above 1.7811”

Euro Inches Higher on Coronavirus Fears and Global Equities Sell-Off

The euro today traded in a wide range against the US dollar with a slightly bullish bias as markets reeled from the spreading coronavirus outbreak and the crash in oil prices. The EUR/USD currency pair today traded with a bullish bias as bears fought for control amid a major sell-off in global equity markets. The … “Euro Inches Higher on Coronavirus Fears and Global Equities Sell-Off”

Japanese Yen Soars As Investors Flee to Safe-Haven Assets

The Japanese yen is soaring against multiple currency rivals to kick off the trading week as investors are fleeing to traditional safe-haven assets amid the market crash. With the major leading stock indexes worldwide posting steep losses, traders are buying the yen, despite the disappointing economic data. Will the yen be the best performing currency in the first quarter? While Covid-19 is still lingering in the background, the main headline at the opening … “Japanese Yen Soars As Investors Flee to Safe-Haven Assets”

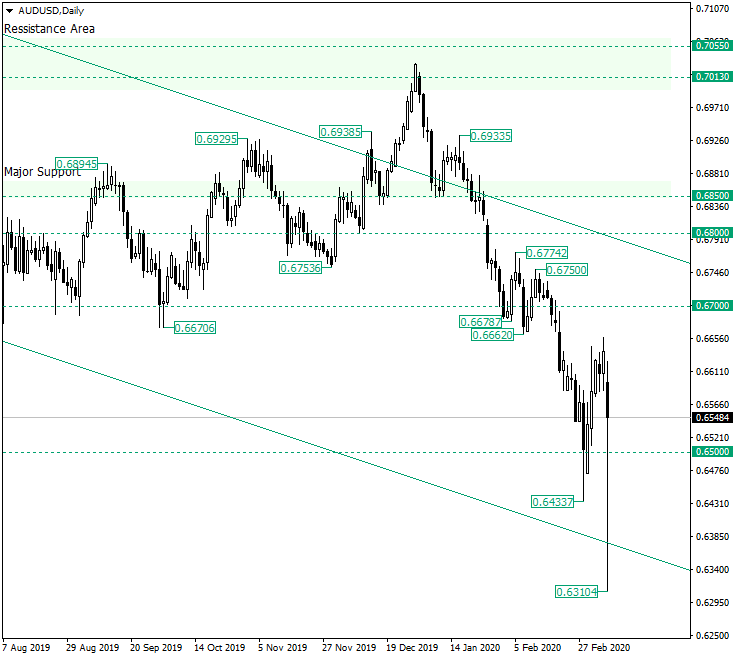

AUD/USD Plunged to 0.63 and Recovered. What Now?

The Australian dollar versus the US dollar currency pair depreciated strongly. Will the recovery last? Long-term perspective After confirming the double resistance area marked by the levels of 0.7055 and 0.7013, respectively, the price formed a head and shoulders pattern that favored a return inside the descending channel. Once back in the channel, the bears pushed the price lower and lower, disengaging the supportive role of 0.6700 and piecing the 0.6500 psychological level. But the 0.6500 was backed … “AUD/USD Plunged to 0.63 and Recovered. What Now?”

Japanese Yen Strong as Coronavirus Panic Persists

The Japanese yen was among the strongest currencies on the Forex market today, rising against almost all of its major peers, though not against the Swiss franc, another refuge currency, and the surprisingly strong New Zealand dollar. The worsening coronavirus pandemic was driving investors to safer assets, including the yen. Domestic macroeconomic reports were mixed, giving no reason for the currency to move in any particular direction. It looks like … “Japanese Yen Strong as Coronavirus Panic Persists”

Euro Gains on German Factory Orders, US Dollar’s Woes

The euro fell against safer currencies, like the Swiss franc and the Japanese yen, but gained on other most-traded rivals, including the US dollar, the Great Britain pound, and commodity currencies. Surprisingly, that did not include the New Zealand dollar, which turned out to be one of the strongest currencies during Friday’s trading session. German factory orders were arguably the most important economic release in the eurozone today. According to data … “Euro Gains on German Factory Orders, US Dollar’s Woes”

Australian Dollar Soft on Market Sentiment, Weak Economic Data

The Australian dollar was soft today. While it managed to gain on the US and Canadian dollars, the Aussie fell against other most-traded currencies. It declined even against its New Zealand counterpart, which is also considered riskier commodity currency. The market sentiment remained in a risk-off mode, weighing on Australian currency, and Australia’s macroeconomic releases were not helping either. The Australian Bureau of Statistics reported that retail sales … “Australian Dollar Soft on Market Sentiment, Weak Economic Data”

Canadian Dollar Gains on Upbeat Jobs Report, Falls on Russian Oil News

The Canadian dollar today posted gains against the US dollar after the release of upbeat Canadian employment data in the early American session. The USD/CAD currency pair alternated between gains and losses, given that both the loonie and the greenback were weak overall. The USD/CAD currency pair today traded in a wide range marked by a low of 1.3379 and a high … “Canadian Dollar Gains on Upbeat Jobs Report, Falls on Russian Oil News”