The US dollar is mixed against several currency rivals to close out the trading week as a blend of strong February jobs data, the coronavirus, and financial market turmoil is causing widespread confusion. Will the greenback rebound or will it continue its fall? According to the Bureau of Labor Statistics (BLS), the US economy added 273,000 jobs in February, up from 225,000 in January. The market had forecast 175,000 new jobs. The unemployment … “US Dollar Uncertainty Despite Strong February Jobs Report, Trade Data”

Month: March 2020

Pound Rallies Against Weak US Dollar on Bullish BoE Stance

The Sterling pound today rallied higher against the much weaker US dollar as traders bought the pound given the Bank of England‘s bullish stance on interest rates. The GBP/USD currency pair rallied for the fourth consecutive session as the bearish sentiment towards the greenback persisted as US Treasury yields continue to fall. The GBP/USD currency … “Pound Rallies Against Weak US Dollar on Bullish BoE Stance”

USD/JPY Still to Tumble from 105.55?

The US dollar pound versus the Japanese yen currency pair continued the movement towards the south. Are there any chances for a pause? Long-term perspective The ascending trend that started from the low of 104.44 extended until the resistance level of 112.25. From there, after confirming the double resistance made possible by the upper line of the channel and the 112.25 level, the price started a depreciation. What initially seemed to be a corrective wave, that was … “USD/JPY Still to Tumble from 105.55?”

Euro Rallies as Coronavirus Fears in the US Push the Dollar Lower

The euro today rallied higher against the US dollar as authorities in California declared a state of emergency amid rising coronavirus cases. The EUR/USD currency pair benefitted from the risk-off investor sentiment and the greenback’s losses despite a mostly empty European docket. The EUR/USD currency pair today rallied from a low of 1.1119 in the early European session to a high of 1.1200 in the early American session despite the risk-off market mood. The currency pair traded sideways … “Euro Rallies as Coronavirus Fears in the US Push the Dollar Lower”

Japanese Yen Jumps on Safe-Haven Demand, Capped by Poor Data

The Japanese yen is strengthening against a handful of currency rivals on Thursday as investors pour into safe-haven assets amid the coronavirus outbreak. Japan, which has experienced an uptick in Covid-19 cases, reported disappointing manufacturing and non-manufacturing data that might force the country into a recession. The big test over the medium-term is if Tokyo … “Japanese Yen Jumps on Safe-Haven Demand, Capped by Poor Data”

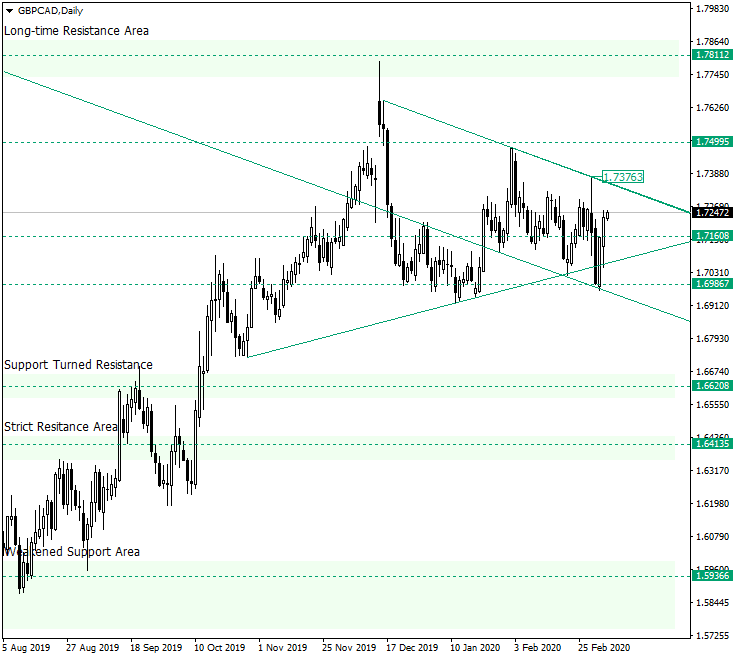

GBP/CAD Still Aiming for 1.7811

The Great Britain pound versus the Canadian dollar currency seems not to be willing to stray away from its path towards 1.7811. Long-term perspective After confirming the level of 1.5936, the price began an appreciation that, starting with late October 2019, seemed to form a symmetrical triangle. Usually, this chart pattern indicates a continuation, and because in the case of this chart it preceded by an upwards pointing movement, the expectations are for the continuation … “GBP/CAD Still Aiming for 1.7811”

Pound Falls Then Rallies on Weak UK Services PMI and BoE Rumours

The Sterling pound today traded lower against the US dollar earlier in the session as investors stayed away from the pound amid Brexit uncertainty and risk-off market sentiment. However, the GBP/USD currency pair later recovered despite the release of weak UK PMI data by Markit Economics amid rumours that the Bank of England would cut … “Pound Falls Then Rallies on Weak UK Services PMI and BoE Rumours”

Canadian Dollar Mixed As BoC Cuts Interest Rates Amid Covid-19 Fears

The Canadian dollar is trading mixed against multiple currency rivals midweek after the central bank delivered on a cut to interest rates. The Bank of Canada (BoC) joins a growing chorus of institutions that are slashing rates this week in response to the growing concerns over the economic fallout from Covid-19. Will it be enough to fight the outbreak or will more monetary easing be necessary? The BoC lowered rates by 50 basis … “Canadian Dollar Mixed As BoC Cuts Interest Rates Amid Covid-19 Fears”

Australian Dollar Rises for Third Day After GDP Beats Expectations

The Australian dollar continued to rise, logging a third consecutive daily gain. This time, it is easier to explain the currency’s rally as it followed the better-than-expected GDP print released during the trading session. Economic data from China, Australia’s biggest trading partner, was atrocious, but it had a little impact on the movement of the Aussie. The Australian Bureau of Statistics reported that gross domestic product rose by 0.5% in the December quarter … “Australian Dollar Rises for Third Day After GDP Beats Expectations”

Chinese Yuan Pauses After Huge Weekly Acceleration on Bearish Data

The Chinese yuan is hitting the pause button on its recent acceleration against several major currency rivals midweek as many economic reports portray a grim picture of the worldâs second-largest economy. All the data came in worse than what the market had forecast, and with the coronavirus still lingering, experts warn there might be plenty more bearish news in the coming months. The Caixin General Services purchasing managersâ index (PMI) … “Chinese Yuan Pauses After Huge Weekly Acceleration on Bearish Data”