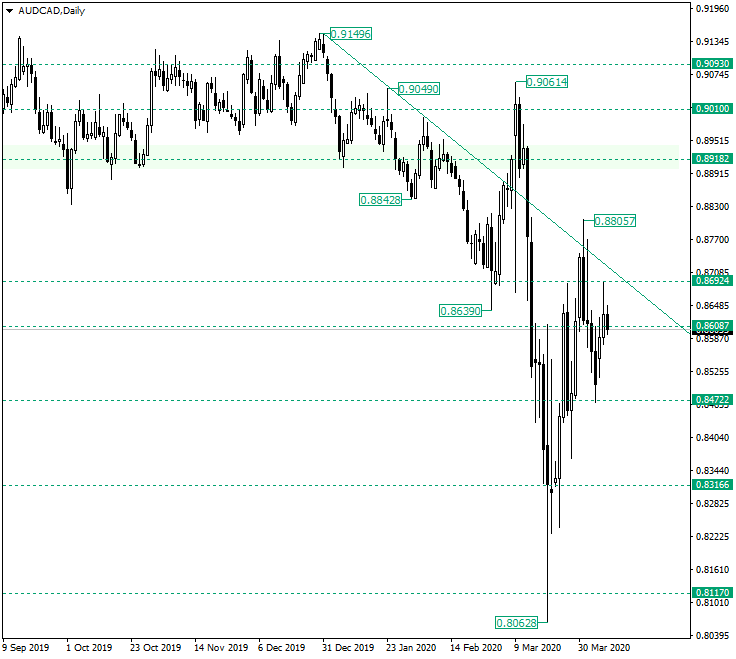

The Australian dollar versus the Canadian dollar currency pair got very close to an area that may decide the very fate of the pair for the medium-term, if not for the long-term?

Long-term perspective

The depreciation that started from the peak of 0.9149, after the confirmation of the 0.9093 level las resistance, extended all the way to 0.8062 low. After a sharp retracement, the price started an ascending and very volatile movement.

Even if it appears that the high of 0.8857 is a false piercing and, as a result, the price should start a new strong impulsive wave towards the south, the fact that the drop from 0.8857 ended with a higher high is a sign of pressure from the bulls.

Of course, at least for now, this does not mean that the double resistance made possible by the trendline and the 0.8692 level cannot stand in front of the buyers.

As a consequence, in the bullish scenario, the price breaks the aforementioned double resistance and heads for the next important area, 0.8918. This can come as a daily close above it or as an extension beyond it that then makes a throwback to confirm the level as support.

In the bearish scenario, the break of the double resistance is rendered as a false break or one does not happen at all. In this case, the bulls may still have the chance for a comeback from 0.8608. But if 0.8608 is confirmed as resistance, then 0.8472 becomes the first target.

Short-term perspective

The price corrected after the ascending movement that started at the 0.8466 support level. If, in the end, it manages to conquer 0.8694, then 0.8748 goes as the prime target, while 0.8801 is the next.

On the other hand, if 0.8694 remains resistance, then the price may end up in range trading, the support of which is 0.8610. Eventually, the bulls might continue the march towards the next two resistance levels.

On the other hand, if 0.8601 becomes resistance, then 0.8530 is the next support to be tested.

Levels to keep an eye on:

D1: 0.8692 0.8918 0.8608 0.8472

H4: 0.8694 0.8748 0.8801 0.8610 0.8530

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.