The US dollar versus the Japanese yen currency pair may have failed to win the bulls, after all?

Long-term perspective

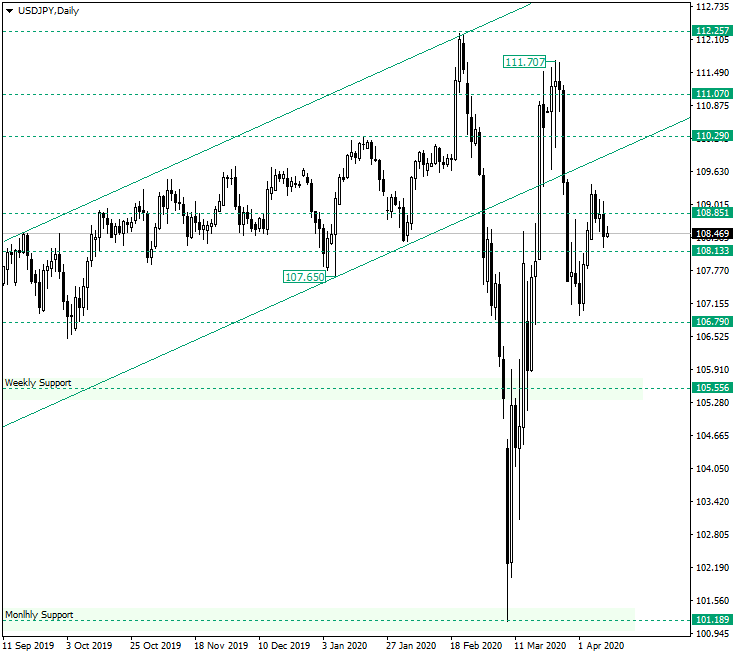

The appreciation that started after the confirmation of the 101.18 monthly support reached the 111.70 high. After that, a sharp decline almost touched the 106.79 support level, and then rallied again. But the price was not able to sustain the gains above the 108.85 level.

In this case, the bears are expected to keep pushing the price lower. So, the first scenario is the one in which the price consolidates above the 108.13 level. The consolidation may then lead the a break of the level which is to be fallowed by the decline that targets 106.79.

Another possibility is to see the bears continuing their current endeavors and, as a result, the price getting beneath 108.13. A daily close under this level can then be followed by a short-lived throwback that confirms the level as resistance. The target, in this case, is the same 106.79 level.

The only scenarios that can save the bulls now are either a false piercing of 106.79, or a confirmation of 108.85 as support. If the bulls mange to pull this out, then their first target would be 110.29.

Short-term perspective

The price is testing the double support made possible by the ascending trendline and the 108.43 level. If the buyers manage to craft another advancement from this area, then 109.19 would be their first target which, if passed, opens the door to the important level of 109.75.

But if the double support gives way, then the bears could extend all the way to 105.66, which is their main target. Along the way, the intermediary levels of 107.92 and 107.06, respectively, could play the role of partial profit parking.

Levels to keep an eye on:

D1: 108.13 106.79 110.29

H4: 108.43 109.19 109.75 107.92 107.06 105.66

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.