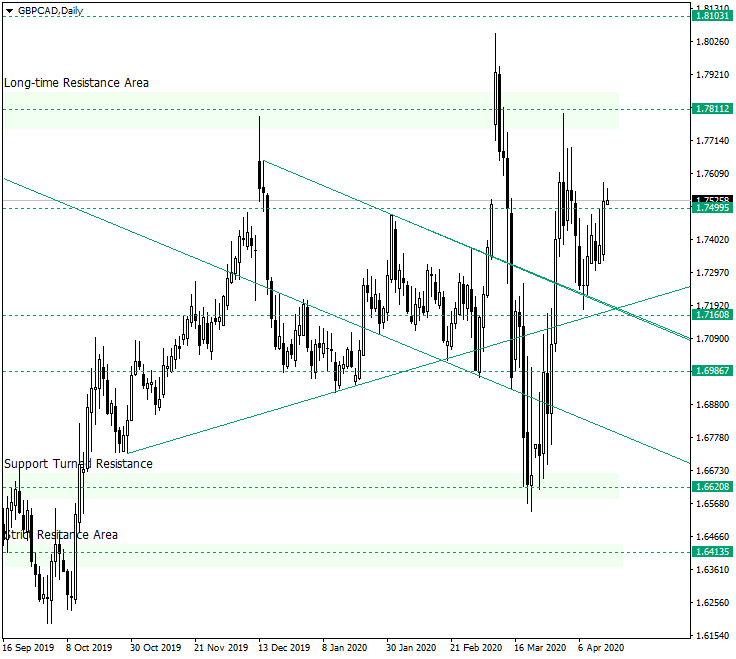

The Great Britain pound versus the Canadian dollar currency pair does seem that it is hard to sell.

Long-term perspective

The appreciation from the 1.6620 level extended to the resistance area defined by the 1.7811 resistance level. The price then head towards the, now, triple support area made possible by the 1.7160 level, the ascending trendline, and the upper line of the descending channel, respectively.

After the confirmation, the price had some trouble passing over the 1.7499 resistance level, but on April 14 it succeeded in closing the day above it.

Even if in itself the closing of the candle overhead the level is not such an important bullish signature, as the price closed similarly on April 1 and did not manage to keep the gains, the context in which this event occurred, gives an edge to the bulls.

So, the fact that the price confirmed a triple support area and then went past the bearish guarded level of 1.7499, contributes to a strong bullish determination.

So, as long as the price does not slip under the 1.7499 level — or it does it only for a brief time, thus rendering it as a false bearish break — 1.7811 remains the prime target.

Short-term perspective

The price is in an ascending trend that started from the low of 1.7180 and extended until 1.7580.

Even if the level of 1.7481 played the role of a resistance, and thus caused the first correction, now it has been turned support.

So, as long as 1.7481 keeps its role, the level of 1.7609 is the first target. Even if 1.7481 gives way, the lower line of the ascending channel can be a good starting point for a new appreciation.

If, later on, the level of 1.7609 becomes support, then the next target is represented by 1.7727.

Levels to keep an eye on:

D1: 1.7499 1.7811 1.7160

H4: 1.7481 1.7609 1.7727

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.