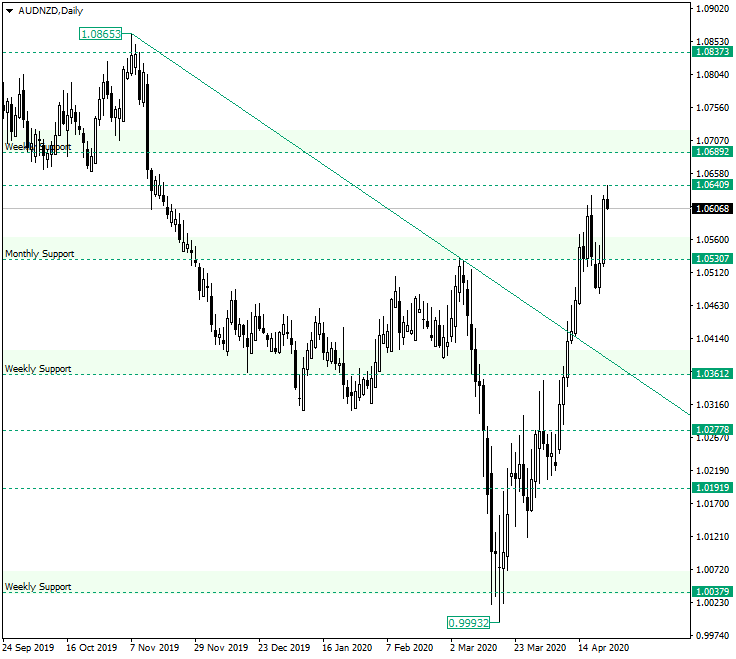

The Australian dollar versus the New Zealand dollar currency pair is in reach of the next major resistance level, 1.0689. Should the bulls have any concerns?

Long-term perspective

From the high of 1.0865, the price extended until the low of 0.9993, a low that confirmed the weekly support level of 1.0037. Being such an important level, it facilitated a rally strong enough to break, and depart from, the descending trendline that starts from the high.

On April 16, the bulls took head-on the next important area, the monthly level of 1.0530. Although the bears showed signs of unease, by fighting back and sending the price under the level on April 20, the bulls seized the situation and brought the price back above the level.

The fact that the bulls recuperated from the area of a monthly level and that they accomplished to extend the movement until the intermediary level of 1.0640, the profile is bullish.

As a consequence, as long as the bulls guard 1.0530, their main target remains 1.0689. On the other hand, if 1.0530 gets pierced, then only it being confirmed as resistance poses a problem for the bullish advancement. If this happens, then the bears could send the price back to 1.0361.

Short-term perspective

From the low of 1.0484, the price is in an ascending movement, one that peaked at 1.0641 and retraced from the level of 1.0635.

While the price sits above the trendline and confirms the double support made possible by it alongside with the 1.0589 level, the bulls should be well aligned with their plan of piercing 1.0635 and confirming it as support.

In such a scenario, the next objective for the buyers is represented by the 1.0709 level.

Only if the aforementioned double support gives way, then the sellers could stretch to 1.0534. From there, the bulls would still be in for another run. However, if the level is pierced and the price reaches the next one, the psychological 1.0500, respectively, then the bears would have reasons to drive the price even lower, with 1.0440 as their next aim.

Levels to keep an eye on:

D1: 1.0530 1.0689 1.0361

H4: 1.0589 1.0635 1.0709 1.0534 1.0500 1.0440

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.