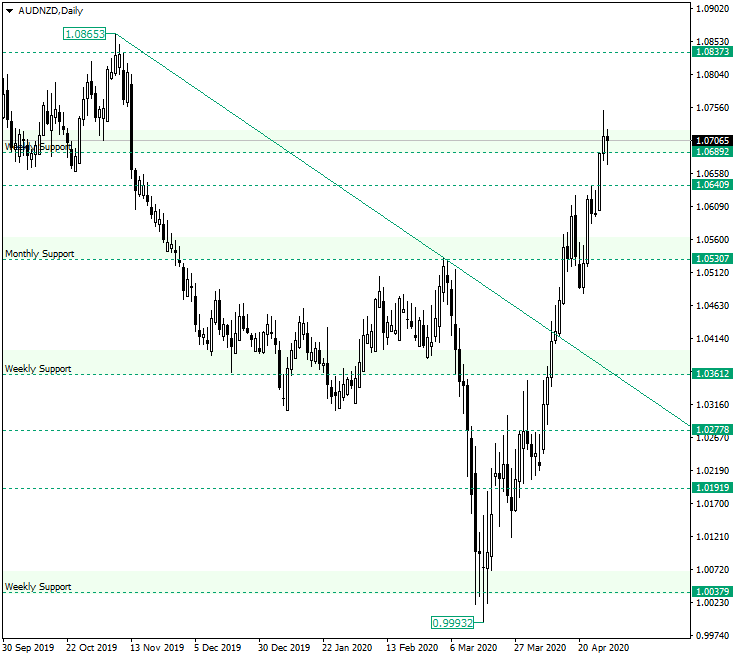

The Australian dollar versus the New Zealand dollar currency pair managed to get above the important old weekly support of 1.0689. Could the bears have anything prepared?

Long-term perspective

The rally that started from the low of 0.9993, after the weekly support of 1.0037 was confirmed, managed to evolve to an extent that brought the price above the trendline that starts from the 1.0865 high and also above the 1.0689 old weekly support.

Because of the importance of this area, as long as the price sits above the 1.0689 level the bulls can drive it even more towards the north. A first scenario, thus, is the one in which the price oscillates above the level. This could take the form of a short-lived consolidation phase, such as a pennant or a flag or of a broader one, like a rectangle.

In the case in which a rectangle does form, one possibility is for its support to be falsely pierced. Irrespective of which of these developments actually take place, the prime target for the buyer is 1.0837.

Another possibility is for the price to draw a retracement towards the 1.0640 level, the confirmation of which would render 1.0689 as the first target and 1.0837 as the second.

Only if 1.0640 fails to serve as support, may allow further continuation towards the monthly support of 1.0530.

Short-term perspective

The price is in an ascending trend that started from the low of 1.0484 and extended until the high of 1.0751.

From the high, it retraced, almost touching the trendline, after pushing upwards and beginning to oscillate around the 1.0709 level.

If the bulls succeed in confirming the 1.0709 level as support, then they could move on for 1.0807, which is their first target.

Even if the trendline gets invalidated, the next level, 1.0635, respectively, could serve as a starting point for a new bullish march. However, in this case, the bulls may target 1.0709 as a profit booking area, as the price could enter in a range limited by 1.0709 as resistance and 1.0635 as support.

Levels to keep an eye on:

D1: 1.0689 1.0837 1.0640 1.0530

H4: 1.0709 1.0807 1.0635

Tags:

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.