The Sterling pound today fell against the US dollar as investors reacted to weak service PMI released by Markit Economics in the early London session. The GBP/USD came under intense selling pressure as the greenback pressed higher despite yesterday’s record high US initial jobless claims numbers. The GBP/USD currency pair today fell from a high of 1.2395 during the late Asian session to a low of 1.2262 in the early European session and was headed … “Pound Falls on Weak UK Services PMI Report as Dollar Surges”

Month: April 2020

Euro Falls to New 5-Day Lows on Record Spanish COVID-19 Deaths

The euro today fell against the US dollar as deaths from the coronavirus in Spain reached new highs even as other European countries battle the disease. The EUR/USD currency pair today fell amid high demand for the dollar and the rising tensions in the European Union as Germany and Holland refuse to support Southern states. … “Euro Falls to New 5-Day Lows on Record Spanish COVID-19 Deaths”

US Dollar Holds Steady As Initial Jobless Claims Surge 6.6 Million

The US dollar is holding steady on Thursday after the federal government reported that initial jobless claims doubled week’s total and topped 6.6 million. The coronavirus pandemic continues to take a toll on a once robust and resilient labor market, and it is unclear as to when Americans will return to the workforce. Despite the federal government’s $2.2 trillion stimulus package that includes direct income support, how much longer can the world’s … “US Dollar Holds Steady As Initial Jobless Claims Surge 6.6 Million”

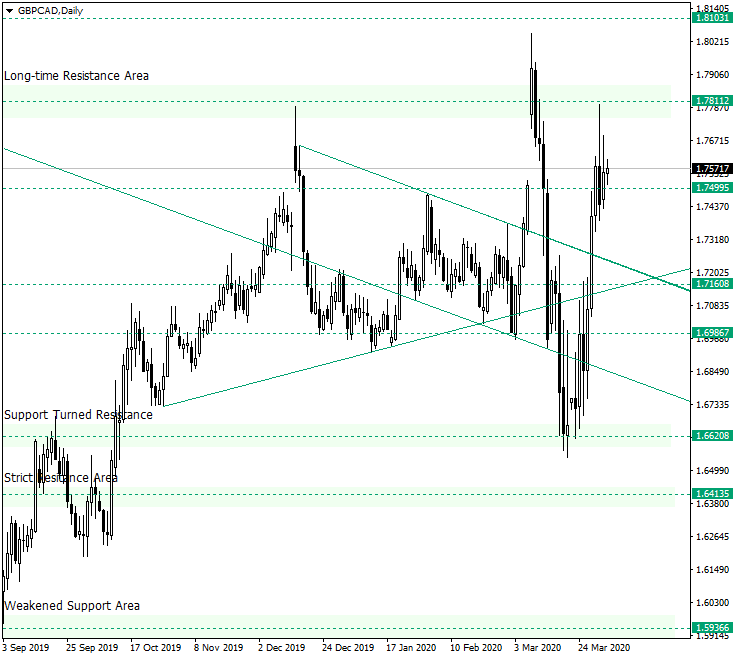

Could GBP/CAD Retest the 1.7811 Resistance?

The Great Britain pound versus the Canadian dollar currency pair may establish above the 1.7500 mark. Is this a bullish profile, or are the bears waiting for even better prices? Long-term perspective After the price was not able to maintain the gains above 1.7811, it strongly depreciated, reaching the important support area of 1.6620. However, this area, being packed with bulls, favored a strong appreciation, one that reached … “Could GBP/CAD Retest the 1.7811 Resistance?”

Pound Sidelined As UK COVID-19 Deaths Rise and Boris Self-Isolates

The pound today traded sideways against the US dollar extending its sideways trading range for the third day in a row as investors took a break following its recent massive rally. The GBP/USD currency pair rangebound trading action was also affected by the surge in UK coronavirus deaths as deaths jumped 31% to 563, hitting a cumulative total of 2,352. The GBP/USD currency pair today traded with a range marked by a low of 1.2331 and a high … “Pound Sidelined As UK COVID-19 Deaths Rise and Boris Self-Isolates”

Japanese Yen Strengthens on Better-Than-Expected Data, BoJ Stimulus

The Japanese yen is strengthening against different currency competitors midweek, buoyed by a plethora of economic data and outlooks that came in much better than initially anticipated. With the federal government set to unveil a comprehensive stimulus package to rescue the worldâs third-largest economy from the fallout of the coronavirus pandemic, the yenâs safe-haven appeal may stay intact. According to official state statistics, retail sales jumped 0.6% in February, down from the 1.5% … “Japanese Yen Strengthens on Better-Than-Expected Data, BoJ Stimulus”

Canadian Dollar Slips As Manufacturing PMI Contracts, GDP Slows

The Canadian dollar is slipping against its currency rivals midweek as new data is beginning to highlight how much damage the coronavirus is impacting the Great White North. Manufacturing contracted, the economy already showed signs of slowing down before the COVID-19 crisis, and producer prices slumped â this could be the start of even more negative economic readings in the weeks to come. The IHS Markit manufacturing purchasing managersâ index … “Canadian Dollar Slips As Manufacturing PMI Contracts, GDP Slows”

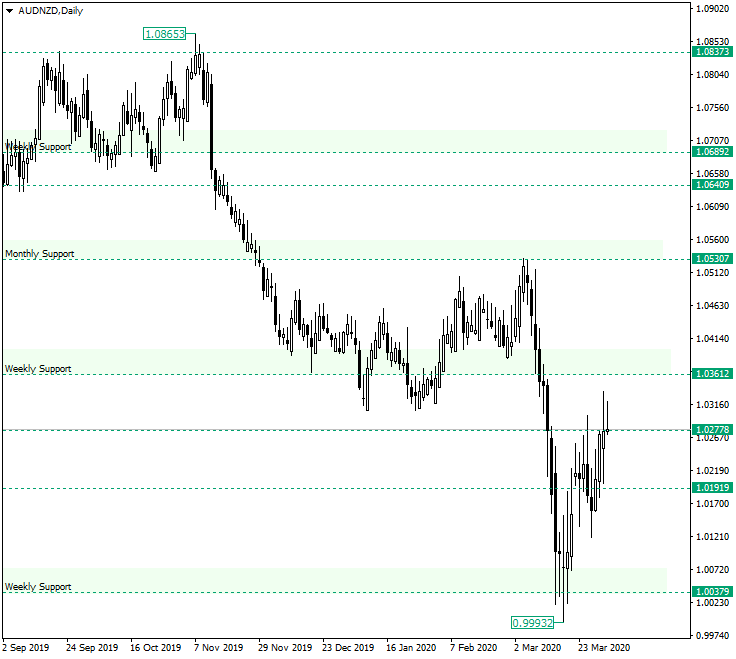

AUDNZD Heading Towards 1.0361

The Australian dollar versus the New Zealand dollar currency pair is approaching the important weekly level of 1.0361. Long-term perspective After confirming the level of 1.0837, the price started to decline. The first strong pullback occurred around the weekly support of 1.0037. But until here, the pierce passed important areas, such as the weekly support of 1.0361. The reconfirmation of the 1.0037 support — which printed the low of 0.9993 — brought about a rally that conquered the first … “AUDNZD Heading Towards 1.0361”