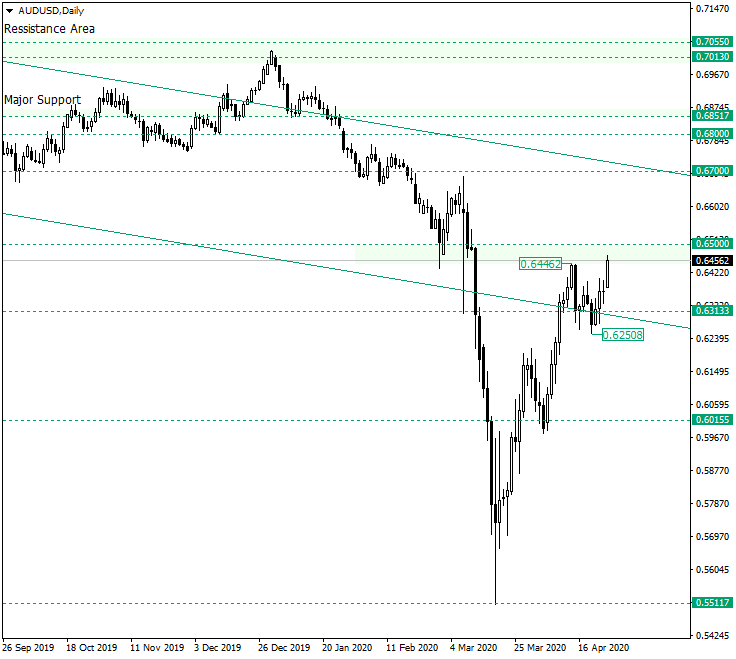

The Australian dollar versus the US dollar currency pair seems determined to conquer the 0.6500 level. Might this be the preparation for a bearish movement? Long-term perspective After retracing from the 0.5511 support level, the price confirmed the support of 0.6015. That confirmation etched a rally that peaked at 0.6446 and then retraced to the 0.6313, confirming the latter as support. The development that took place from 0.6015 could repeat from 0.6313. As a consequence, this … “Bulls on AUD/USD Eye the 0.6500 Psychological Level”

Month: April 2020

Japanese Yen Mixed After BoJ Expands Stimulus

The Japanese yen was mixed today after the Bank of Japan boosted measures to stimulate the national economy at today’s shortened one-day meeting. The currency fell against the Australian and New Zealand dollars as well as the Great Britain pound but managed to gain on the US dollar and the Swiss franc. The Bank of Japan announced that it is going to purchase as many government bonds as necessary to keep the 10-year bond yields at around zero percent, removing … “Japanese Yen Mixed After BoJ Expands Stimulus”

US Dollar Weakens After Crash in Durable Goods Orders

The US dollar is weakening against its major currency competitors to finish the trading week. While the greenback is on track for a weekly boost, the buck fell on the latest worse-than-expected economic data. The dollarâs descent on Friday could also be driven by inflation fears as the federal government approved another massive spending bill. According to the US Census Bureau, new orders for manufactured durable goods cratered 14.4% in March, which is the sharpest … “US Dollar Weakens After Crash in Durable Goods Orders”

Australian Dollar Falls Then Recovers Driven by Investor Sentiment

The Australian dollar today fell against the US dollar before recovering to trade at breakeven driven by positive investor sentiment and news events. The AUD/USD currency pair today rallied higher as investors bought the Aussie ahead of a gradual reopening of Australia’s economy. The AUD/USD currency pair today fell to a low of 0.6337 in the late Asian session before reversing … “Australian Dollar Falls Then Recovers Driven by Investor Sentiment”

Canadian Dollar Posts Gains as Oil Recovers and Trades Sideways

The Canadian dollar today extended its winning streak against the US dollar as the recovery in crude oil prices saw the US crude oil trading sideways in a tight range. The USD/CAD currency pair fell for the third consecutive session as crude oil prices recovered strongly from Monday’s crash despite concerns about global demand for the commodity. The USD/CAD currency pair today fell from a high … “Canadian Dollar Posts Gains as Oil Recovers and Trades Sideways”

Euro Mixed After Collapse of German Business Climate, EU Rescue Package Disagreement

The euro fell against the US dollar and the bigger-than-expected slump of the German business climate and the disagreement between the European Union members about how to tackle financial stimulus to the economy. Against other rivals the euro was mixed. The Ifo Business Climate Index plummeted from 96.0 in February to 86.1 in March, seasonally adjusted. It was the lowest level since June 2009. Furthermore, it was the steepest drop since German unification. The report … “Euro Mixed After Collapse of German Business Climate, EU Rescue Package Disagreement”

Great Britain Pound Soft After Retail Sales, Tries to Hold Ground

The Great Britain pound was soft today, erasing its earlier gains versus commodity currencies. The reason for the currency’s underwhelming performance was a worse-than-expected retail sales report. But the sterling did not perform particularly poorly despite the rather negative data and even managed to hold gains against a number of currencies, including the euro and the Swiss franc. Britain’s Office for National Statistics reported that retail sales slumped by 5.1% in March, … “Great Britain Pound Soft After Retail Sales, Tries to Hold Ground”

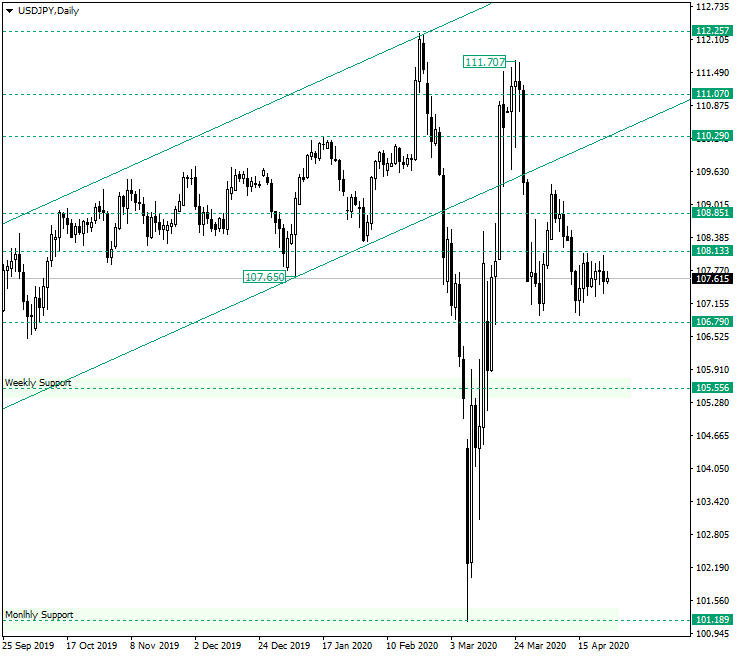

USD/JPY Just Under the 108.13 Resistance

The US dollar versus the Japanese yen currency pair sits in a consolidative phase. What may come after it? Long-term perspective The lift form the monthly support of 101.18 managed to extend until the 111.70 high. By doing so, it also reentered into the ascending channel that starts from the low of 104.44. But as the price failed to find support after the correction from the peak of 111.70, it dropped, yet again, under … “USD/JPY Just Under the 108.13 Resistance”

Japanese Yen Flat, Tries to Gain on Commodity Currencies

The Japanese yen was about flat versus major currencies today. The yen was trying to rise against commodity currencies but so far it had limited success. Negative domestic macroeconomic data and the rise of crude oil prices were working against the Japanese yen but the pessimistic mood, which persists among investors, was working in favor of the Japanese currency. The Statistic Bureau of Japan reported that the national core … “Japanese Yen Flat, Tries to Gain on Commodity Currencies”

Pound Rallies Despite Negative UK PMIs and High COVID-19 Cases

The British pound today rallied higher against the US dollar despite the release of disappointing UK PMI data by Markit/CIPS as traders remained bullish on the pound. The GBP/USD currency pair alternated between gains and losses as traders fought for control at a critical resistance level ignoring the fundamentals. The GBP/USD currency pair today rallied … “Pound Rallies Despite Negative UK PMIs and High COVID-19 Cases”