The US dollar is mixed against its most-traded currency competitors on Thursday after the government released a worse-than-expected jobless claims report. But the job-loss trend may have peaked after three consecutive weeks of falling numbers, leaving markets indifferent to the weekly figures. According to the Department of Labor, initial jobless claims clocked in at 4.427 million for the week ending April 18, worse than the median estimate of 4.2 million. This is … “US Dollar Mixed on Worse-Than-Expected Jobless Claims”

Month: April 2020

Euro Falls to Fresh Monthly Lows on Negative Euro Area PMIs

The euro today fell to new lows against the US dollar following the release of disappointing PMI data from across the euro area by Markit Economics. The EUR/USD currency pair crashed as traders reacted to the PMI prints that were lower than expected, reflecting the impact of the COVID-19 pandemic. The EUR/USD currency pair today … “Euro Falls to Fresh Monthly Lows on Negative Euro Area PMIs”

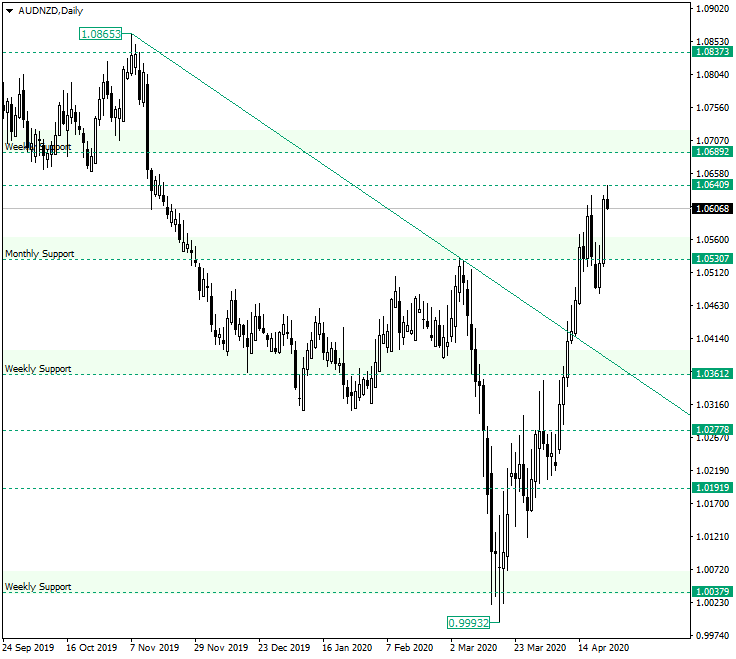

AUD/NZD Halfway to the Next Target

The Australian dollar versus the New Zealand dollar currency pair is in reach of the next major resistance level, 1.0689. Should the bulls have any concerns? Long-term perspective From the high of 1.0865, the price extended until the low of 0.9993, a low that confirmed the weekly support level of 1.0037. Being such an important level, it facilitated a rally strong enough to break, and depart from, the descending trendline that starts from the high. … “AUD/NZD Halfway to the Next Target”

Japanese Yen Mixed As BoJ Warns of Risks to Financial Stability

The Japanese yen is trading mixed against its most-traded currency rivals as the central bank is sounding the alarm on risks to financial stability in the wake of the coronavirus. This comes as the federal government has unleashed a massive stimulus package that extends a lifeline to consumers and the private sector, which is expected to weigh on Tokyoâs budget. With the country under a state of emergency and policymakers trying everything to stave off a recession, what else could … “Japanese Yen Mixed As BoJ Warns of Risks to Financial Stability”

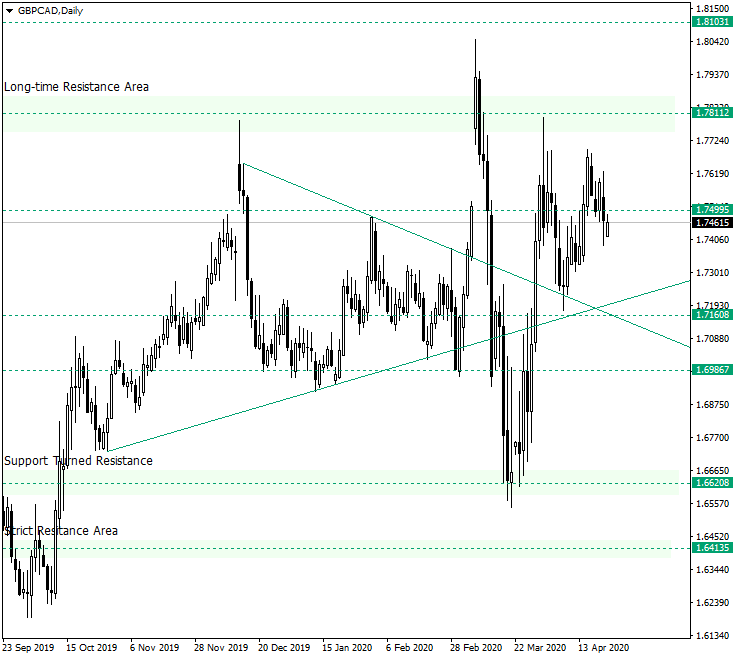

Bears at Their Posts on GBP/CAD from 1.7499

The Great Britain pound versus the Canadian dollar currency pair looks like it is not able to stay above the 1.7499 level. Long-term perspective After confirming the major area of 1.6620, the price appreciated until the important resistance area of 1.7811. On its way, it validated the zone defined by the level of 1.7160, the descending trendline, and the ascending trendline, respectively, as a triple support. However, this was not enough for the buyers, which, after … “Bears at Their Posts on GBP/CAD from 1.7499”

Aussie Climbs After Jump in Retail Sales, Struggles to Maintain Gains

The Australian dollar rallied today, though currently, it has trimmed its gains. While the rally happened after a surprisingly positive retail sales report came out, the currency did not rally immediately following the release, therefore it cannot be said with certainty that the report directly contributed to the strength of the Aussie. Whatever the case may be, the Australian currency will have a hard time maintaining gains as the market … “Aussie Climbs After Jump in Retail Sales, Struggles to Maintain Gains”

Pound Falls on Bearish Sentiment as UK to Test COVID-19 Vaccine

The Sterling pound today fell against the US dollar as investor sentiment remained decidedly bearish amid news that the UK was developing a COVID-19 vaccine. The GBP/USD currency pair fell despite the release of upbeat UK jobs data as investor risk appetite evaporated pushing the pair lower into negative territory. The GBP/USD currency pair today … “Pound Falls on Bearish Sentiment as UK to Test COVID-19 Vaccine”

Mexican Peso Falls 1% on Surprise Interest Rate Cut, Bearish Outlook

The Mexican peso is falling against the US dollar and other G10 currency competitors on Tuesday after the central bank surprised financial markets and cut interest rates. The peso weakened even further as officials are sounding the alarm about a significant crash in Latin Americaâs second-largest economy. On Tuesday, Banxico slashed the overnight rate by 50 basis points to 6% in response to a widely anticipated recession this year. This is the third rate … “Mexican Peso Falls 1% on Surprise Interest Rate Cut, Bearish Outlook”

South Korean Won Weakens on Kim Jong-un âGrave Dangerâ Reports

The South Korean won has been weakening against multiple currency rivals since it was first reported that North Korean Supreme Leader Kim Jong-unâs health is in âgrave danger.â The won has slightly recovered, but investors appear to be waiting for confirmation that the dictator is in good shape. Since rising to power, Kim has been engaging with South Korea, and analysts fear that relations … “South Korean Won Weakens on Kim Jong-un âGrave Dangerâ Reports”

EUR/USD not that far if EU leaders cannot agree on coronabonds

The coronavirus crisis is taking a human and economic toll on Europe. Germany is trying to fend off demands for mutual debt, which threatens the integrity. The worsening political situation may weigh on EUR/USD, potentially sending it to parity. Over 50% of the global death toll from coronavirus is concentrated in Italy, Spain, and France … “EUR/USD not that far if EU leaders cannot agree on coronabonds”